Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

Can copper volumes meet big expectations?

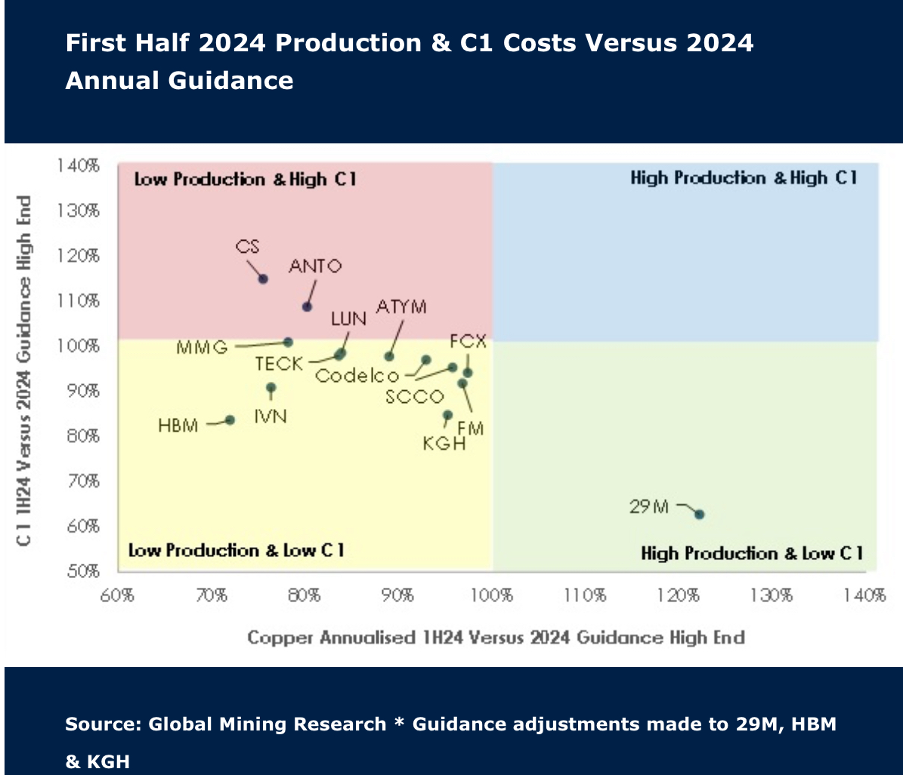

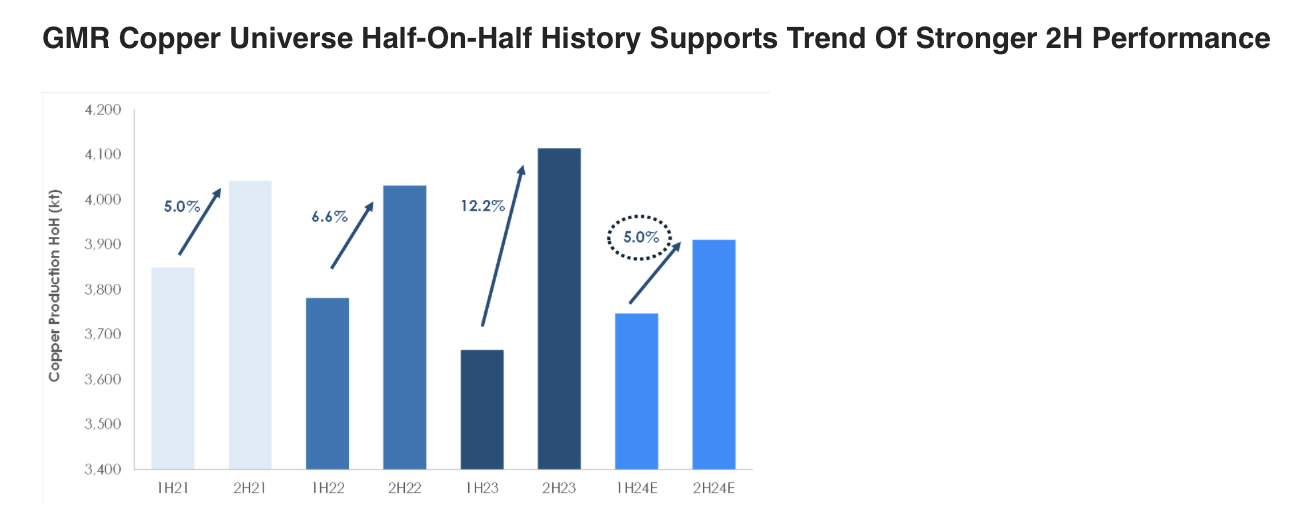

As expected, the first half of the year was met with weaker production, with companies in Global Mining Research’s coverage reporting flat figures of +1.5% and low capex. Costs increased some 4.8%, but this was offset by a ~US$0.60/lb increase in copper prices in the latest quarter. 60% of producers are expecting stronger H2 volumes, but Antofagasta, Ero Copper, Ivanhoe Mines and Capstone Copper are most at risk of missing 2024 guidance. Following the recent pullback and ahead of seasonally stronger Q4 prices, GMR continues to see the sector as attractive. Ratings have been raised for leveraged plays KGHM (to buy) and MMG (to hold).

Edition: 193

- 23 August, 2024

Copper: Risk to the downside

Copper prices had a strong start to the year. David Radclyffe’s review of the Q1/2024 performance versus 2024 guidance for the December year-end stocks helps put the market tightness into perspective. The key takeaway is that, as with gold companies, copper miners are banking on a strong H2/2024 to meet annual guidance figures. The risk is therefore to the downside, with once again copper producers struggling to either meet guidance or increase production appreciably. Only Hudbay Minerals, KGHM, Southern Copper, Freeport-McMoRan and First Quantum Minerals are tracking to 2024 production expectations. David’s preferred copper miners are in the small/mid-cap space on valuation grounds, including Atalaya Mining, Capstone Copper, Sandfire and Hudbay Minerals.

Edition: 187

- 31 May, 2024

Copper sector: Gold credits to shine

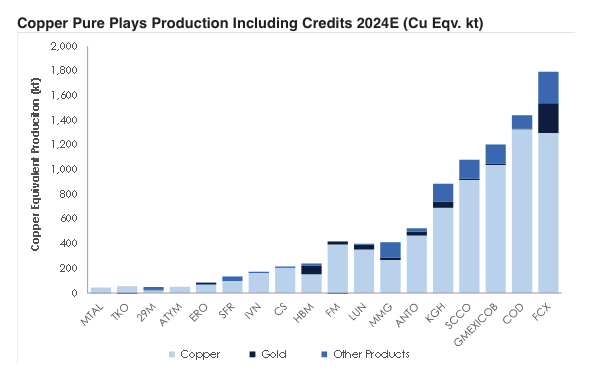

Commodity prices are overall moving in the right direction for the copper sector, with spot LME copper now at ~US$4.25/lb. However, many copper miners enjoy important by-product credits, including molybdenum, lead, zinc, silver and gold. Interestingly, precious metal credits have outperformed other by-products with gold at >US$2,350/oz. The sector is expected to generate ~82% of revenues from copper in 2024E with gold the next highest at ~6%. In 2024E, GMR’s copper universe is expected to produce ~2.2Moz of attributable gold production (~0.5Mt Cu Eqv.). However, analysis shows credits do not always correspond to the best position on the cost curve. Many copper miners don’t receive the full impact of higher precious metals credits due to streaming/royalty funding deals. The best way to play this “free kick” is through Hudbay Minerals, KGHM, and Freeport-McMoRan.

Edition: 184

- 19 April, 2024