Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

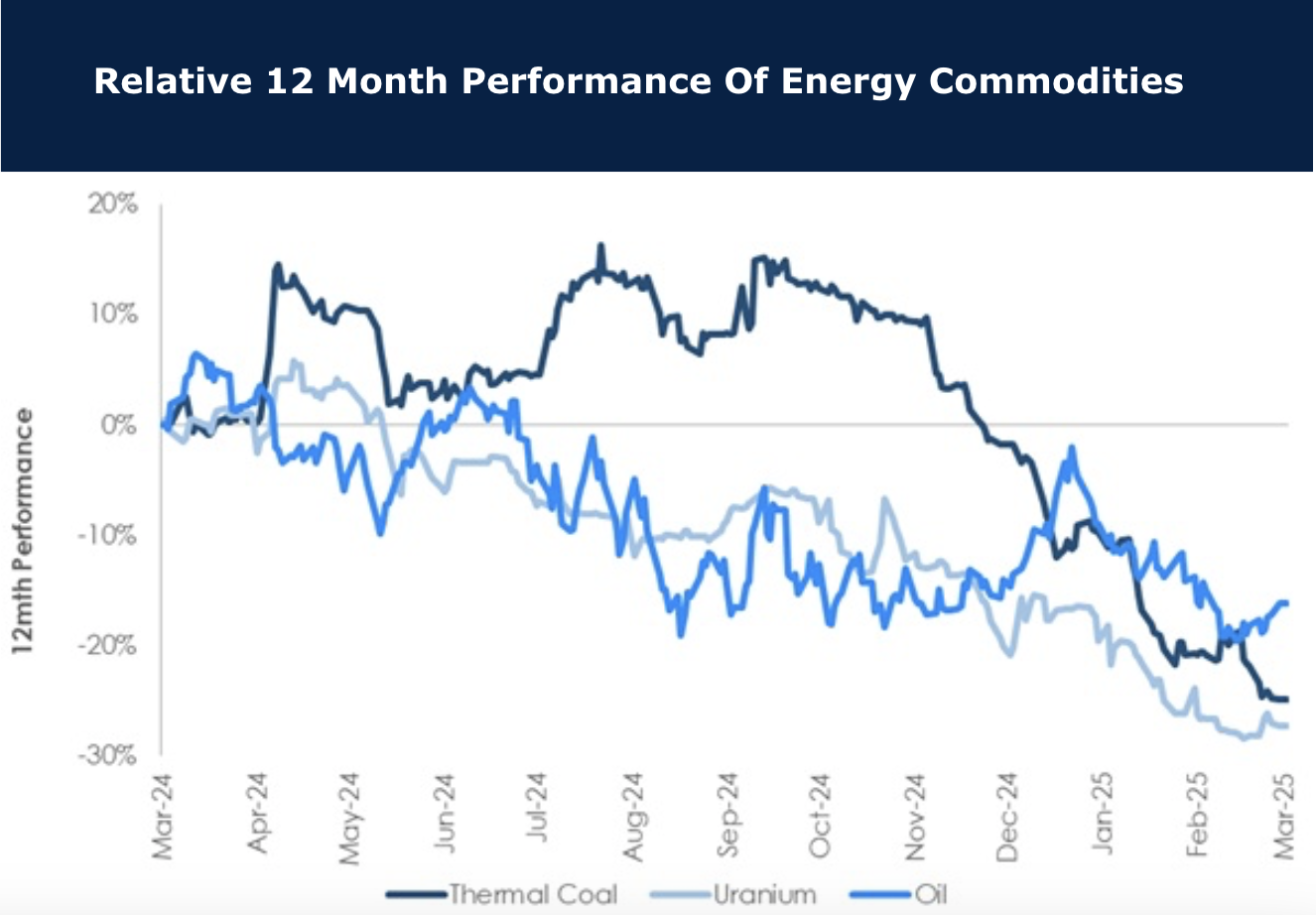

Thermal lost its spark

One of the worst performing commodities of 2025, thermal coal has been a drag on the coal miners. The reason is largely down to China and Australia’s strong production. Of course, there is a wider overlay of tariff concerns, recession fears and Deepseek disrupting the AI market. The chart shows how thermal weakness is not isolated, and has actually lagged the decline in both oil and uranium prices. Some coal producers are feeling the pain, although some producers have seen stronger share prices relative to the underlying thermal and met coal prices--they’ll need this strength going forward. The potential silver lining is that lower energy prices are deflationary, which can support remote miners reliant on diesel power generation. It’s bad news for the diversified miners producing coal such as Anglo American, BHP Group and Glencore, and also the pure play coal miners, but good news for much of the mining sector.

Edition: 208

- 04 April, 2025

Anglo American (AAL LN) & Glencore (GLEN LN) UK

Materials

With the Golden Age, when copious amounts of cash was returned to shareholders, now a distant memory, GMR examines where the diversified miners are, in terms of existing and prospective valuations, free cash flows, as well as exposure to preferred commodities. Averages are EV/EBITDA 5.2x, FCF Yield 7.2% and Dividend Yield 4.8% for 2025 on GMR forecasts (iron ore US$115/t, copper US$4.20/lb), with P/NPV10 a reasonable 1.0x. Cash + capex costs range from US$2.49/lb for BHP to US$3.89/lb for South32, on a copper equivalent basis. GLEN is upgraded to Buy, offering reasonable value with good FCF, with AAL reduced to Sell following share price run to £24.

Edition: 196

- 04 October, 2024

BHP + Anglo American = 0.5Mt more copper and a lot of baggage

Materials

In this 14-page report, GMR examines the potential BHP takeover of AAL. BHP would need to take a long-term view as AAL comes with ~US$11bn net debt and midterm FCF is very weak, plus uncertainty in several of its businesses including DeBeers. Fundamentally, GMR fails to see the material value opportunity for BHP in what appears to be a dilutionary transaction. How is this different from the large deals of the past which struggled to add value?

Edition: 185

- 03 May, 2024

Miners forced to become green power companies?

David Radclyffe reviews how mines with little access to green electricity will need to build capacity themselves or via a third party in order to meet emissions targets. Some will come under increasing scrutiny; Rio Tinto, South32, Southern Copper Corp, Freeport-McMoRan and Anglo American could all face increased capital/opex exposure. The potential capital costs associated with self-generation are massive, so investors should keep a close eye for opportunities present in the partial or full outsourcing of infrastructure.

Edition: 122

- 29 October, 2021

Which fuel cell companies are best positioned to benefit from the Infrastructure Bill?

Plug Power and Ballard Power Systems to benefit the most from The Infrastructure Investment and Jobs Act commitment to hydrogen. PLUG was cited for its industry leadership, strong management, innovation and how its recent acquisitions have expanded its offering across the hydrogen economy. BLDP is well-funded and considered the “big dog” in transportation. Other companies highlighted in Blueshift’s 31-page report include Air Liquide, Anglo American, Caterpillar, Cummins, Hyundai, ITM and Linde. Traditional oil & gas companies will also have a role to play, while Hyzon Motors and Nikola could be M&A targets.

Edition: 120

- 01 October, 2021