Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

Chemicals: Is the worst behind us?

Materials

Frank Mitsch sees early signs of stabilisation in the chemicals sector, despite short interest sitting at 52-week (or longer) highs and persistent investor concerns around potential dividend cuts. While he remains cautious on Tronox and Huntsman’s payouts, he considers dividends from Dow and LyondellBasell to be safe. Roughly 60% of 1Q results landed within 4% of his expectations, with Olin, Corteva, FMC and Celanese leading on beats vs. the Street. Westlake was the notable miss, due to underperformance in its PEM segment, partly from unplanned downtime. After over two years of sector underperformance, exacerbated by the overreaction to Liberation Day, Frank believes the worst may be behind us; hence his recent upgrades (to Buy) on DOW, LYB and PPG. He has also been heartened by how the credit markets have been open to companies such as CE and OLN.

Edition: 212

- 30 May, 2025

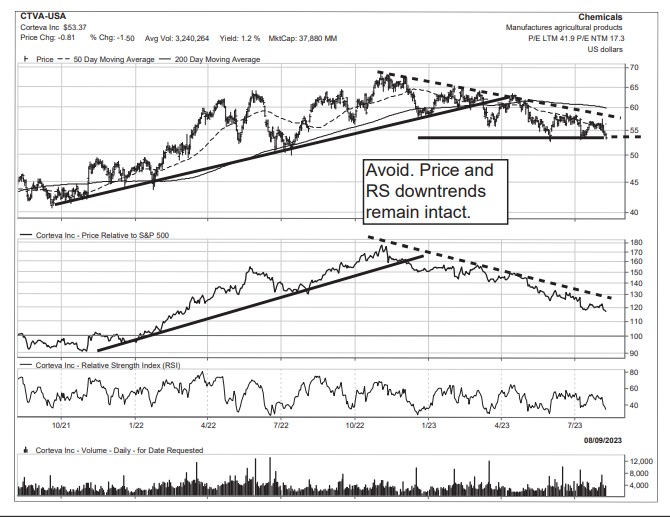

Short Shots

Is a collection of technically vulnerable charts culled from the “Negatively Inflecting” and “Toppy” columns within Vermilion’s Weekly Compass report or from various technical screening processes. The charts contained in this report have developed concerning technical patterns that suggest further price deterioration is likely. For these reasons Short Shots can also be a great source of ideas for investors interested in short-selling candidates.

Charts highlighted include Corteva (see above), Enphase Energy, General Mills, Kraft Heinz, Hershey, MarketAxess, Moderna, Newmont, Penumbra, Roblox, SolarEdge and Valmont Industries.

Edition: 167

- 18 August, 2023