Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

Materials

SLVM's singular focus on the uncoated freesheet market positions it to gain from capacity rationalisation while strengthening its competitive edge through high-return capital projects. In the 3 years of operations since its spinoff from International Paper, SLVM has generated a total shareholder return of 150% and adjusted FCF of $920m, while debt has fallen $725m. The company has a top-tier management team driving its long-term strategy and despite the secular decline in UFS, Sidoti expects SLVM will continue to reinvest in its business to grow cash flow and earnings. TP $93 (45% upside).

Edition: 208

- 04 April, 2025

Pulp sellers blink in China

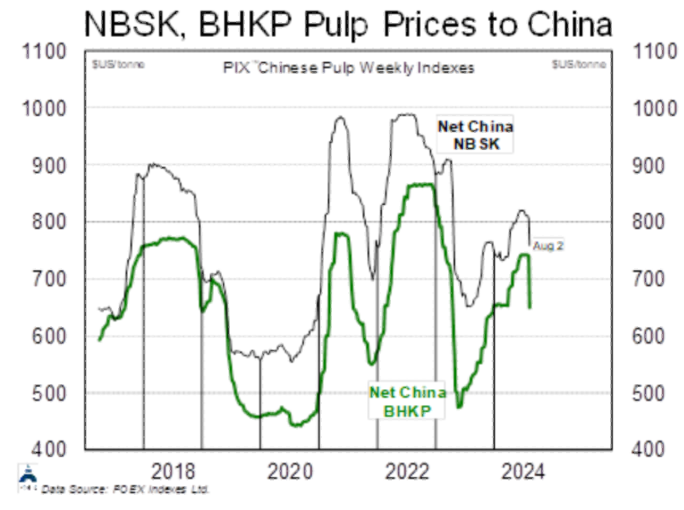

Pulp prices in China have been rangebound since early June, with Chinese buyers and sellers locked in a standoff. Given the huge week over week PIX China pulp price changes (chart), the producers have blinked first. PIX prices dropped $48 and BHK fell by an astounding $91, a correction of a magnitude that would usually take weeks to occur. Expect other international markets to see accelerated price drops as a result. The biggest market-pulp consumers are tissue producers and in ERA’s stock coverage Cascades is expected to benefit the most. Pulp producers are the losers, including Mercer International and International Paper. Expect pulp names to remain under pressure for at least a quarter, or until closures accelerate.

Edition: 192

- 09 August, 2024

Forest Products: Tough year ahead

Materials

The outlook for lumber / panel producers (Canfor, West Fraser, Boise Cascade, Louisiana-Pacific) is difficult, with no obvious upside catalyst before a recovery in US housing (unlikely before late 2023). ERA expects pulp prices to move lower through 1H23. Anticipated price declines are now almost fully priced into pulp names (Mercer, International Paper). In packaging, more pain lies in store for containerboard (Westrock) and a raft downtime will be needed to combat weaker demand and offset new capacity. Boxboard will outperform (Graphic Packaging, Clearwater Paper), with both demand and prices expected to remain robust.

Edition: 151

- 06 January, 2023

Materials

Spun-out from International Paper Company last month, John Sims (CFO) and Gregory Gibson (Senior VP) have wasted no time in materially boosting their stakes - John Sims purchased $646,000 of stock at $30.46, increasing his holding by 44%. He previously made six non-option sells of IPC in the four years prior to the spin-out and never made a purchase. Gregory Gibson purchased $574,000 of stock on the same day, increasing his holding by 80%. These large purchases shortly after the spin-out are very encouraging. Stock Ranking +1 (highest rating).

Edition: 124

- 26 November, 2021