Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

Gold: Are buybacks a fad?

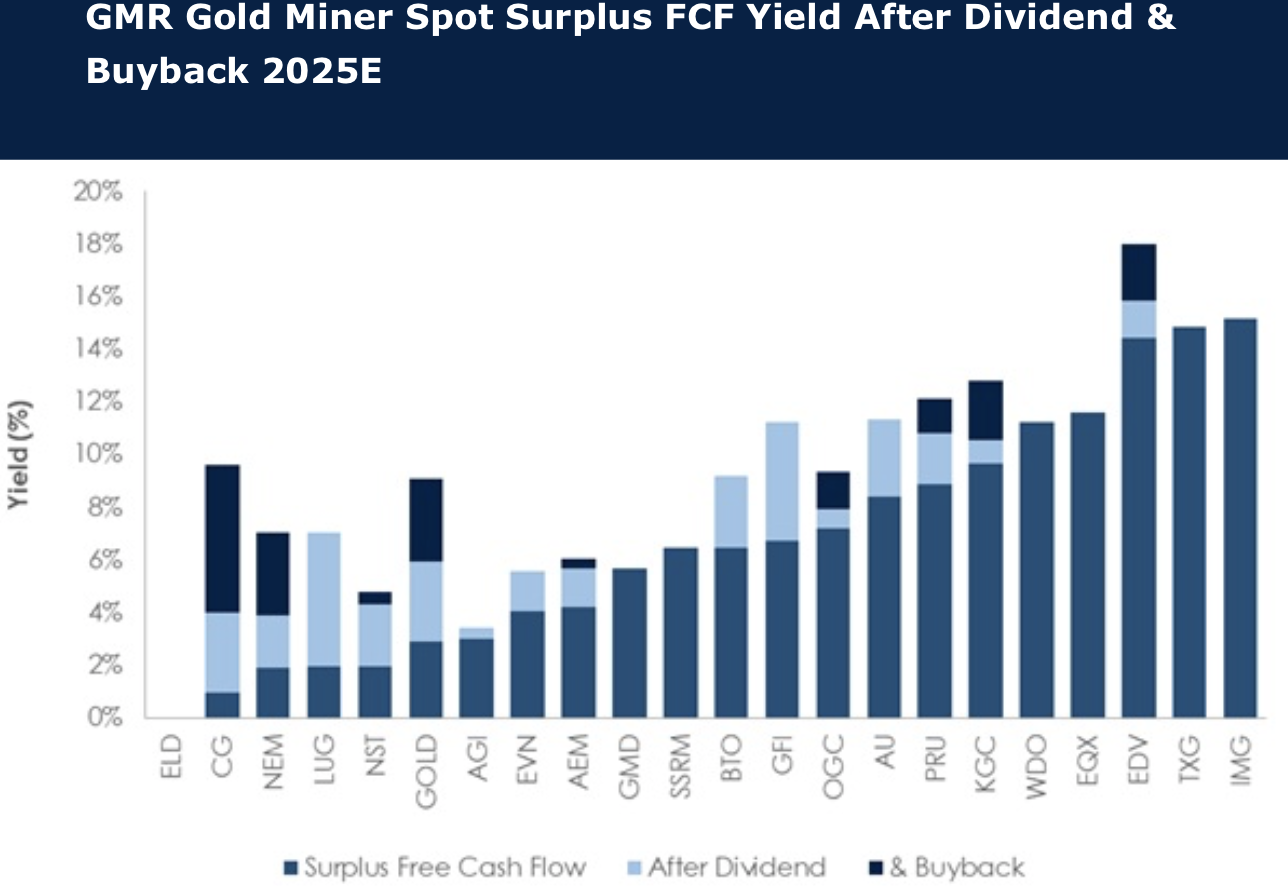

In the face of meaningful cash surpluses, miners are repurchasing shares in record amounts. Some 40% of the Global Mining Research team’s gold coverage have active buybacks in 2025E, equating to ~US$3.7B of cash returns, a record level for the sector and equivalent to ~US$110/GEO. The impact on share prices is subject to debate. The team find that at spot gold the 2025E FCF yield of the sector after expected dividends and buybacks is ~4.6% (and ~8.5% in 2026E). So, shareholder return potential is still to the upside whilst gold prices remain elevated. Stocks least progressed (~20% or less) with buybacks include Carlyle Group, OceanaGold, Barrick Gold, Kinross Gold and Agnico Eagle Mines. Stocks trading at larger discounts to 2025E spot FCF include IAMGOLD, Torex Gold, Endeavour Mining, Equinox Gold and Wesdome Gold Mines. Preferred stocks of these are Kinross Gold, Agnico Eagle Mines, IAMGOLD and Equinox Gold.

Edition: 211

- 16 May, 2025

Gold: Can higher prices translate into cash?

All too often in the last decade for the gold sector, fully loaded costs have come close to equalling the received price. Therefore, one reason gold equities have likely recently lagged spot prices reflects a degree of market scepticism of the sector's ability to translate higher prices into “cash”. Unfortunately, the senior producers have often been key protagonists, but this isn’t the case for all gold stocks. Herein, David Radclyffe updates the sector cost analysis including highlighting Free Cash Flow (FCF) costs and FCF costs plus dividends, seeking to identify those stocks that could bank the proceeds of higher spot prices in 2024. The notional spot margin after base case dividends in 2024E for Agnico Eagle Mines / Barrick Gold Corp / Newmont is ~US$395/GEO, up from US$200/GEO in 2023. However, the best cash notional margins in 2024E could be delivered by Evolution Mining, Lundin Gold, Centerra Gold, and Barrick Gold Corp.

Edition: 186

- 17 May, 2024