Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

What happens when retail investors wake up?

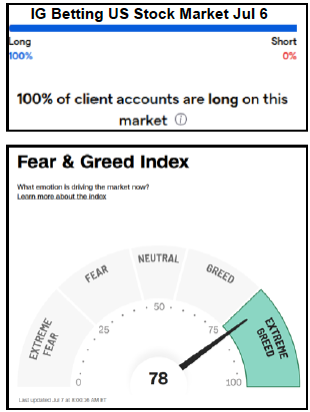

The April-July rally was driven by the perception that the tariff war was over. Since then, retail investors have flooded the stock market with reckless inflows, remarks Michael Belkin. The IG stock market betting site registered 100% of investors being long this past weekend, which he has never seen before. Tariff rates have further to go, and this will be incredibly bearish for the stock market. Corporate insiders (like NVIDIA) are already selling shares, unloading into the unsuspecting hands of retail and institutional investors. Michael says it is clear that we are in a bubble, but many refuse to see it. Defensive sectors have a coiled spring forecast and a long-term model outperform forecast, but Michael’s top picks are gold and energy stocks, including Newmont and Barrick.

Edition: 215

- 11 July, 2025

Gold: Are buybacks a fad?

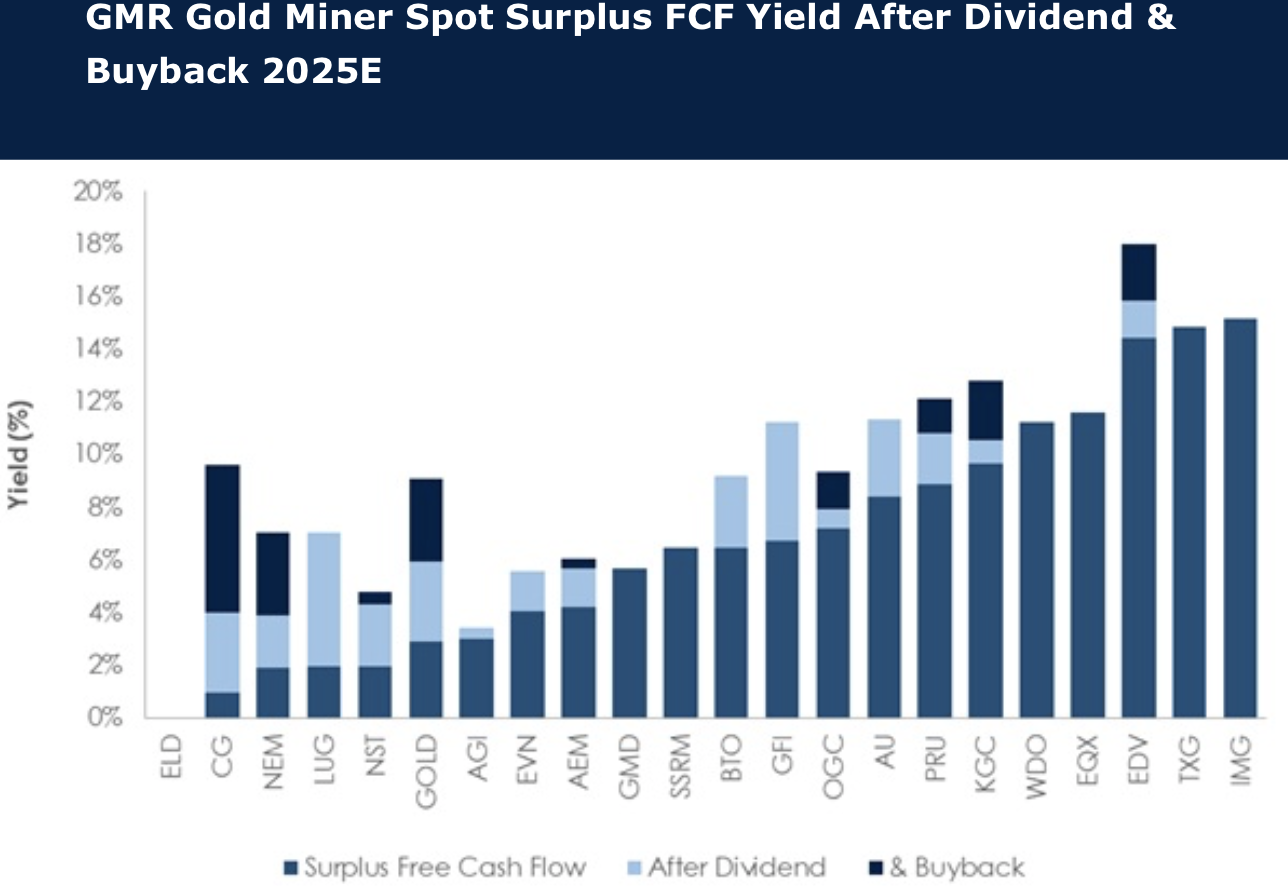

In the face of meaningful cash surpluses, miners are repurchasing shares in record amounts. Some 40% of the Global Mining Research team’s gold coverage have active buybacks in 2025E, equating to ~US$3.7B of cash returns, a record level for the sector and equivalent to ~US$110/GEO. The impact on share prices is subject to debate. The team find that at spot gold the 2025E FCF yield of the sector after expected dividends and buybacks is ~4.6% (and ~8.5% in 2026E). So, shareholder return potential is still to the upside whilst gold prices remain elevated. Stocks least progressed (~20% or less) with buybacks include Carlyle Group, OceanaGold, Barrick Gold, Kinross Gold and Agnico Eagle Mines. Stocks trading at larger discounts to 2025E spot FCF include IAMGOLD, Torex Gold, Endeavour Mining, Equinox Gold and Wesdome Gold Mines. Preferred stocks of these are Kinross Gold, Agnico Eagle Mines, IAMGOLD and Equinox Gold.

Edition: 211

- 16 May, 2025

High beta gold stocks outperforming peers

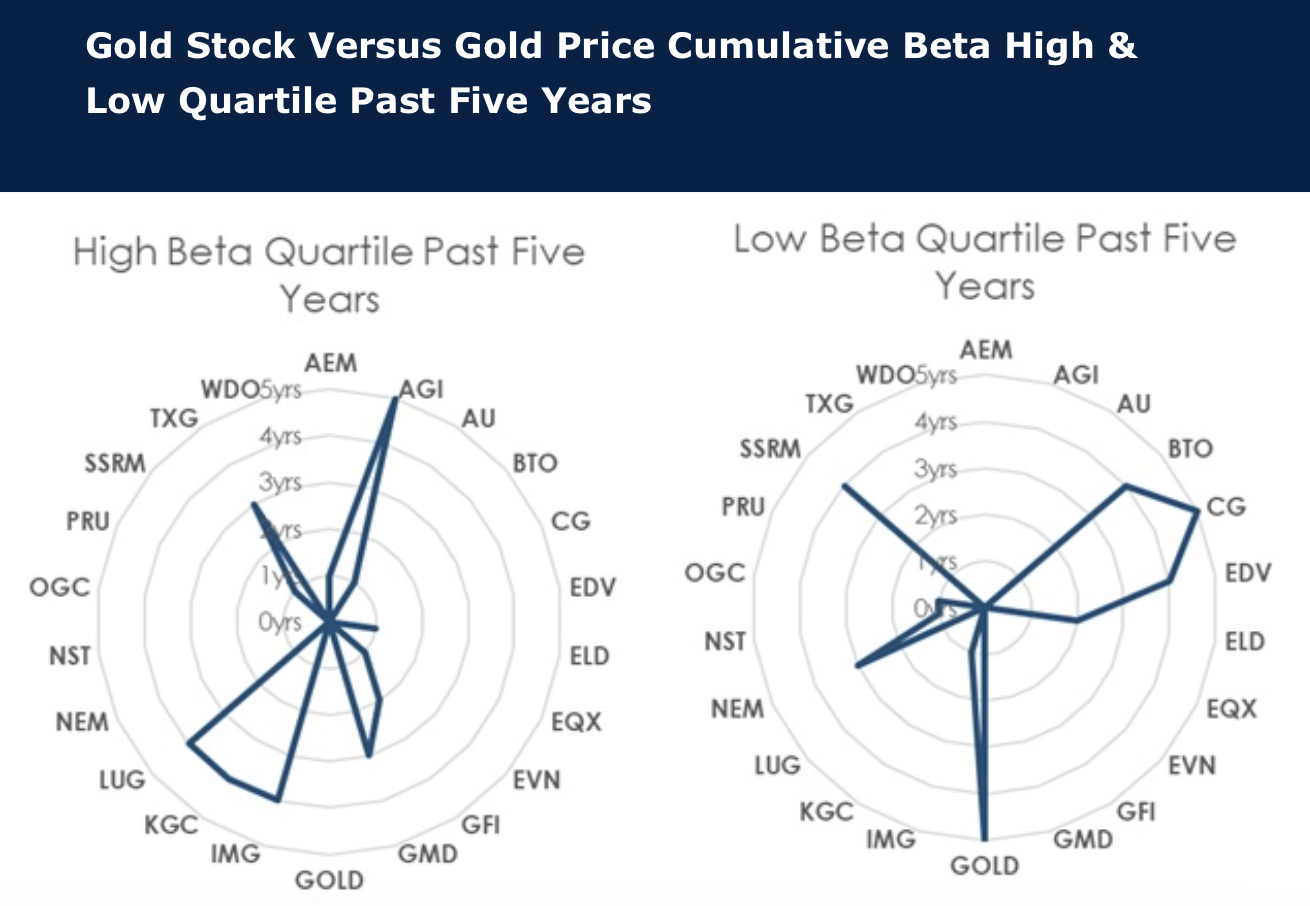

The Global Mining Research team research the correlation of stocks to the gold price and the beta of those stocks. The stocks with consistently high beta to the gold price over the past five years are Alamos Gold, Genesis Minerals, IAMGOLD, Kinross Gold, Lundin Gold and Torex Gold Resources. Stocks with a weak beta to gold price over the past five years are B2Gold, Centerra Gold, Endeavour Mining, Barrick Gold, Newmont and SSR Mining (except 2025), each with mine or management issues, heightened risk or M&A troubles. Market preference for gold stocks appears to be more driven by investor perception rather than quantifiable valuation or sensitivity measures, and investors are preferring stocks with “issues” and aren’t seeking deeply discounted cheap stocks. Preferred gold stocks are BUY-rated Agnico (delivery and lower-risk portfolio), Kinross (risk reduction and execution), Equinox (transitions from project development to cash generation), IAMGOLD (Côté ramp up and derisking) and Lundin Gold (FDN continues to outperform).

Edition: 209

- 18 April, 2025

Gold ESG Focus 2024

Metals Focus has recently published its annual report on environmental, social and governance in the gold mining industry, covering the last decade for 17 of the largest gold miners. Key findings include a reduction in combined scope 1 and 2 greenhouse gas emissions by 5.4% y/y in 2023, with Harmony reporting the highest emissions intensity; a rise in payments to governments by 12%, with Barrick leading the way; a fall in community investment by 16%, with Polyus the largest contributor; and the lowest level of fatalities on record amidst improving injury rates. Please contact us to find out more.

Edition: 194

- 06 September, 2024

Gold: Can higher prices translate into cash?

All too often in the last decade for the gold sector, fully loaded costs have come close to equalling the received price. Therefore, one reason gold equities have likely recently lagged spot prices reflects a degree of market scepticism of the sector's ability to translate higher prices into “cash”. Unfortunately, the senior producers have often been key protagonists, but this isn’t the case for all gold stocks. Herein, David Radclyffe updates the sector cost analysis including highlighting Free Cash Flow (FCF) costs and FCF costs plus dividends, seeking to identify those stocks that could bank the proceeds of higher spot prices in 2024. The notional spot margin after base case dividends in 2024E for Agnico Eagle Mines / Barrick Gold Corp / Newmont is ~US$395/GEO, up from US$200/GEO in 2023. However, the best cash notional margins in 2024E could be delivered by Evolution Mining, Lundin Gold, Centerra Gold, and Barrick Gold Corp.

Edition: 186

- 17 May, 2024

Canadian mines for Canadian owners?

The recent moves related to Teck Resources has prompted some jingoistic statements from mining participants and the government about Canadian ownership of Canadian assets. David Radclyffe examines the ownership of mines in the country, finding that, although Canadian gold mines are mostly owned by the country’s miners, Canada represents just one-quarter of the value of mines owned by Canadian domiciled gold stocks. Should the jingoism be contagious, Canadian miners will be the losers if the insistence of local ownership spreads. Preferred Canadian domiciled gold stocks are Barrick and B2Gold among the senior stocks and Lundin Gold as a junior stock.

Edition: 160

- 12 May, 2023

Materials

David Radclyffe evaluates the impact of developing Reko Diq and benchmarks the project against 37 of the larger open pit copper mines covered by GMR - he estimates a 15% IRR which is attractive given a 2028 start and assuming a 20% capex hike and US$19/t operating costs. The 2023-28 average FCF yield reduces from 6.9% to 5.7% with Reko Diq but increases from of 3.3% to 4.1% during 2035-40. Sovereign risk may explain GOLD’s continuing discount to peers, but the copper project could have a material impact on the miner's production profile (+190kt CuEq from 2035E) and it appears attractive as GOLD's preferred mid-term growth option.

Edition: 153

- 03 February, 2023

Gold sector: 2023 looking positive (so far)

Gold prices will always be volatile but two of the unexpected headwinds of 2022, inflation and USD strength, have now peaked. David Radclyffe reviews the outlook for the sector in 2023. He expects gold equity inflows as price and margin pressures of 2022 abate and the potential for surpluses return. M&A is expected to continue, and significant C-suite turnover offers opportunities to reset stale strategies. Preferred stocks are Barrick, Endeavour and B2Gold for scale/value, Northern Star and Evolution for leverage to better gold/copper prices and Lundin Gold and Centerra for attractive potential in smaller caps.

Edition: 152

- 20 January, 2023

An opportunity for gold stocks to acquire non-gold assets?

Gold companies have been actively acquiring base metal assets in the last year, and David Radclyffe wonders if this makes sense in the current market. In his latest report he finds that base metal assets can lower gold company group costs and boost cash flow, and over the last year base metal stocks have outperformed gold stocks when adjusted for the performance of the underlying metal. His preferred gold stocks with diversification of commodity mix are Barrick with 16% copper, Evolution with 20% copper exposure and Agnico which may still be 99% gold but has a growing potential for more base metal exposure.

Edition: 147

- 28 October, 2022

More gold miners addressing greenhouse gas emissions (GHG)

David Radclyffe’s latest report examines the GHG reporting structures and emission reduction/mitigation plans for gold stocks covered by Global Mining Research (GMR). Interestingly, scope 1 & 2 GHG intensity increased by 35% for CO2-e t/GEO from 2015 to 2021, highlighting the challenges ahead for miners to achieve reduction targets. Within the GMR universe, Barrick continues to provide the clearest pathway. Newmont has a list of GHG initiatives, while GFI and NST provide timelines to 2030. Most other gold miners need to lift their game as few show a tangible commitment to GHG reduction.

Edition: 146

- 14 October, 2022

Barrick Gold (ABX CN) Canada

Materials

Defence wins championships - gold's precedent of outperforming amidst real GDP loss and high inflation offers a defensive diversification opportunity for Veritas’ V-list model portfolio (1-yr +8.95% vs. S&P/TSX Composite -3.87%). The new ABX combines low-cost assets with a proven CEO that will not destroy value in expensive acquisitions. ABX is trading at low P/E and EV/EBITDA multiples compared to Newmont and Agnico Eagle despite higher profitability per ounce of gold produced, a higher dividend pay-out and an attractive buyback programme in place. TP C$32 (40% upside).

Edition: 139

- 08 July, 2022

ESG in gold mining

Metals Focus’ new annual report, The Gold ESG Focus, is due for release in July. The extensive report compares a wide range of senior gold producers, including the likes of Barrick Gold, Endeavour, IAMGOLD and others. Looking at topics such as emissions, water, waste, biodiversity and health & safety, the report features “apple versus apple” ESG comparisons for the included companies. Please contact us to find out more.

Edition: 136

- 27 May, 2022

How to pick a gold stock in 2022

Global Mining Research’s BUY and SELL signals served investors well in 2021 despite some market disconnect between equity price and numerous variables, including dividends. This year, David Radclyffe sees the gold sector shifting more to a growth/scale focus over returns/balance sheets; so, more M&A, growth investment, inflation impacting margins, lower dividends and a focus on ESG. David’s latest report looks for stocks that match the investment themes within the sector. Key picks include Agnico Eagle (new BUY signal), Barrick Gold, Northern Star Resources and Endeavour Mining.

Edition: 129

- 18 February, 2022

Gold and gold mining stocks are attractive

Higher inflation is the catalyst that gold prices have been waiting for and it’s time to act; Michael Belkin recommends LONG GDX gold stock and GLD gold ETFs. Michael also follows every investable gold/silver/platinum mining stock in the world and advises investors to stay away from Newmont or Barrick, which are underperforming the GDX. Instead, opt for mid-sized producers such as Kinross, SSR Mining or Eldorado Gold.

Edition: 124

- 26 November, 2021