Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

US copper continues to atrophy

Political and legal challenges continue with few domestic US copper projects advancing (and some then failing), while existing production continues to mature (see chart). Ultimately, stagnation of US domestic production strengthens the upside case for the copper price. The US has the resource inventory to be self-sufficient, yet it is hard to see any of the key larger projects progressing in the mid-term. By the end of this decade, Global Mining Research sees incremental projects lifting volumes to ~1.3Mt/yr from current production at ~1.1Mt/yr. Preferred US-exposed copper plays are Freeport (upside from leach and Bagdad 2X), Taseko (Florence ISL expected to commence in 2025) and Hudbay (significant resource optionality).

Edition: 204

- 07 February, 2025

Copper: Risk to the downside

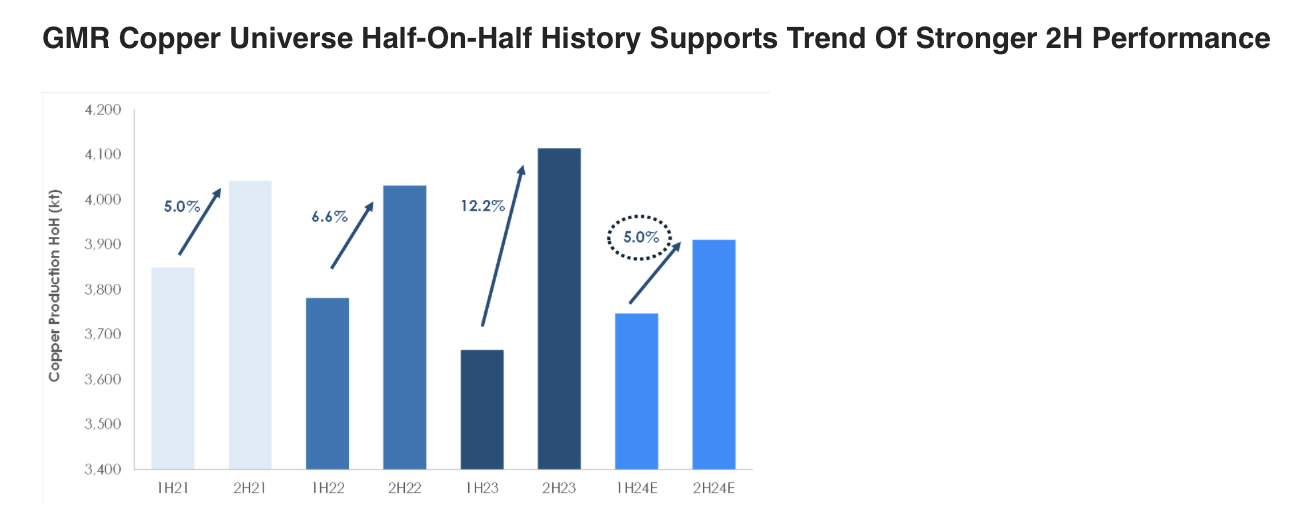

Copper prices had a strong start to the year. David Radclyffe’s review of the Q1/2024 performance versus 2024 guidance for the December year-end stocks helps put the market tightness into perspective. The key takeaway is that, as with gold companies, copper miners are banking on a strong H2/2024 to meet annual guidance figures. The risk is therefore to the downside, with once again copper producers struggling to either meet guidance or increase production appreciably. Only Hudbay Minerals, KGHM, Southern Copper, Freeport-McMoRan and First Quantum Minerals are tracking to 2024 production expectations. David’s preferred copper miners are in the small/mid-cap space on valuation grounds, including Atalaya Mining, Capstone Copper, Sandfire and Hudbay Minerals.

Edition: 187

- 31 May, 2024

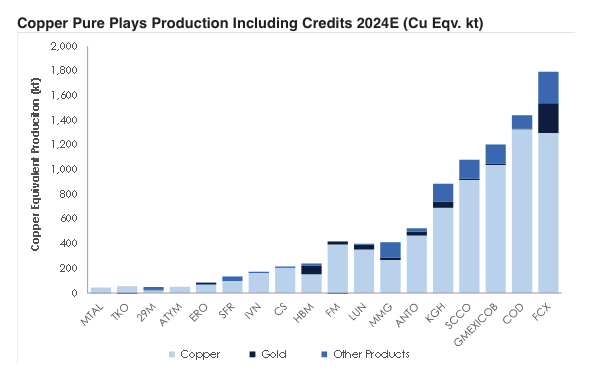

Copper sector: Gold credits to shine

Commodity prices are overall moving in the right direction for the copper sector, with spot LME copper now at ~US$4.25/lb. However, many copper miners enjoy important by-product credits, including molybdenum, lead, zinc, silver and gold. Interestingly, precious metal credits have outperformed other by-products with gold at >US$2,350/oz. The sector is expected to generate ~82% of revenues from copper in 2024E with gold the next highest at ~6%. In 2024E, GMR’s copper universe is expected to produce ~2.2Moz of attributable gold production (~0.5Mt Cu Eqv.). However, analysis shows credits do not always correspond to the best position on the cost curve. Many copper miners don’t receive the full impact of higher precious metals credits due to streaming/royalty funding deals. The best way to play this “free kick” is through Hudbay Minerals, KGHM, and Freeport-McMoRan.

Edition: 184

- 19 April, 2024

Miners forced to become green power companies?

David Radclyffe reviews how mines with little access to green electricity will need to build capacity themselves or via a third party in order to meet emissions targets. Some will come under increasing scrutiny; Rio Tinto, South32, Southern Copper Corp, Freeport-McMoRan and Anglo American could all face increased capital/opex exposure. The potential capital costs associated with self-generation are massive, so investors should keep a close eye for opportunities present in the partial or full outsourcing of infrastructure.

Edition: 122

- 29 October, 2021

Freeport-McMoRan (FCX) vs. Grupo Mexico (GMEXICOB MM) vs. Southern Copper (SCCO)

Materials

GMR provide a comprehensive review of these 3 copper producers who together make up 15% of global copper supply. GMEX is their preferred choice on valuation grounds given it trades at ~1x P/NPV (vs. 2.3x for FCX and 2x for SCCO) and 4.6x EV/EBITDA (vs. 8.4x for FCX and 9.1x for SCCO). GMEX's significantly higher dividend (6.5%) will also appeal to income-hungry investors. GMR see no reason to own SCCO (rated Sell) since it can be bought effectively much cheaper via parent GMEX. While FCX is acceptable at spot prices, it looks very expensive on LT copper US$3.25/lb.

Edition: 112

- 11 June, 2021