Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

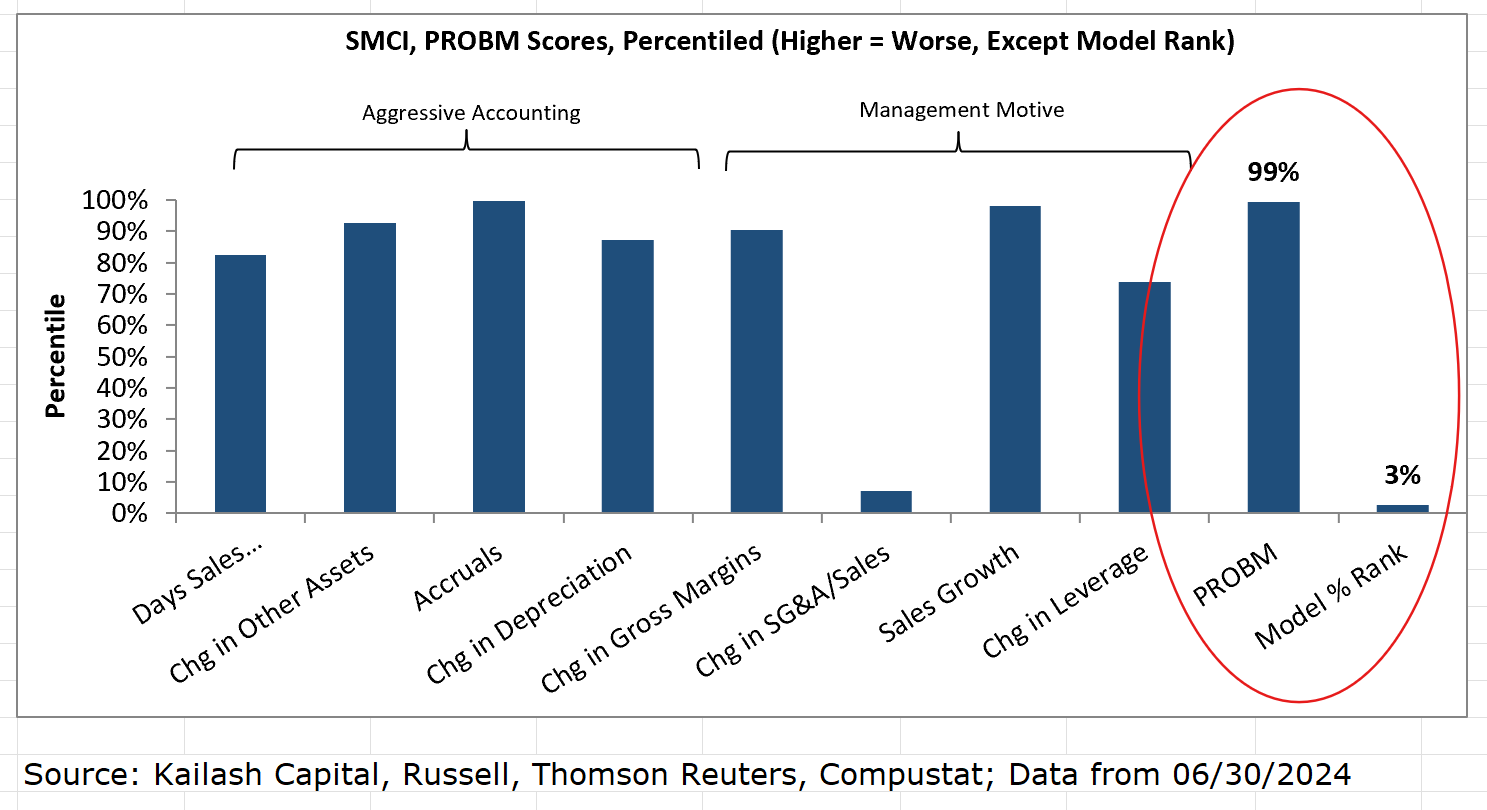

A systematic approach to identifying potential earnings manipulators like SMCI

SMCI shares fell nearly 20% after the company delayed the filing of its annual report and Hindenburg Research alleged “fresh evidence of accounting manipulation”. Interestingly, SMCI features in KCR’s S&P 500 Earnings Manipulator list, which includes stocks in 1) the worst quintile based on academia’s PROBM formula and 2) the bottom 20% of KCR’s ranking methodology. Other companies flagged include Advanced Micro Devices, Tesla, and Xylem, with Block and Emerson Electric added last month. Over the past 14 years, KCR’s Research Short Portfolios have been valuable for spotting potential risk flags and generating short ideas. To access the return summary for these portfolios click here.

Edition: 194

- 06 September, 2024

China Automation: Destocking nearing end, but 2024 expected to be flat Y/Y

Industrials

SRR’s latest channel checks reveal short cycle orders have bottomed and destocking headwinds have significantly eased Q/Q. The auto industry was cited as an area of strength, while the export market and the electronics sector were highlighted as areas of weakness. The biggest medium-term headwind cited for foreign brands was rising domestic competition. Local automation companies have rapidly moved up the technology curve, while pricing for domestic brands in robotics were estimated to be 10-20% lower than foreign brands, while DCS products were 30-50% lower. Brands mentioned by private systems integrators that have been vulnerable to share loss to domestic brands include Yaskawa, Emerson and Siemens.

Edition: 171

- 13 October, 2023