Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

Materials

Ben Jones provides his thoughts following solid 1H24 results and believes San Dionisio will be transformative for ATYM, boosting production from 48kt Cu in 2024 to over 100kt CuEq by 2030. The increase in production comes from higher grades alone, Ben expects no change in the mining and processing rates, which allows for strong economics. San Dionisio’s proximity to the existing Cerro Colorado pit and its use of the existing processing facilities also provide extremely strong economics. Masa Valverde and Proyecto Touro are two excellent development assets Ben sees priced as free options. He thinks they are being ignored by the market due to limited information.

Edition: 193

- 23 August, 2024

Copper: Risk to the downside

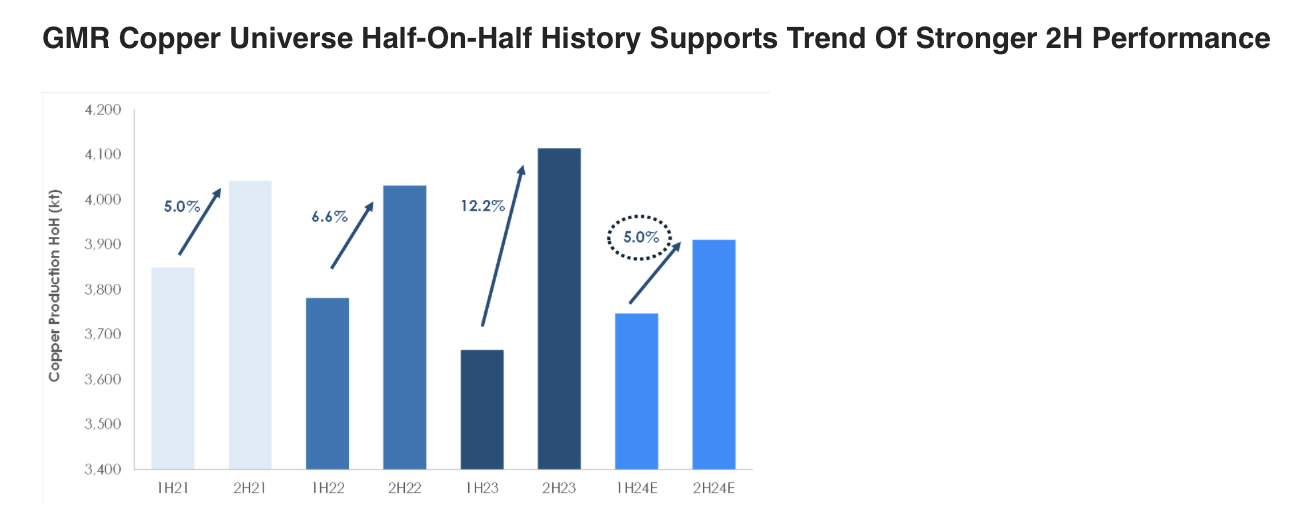

Copper prices had a strong start to the year. David Radclyffe’s review of the Q1/2024 performance versus 2024 guidance for the December year-end stocks helps put the market tightness into perspective. The key takeaway is that, as with gold companies, copper miners are banking on a strong H2/2024 to meet annual guidance figures. The risk is therefore to the downside, with once again copper producers struggling to either meet guidance or increase production appreciably. Only Hudbay Minerals, KGHM, Southern Copper, Freeport-McMoRan and First Quantum Minerals are tracking to 2024 production expectations. David’s preferred copper miners are in the small/mid-cap space on valuation grounds, including Atalaya Mining, Capstone Copper, Sandfire and Hudbay Minerals.

Edition: 187

- 31 May, 2024

Copper vs Gold

Gold miners have traditionally been considered premium rated miners, yet copper stocks covered by GMR have moved to a premium compared to gold and other base metal and bulk miners. Gold stocks are out of favour with valuations underperforming the gold metal price during 2023; the high beta of gold stocks presents an opportunity when the gold price gains traction. Preferred equities include Lundin Gold and Northern Star. Copper stocks remain attractive as supply weakness and low inventories are offset by macro concerns. Preferred stocks are Atalaya Mining and Taseko Mines as junior miners, and Sandfire amongst the mid-larger names.

Edition: 170

- 29 September, 2023