Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

Technology

While revenue guidance was largely in line with Street expectations what caught investor attention was the "insane" margin outlook. TSMC is clearly doing a good job extracting value from Nvidia’s high margin AI business. The steady tone of management is likely to temper a surge in negative sentiment in response to ASML’s caution. There was no change to TSMC’s capex outlook, which ought to help investors return to the deeply sold-off Lam Research and Applied Materials. KC Rajkumar expects the stock to drift up, but not without volatility driven by investor concerns regarding sustainability of the AI rally and potential new restrictions on the export of AI chips. He raises his 2024 estimate to NT$2.87tn/NT$44.6 and 2025 estimate to NT$3.67tn/NT$56.7. TP NT$1250.

Edition: 197

- 18 October, 2024

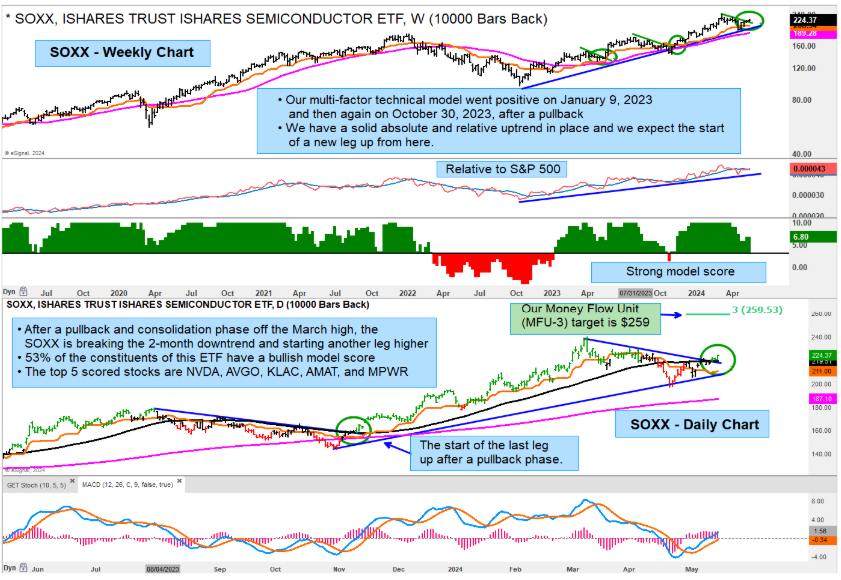

SOXX starting another leg higher

Technology

After a 17% pullback from the March high the iShares Semiconductor ETF (SOXX) is emerging from a consolidation phase and about to start another bullish leg higher. Guy Cerundolo scored the constituents of the SOXX and found 53% of the stocks with a bullish multi-factor model score. His top five scoring stocks are: Nvidia, Broadcom, KLA Corp, Applied Materials and Monolithic Power Systems. A full listing and chart review of the constituents is available on request.

Edition: 186

- 17 May, 2024