Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

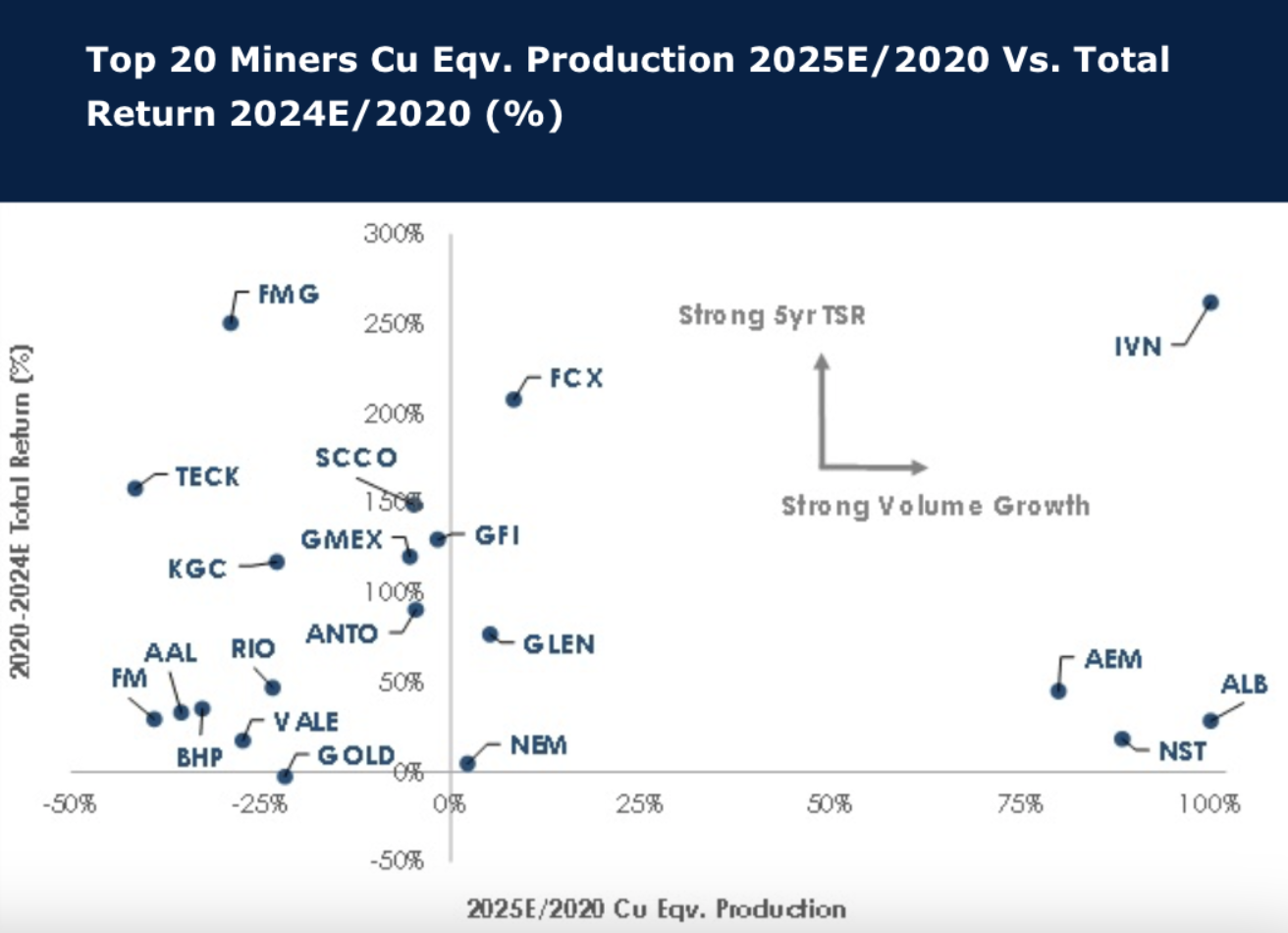

Large cap miners: Performance and growth are not related

As Sellside and Buyside set expectations for 2025, Global Mining Research examines the recent history of the leading miners. Interestingly, only Agnico Eagle Mines Limited, Albemarle Corporation, Ivanhoe Mines Ltd, and Northern Star Resources Limited are estimated to have materially grown through investment and M&A over 2020-2025E. In fact, most miners have shrunk in terms of Cu Eqv. Production, and exiting coal was a clear trend. The copper miners have outperformed, despite iron ore miners clearly returning the most cash to shareholders in dividends. Buybacks should have helped the share price return but there is little evidence this works. For over half the group, a ‘buy and hold’ strategy has not generated a robust return over the period. This reinforces the view that miners are to be traded.

Edition: 202

- 10 January, 2025

Can copper volumes meet big expectations?

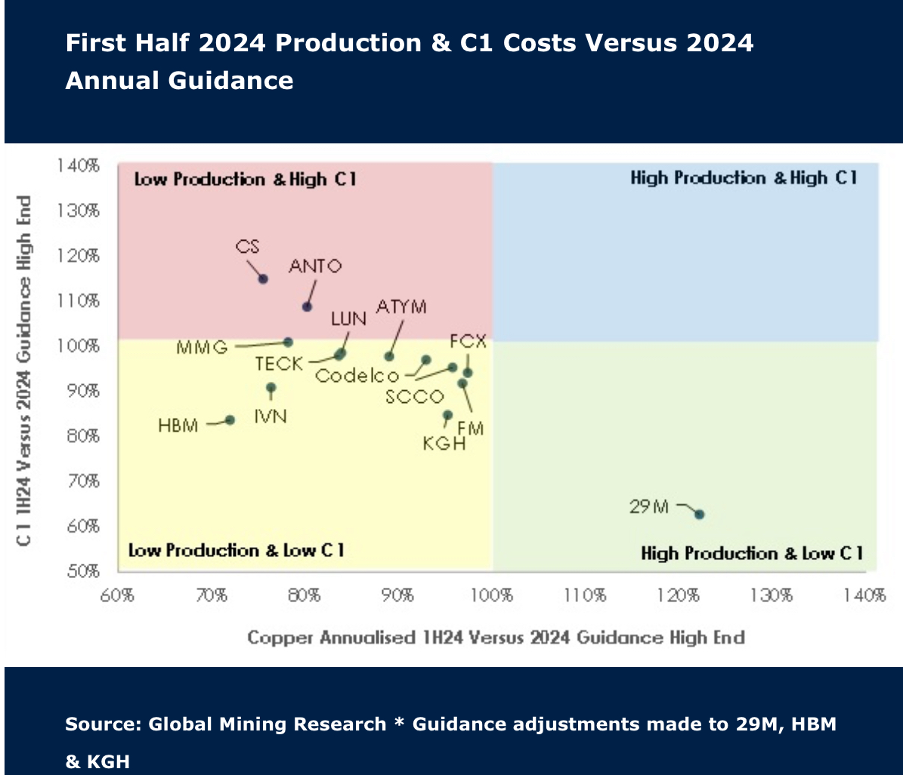

As expected, the first half of the year was met with weaker production, with companies in Global Mining Research’s coverage reporting flat figures of +1.5% and low capex. Costs increased some 4.8%, but this was offset by a ~US$0.60/lb increase in copper prices in the latest quarter. 60% of producers are expecting stronger H2 volumes, but Antofagasta, Ero Copper, Ivanhoe Mines and Capstone Copper are most at risk of missing 2024 guidance. Following the recent pullback and ahead of seasonally stronger Q4 prices, GMR continues to see the sector as attractive. Ratings have been raised for leveraged plays KGHM (to buy) and MMG (to hold).

Edition: 193

- 23 August, 2024

Returns on capital: Copper vs Gold

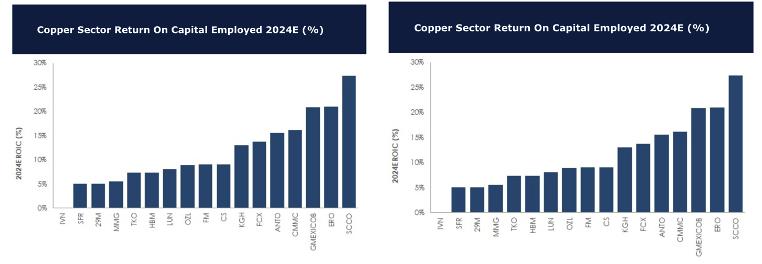

For 2024, David Radclyffe forecasts copper to enjoy an average ROCE of 11.1%. The standout is Southern Copper Corp, helped by some very low cost and long-lived assets. Relatively new to the market Ero Copper Corp does well, while at the lower end sit Ivanhoe Mines and Sandfire Resources. When it comes to gold, the forecasted average ROCE for 2024 is at 8.3%, with Gold Fields coming out on top and Lundin Gold close behind. The copper sector as a whole continues to generate better real returns on capital than the gold sector, with gold miners continuing to suffer from shorter mine lives and a commitment to M&A to create growth.

Edition: 155

- 03 March, 2023