Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

Pulp pricing floor approaching

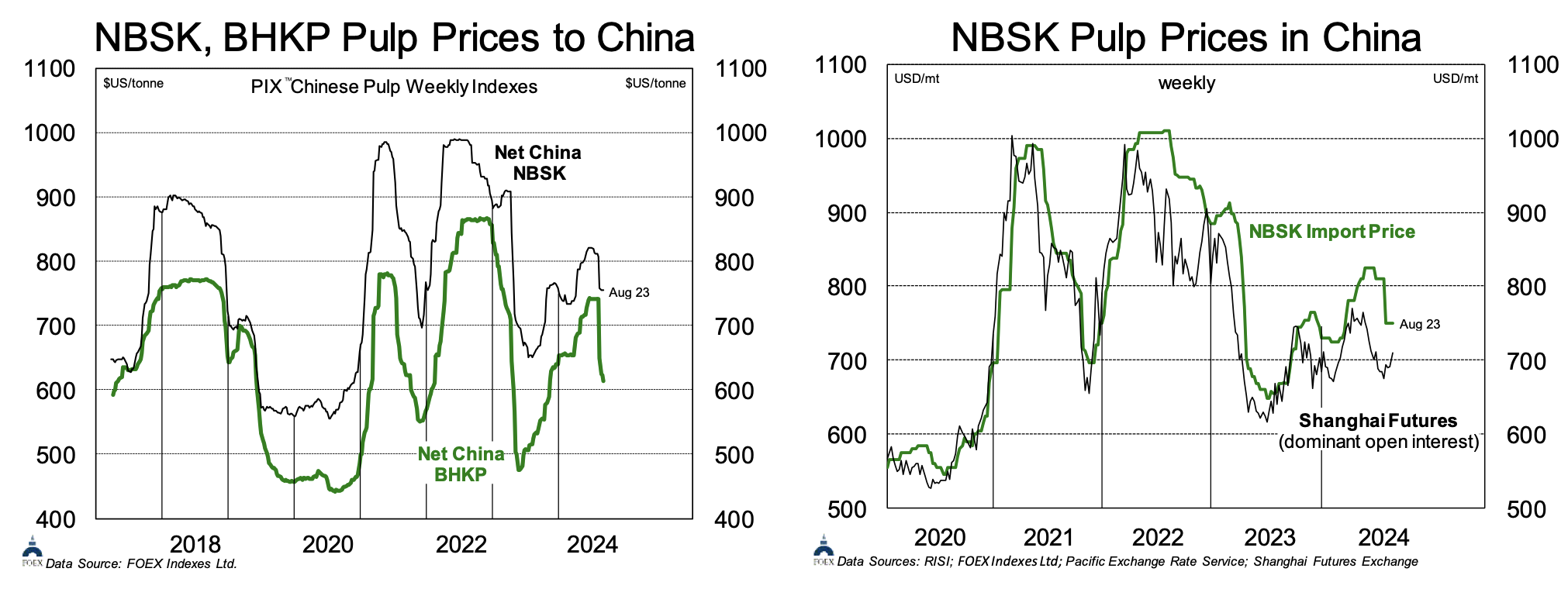

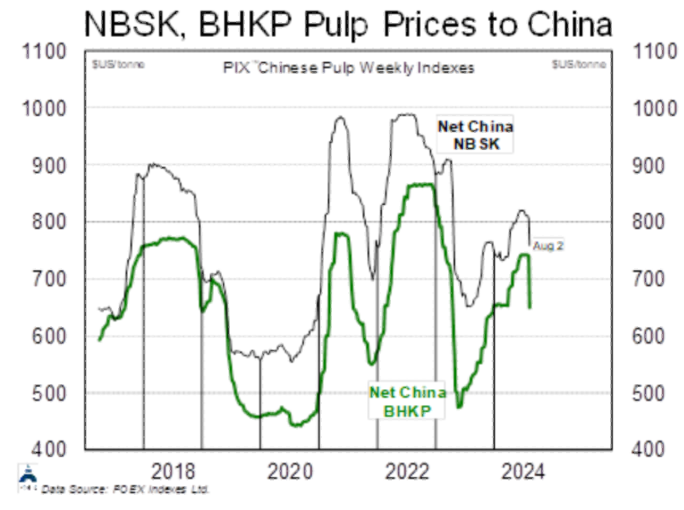

After an exceptionally steep correction in late July/August, week-over-week price changes for both softwood and hardwood pulps slowed in China (chart 1). Shanghai NBSK futures had been falling for some time, but prices for imported pulp finally began to collapse in early August and have started to climb again (chart 2). The magnitude of the correction has accelerated the pulp pricing cycle and signs indicate that spot hardwood pricing is approaching its trough. For NBSK, the correction has been more gradual and shallower, and new threats to global supply should support pricing in the near term. With 2.0MMmt of mostly NBSK, Mercer is the team’s preferred route to pulp exposure. It is trading at a 3+ year low. While the company has a 2026 maturity to address, it reduced net debt by $45MM in Q2 and expects the same in Q3. The team’s $10 target reflects a 7.0x multiple on 2025E EBITDA of $272MM.

Edition: 194

- 06 September, 2024

Pulp sellers blink in China

Pulp prices in China have been rangebound since early June, with Chinese buyers and sellers locked in a standoff. Given the huge week over week PIX China pulp price changes (chart), the producers have blinked first. PIX prices dropped $48 and BHK fell by an astounding $91, a correction of a magnitude that would usually take weeks to occur. Expect other international markets to see accelerated price drops as a result. The biggest market-pulp consumers are tissue producers and in ERA’s stock coverage Cascades is expected to benefit the most. Pulp producers are the losers, including Mercer International and International Paper. Expect pulp names to remain under pressure for at least a quarter, or until closures accelerate.

Edition: 192

- 09 August, 2024

NBSK Pulp prices in China

After a spike in January, the Shanghai pulp futures have reversed course, ending last week at $769, a price level not seen in the front contract since late 2021. Following the Western Canadian closure and downtime announcements, in combination with expectations of robust China demand, an optimism that pulp prices would make early gains had pervaded the market. This has been unmet, largely in part due to extremely soft paper and packaging markets in Europe and North America and poor Chinese demand. Downward pressure may be exacerbated by expectations for market expectations for new hardwood supply from two new greenfield mills coming online in LATAM. Tissue producers will benefit from lower pulp prices, including Cascades and Clearwater Paper. Mercer continues to be the preferred route to pulp exposure for long-term investors, with the softer outlook already priced in valuations.

Edition: 156

- 17 March, 2023

Forest Products: Tough year ahead

Materials

The outlook for lumber / panel producers (Canfor, West Fraser, Boise Cascade, Louisiana-Pacific) is difficult, with no obvious upside catalyst before a recovery in US housing (unlikely before late 2023). ERA expects pulp prices to move lower through 1H23. Anticipated price declines are now almost fully priced into pulp names (Mercer, International Paper). In packaging, more pain lies in store for containerboard (Westrock) and a raft downtime will be needed to combat weaker demand and offset new capacity. Boxboard will outperform (Graphic Packaging, Clearwater Paper), with both demand and prices expected to remain robust.

Edition: 151

- 06 January, 2023

ESG report on pulp, paper, packaging and tissue

ERA Forest Products Research released their latest report on ESG commitments, progress and gaps for pulp, paper, packaging and tissue companies. Within the sphere of pulp producers, Mercer and Sappi are cited as examples of companies with strong disclosure and targets. In European paper, pulp and packaging, ambitious targets appear common but data and disclosures are healthy, with firms including UPM and Billerud mentioned. In the packaging, paper and tissue industry, WestRock appears to lead the way, with Graphic Packaging also referenced as having good targets that could spur near-term action.

Edition: 146

- 14 October, 2022

Pulp prices to remain strong in coming months

Pulp exports from Russia’s large forest resource mainly head towards China, therefore Western sanctions will see little direct impact on pulp prices. Nevertheless, ERA Research expects pulp prices to remain stronger for longer in the face of logistical issues that will present themselves, with early-year strength continuing for longer before excess inventories are finally delivered. Recommended trades include LONG Mercer, with another quarter of low maintenance and good shipments expected (TP $16). Despite the strong pulp outlook, investors should EXIT Rayonier Advanced Materials with a heavy maintenance year ahead a key risk.

Edition: 130

- 04 March, 2022