Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

Pulp sellers blink in China

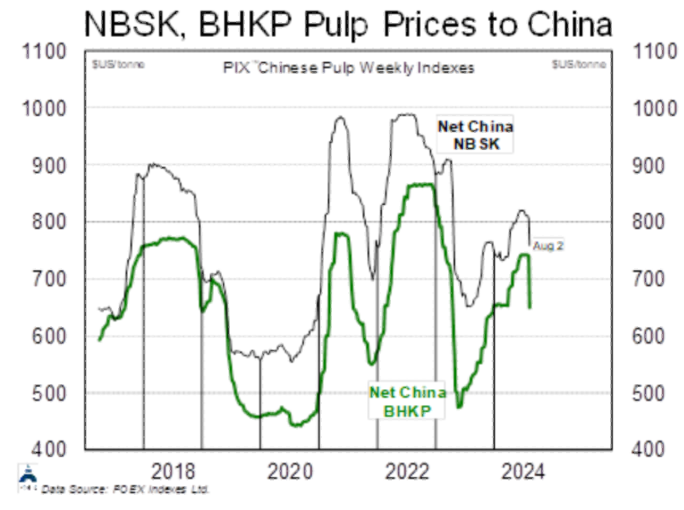

Pulp prices in China have been rangebound since early June, with Chinese buyers and sellers locked in a standoff. Given the huge week over week PIX China pulp price changes (chart), the producers have blinked first. PIX prices dropped $48 and BHK fell by an astounding $91, a correction of a magnitude that would usually take weeks to occur. Expect other international markets to see accelerated price drops as a result. The biggest market-pulp consumers are tissue producers and in ERA’s stock coverage Cascades is expected to benefit the most. Pulp producers are the losers, including Mercer International and International Paper. Expect pulp names to remain under pressure for at least a quarter, or until closures accelerate.

Edition: 192

- 09 August, 2024

NBSK Pulp prices in China

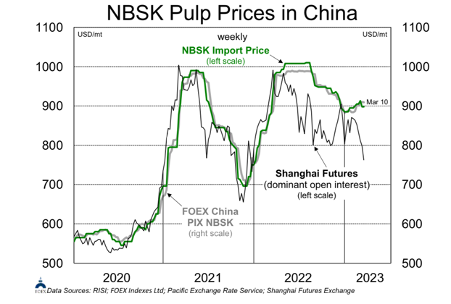

After a spike in January, the Shanghai pulp futures have reversed course, ending last week at $769, a price level not seen in the front contract since late 2021. Following the Western Canadian closure and downtime announcements, in combination with expectations of robust China demand, an optimism that pulp prices would make early gains had pervaded the market. This has been unmet, largely in part due to extremely soft paper and packaging markets in Europe and North America and poor Chinese demand. Downward pressure may be exacerbated by expectations for market expectations for new hardwood supply from two new greenfield mills coming online in LATAM. Tissue producers will benefit from lower pulp prices, including Cascades and Clearwater Paper. Mercer continues to be the preferred route to pulp exposure for long-term investors, with the softer outlook already priced in valuations.

Edition: 156

- 17 March, 2023