Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

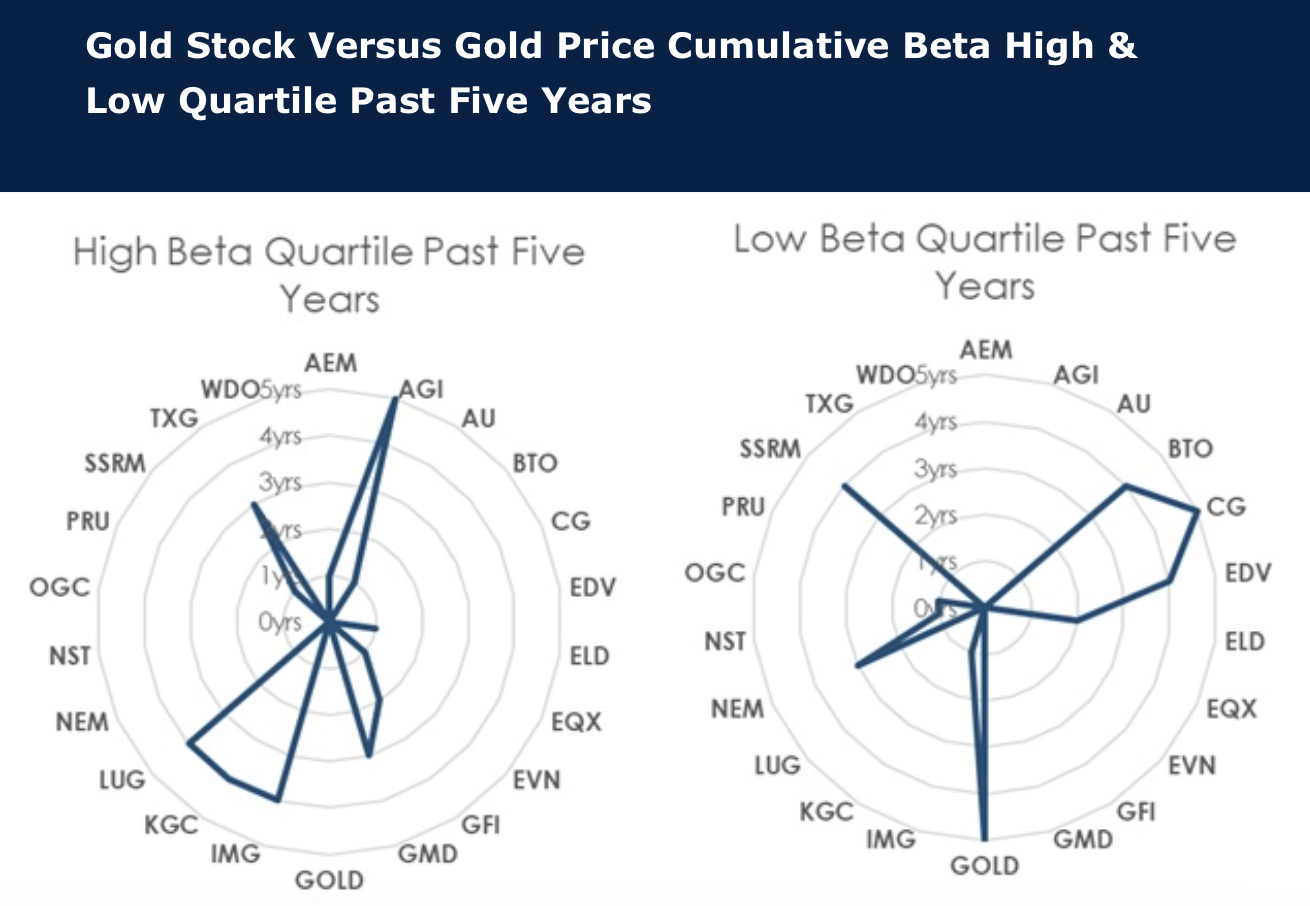

High beta gold stocks outperforming peers

The Global Mining Research team research the correlation of stocks to the gold price and the beta of those stocks. The stocks with consistently high beta to the gold price over the past five years are Alamos Gold, Genesis Minerals, IAMGOLD, Kinross Gold, Lundin Gold and Torex Gold Resources. Stocks with a weak beta to gold price over the past five years are B2Gold, Centerra Gold, Endeavour Mining, Barrick Gold, Newmont and SSR Mining (except 2025), each with mine or management issues, heightened risk or M&A troubles. Market preference for gold stocks appears to be more driven by investor perception rather than quantifiable valuation or sensitivity measures, and investors are preferring stocks with “issues” and aren’t seeking deeply discounted cheap stocks. Preferred gold stocks are BUY-rated Agnico (delivery and lower-risk portfolio), Kinross (risk reduction and execution), Equinox (transitions from project development to cash generation), IAMGOLD (Côté ramp up and derisking) and Lundin Gold (FDN continues to outperform).

Edition: 209

- 18 April, 2025

Digging for gold

A spate of new gold projects is about to be delivered after a period of subdued development, with nine new projects in David Radclyffe’s coverage ready to contribute to production over the next 18 months. With the potential to add over 2.5Moz AuEq per year by 2026, the projects will see a meaningful increase in production for the companies concerned. All projects are forecast with a by-product AISC below US$1,000/oz, offering healthy margins ahead. Overall, Côté is the most impressive of the new projects in terms of valuation, impact on the owner (IAMGOLD), and jurisdiction, despite the rocky road on the way. David favours companies with proven reliability to deliver together with lower risk, such as Agnico and Northern Star, and those with slightly higher risk, including B2Gold, Centerra, IAMGOLD and Perseus.

Edition: 188

- 14 June, 2024

Gold: Can higher prices translate into cash?

All too often in the last decade for the gold sector, fully loaded costs have come close to equalling the received price. Therefore, one reason gold equities have likely recently lagged spot prices reflects a degree of market scepticism of the sector's ability to translate higher prices into “cash”. Unfortunately, the senior producers have often been key protagonists, but this isn’t the case for all gold stocks. Herein, David Radclyffe updates the sector cost analysis including highlighting Free Cash Flow (FCF) costs and FCF costs plus dividends, seeking to identify those stocks that could bank the proceeds of higher spot prices in 2024. The notional spot margin after base case dividends in 2024E for Agnico Eagle Mines / Barrick Gold Corp / Newmont is ~US$395/GEO, up from US$200/GEO in 2023. However, the best cash notional margins in 2024E could be delivered by Evolution Mining, Lundin Gold, Centerra Gold, and Barrick Gold Corp.

Edition: 186

- 17 May, 2024

Gold sector: 2023 looking positive (so far)

Gold prices will always be volatile but two of the unexpected headwinds of 2022, inflation and USD strength, have now peaked. David Radclyffe reviews the outlook for the sector in 2023. He expects gold equity inflows as price and margin pressures of 2022 abate and the potential for surpluses return. M&A is expected to continue, and significant C-suite turnover offers opportunities to reset stale strategies. Preferred stocks are Barrick, Endeavour and B2Gold for scale/value, Northern Star and Evolution for leverage to better gold/copper prices and Lundin Gold and Centerra for attractive potential in smaller caps.

Edition: 152

- 20 January, 2023

Black Swans

There is nothing more detrimental to shareholder value than Black Swan Events, such as Covid-19 impacts, mine catastrophes and in-country issues. Tony Robson and David Radclyffe focus on the latter in their latest report, looking at three recent events: Malian government refusal to extend B2Gold’s Menanko permit; Ghanaian govt’s recent termination of Resolute’s Bibiani mining lease; and the Kyrgyz Republic raising a new tax dispute with Centerra.

Edition: 108

- 16 April, 2021