Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

Is Argentina the next big thing?

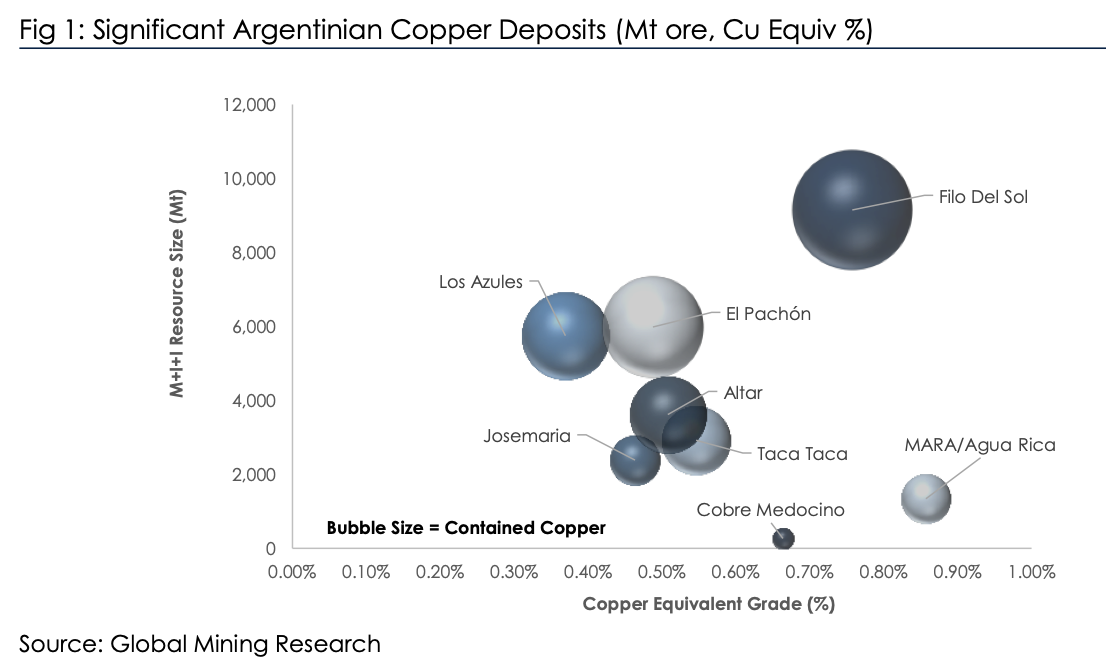

Argentina has significant copper reserves yet produces no material copper (see chart). The new investment climate (RIGI) in Argentina, spearheaded by libertarian President Milei, is hoping to reverse this. Other volatile countries including DRC have achieved significant growth, so it’s possible. In his latest report, David Radclyffe examines the potential of Argentina copper. He sees potential for the nation to become a 1.0–1.5 Mt per year copper producer (top 10 globally), but comments on the aspirational timelines, with first copper unlikely on this side of 2029. Issues also cannot be discounted, with ESG concerns bubbling alongside a lack of infrastructure and skilled workers. David estimates the total capex at USD $40–50 billion. Lundin Mining has the most leveraged exposure to Argentina in partnership with BHP and is the preferred exposure. There are a few exploration plays, of which NGEx Minerals (non-rated) and its Lunahuasi discovery is the largest.

Edition: 222

- 17 October, 2025

Copper: Gold to the rescue

China, the largest copper market, shows no signs of improvement. Meanwhile, the global copper market recorded a 251k-ton surplus in the first half of the year, and some studies are projecting further surpluses for FY2026. Broader commodity signals reinforce this outlook, particularly the sustained weakness in iron ore prices. Expect a 5-10% decline in copper prices by year-end. Interestingly, in Veritas Research’s sample of nine copper producers, costs decreased by an average 16% and 21% in the last two quarters, driven by higher gold prices for which the precious metal is a by-product. Hudbay as a result takes the crown as the lowest cost producer, with strong growth potential and the lowest valuation in their sample. Teck Resources and Lundin Mining are fighting for the dubious honour of being the highest cost producer.

Edition: 219

- 05 September, 2025

Boliden (BOL SS) Sweden

Materials

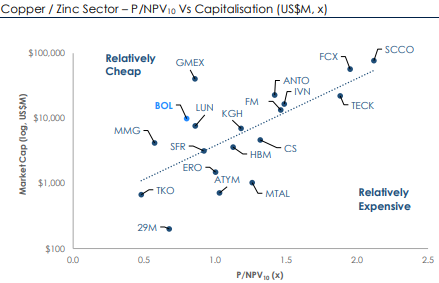

GMR continues to favour the outlook for zinc, where BOL is a large player (~0.5Mt/yr) and offers hard to find exposure. It is rare to find a company with several near-term events expected to support the business. These include a forecast recovery in Aitik grades; Tara moving back to full production rates; completion of the Odda expansion; Garpenberg throughput upside from permit revision; as well as plans to acquire Lundin’s Neves Corvo and Zinkgruvan mines. BOL is not expensive trading at 0.8x NPV10 and a prospective 2026E EV/EBITDA of 4.2x and FCF yield of 11%. Gearing is expected to peak in 2025 at ~22%.

Edition: 205

- 21 February, 2025

Lundin Mining (LUN CN) Canada

Materials

Seeking a wealthy partner - the Josemaria project in Argentina carries significant risk, with returns likely below a reasonable cost of capital for LUN. Absent a contribution from a partner, Martin Pradier fears value dilution on an equity issuance to fund the project. Development and associated funding risk, combined with unimpressive ROE, a weaker outlook for copper prices and recession risk, all contribute to his initiation on the stock with a Sell rating and $9.5 per share value estimate. His valuation implies 3.5x and 8.5x 1-yr forward EBITDA and EPS, respectively.

Edition: 166

- 04 August, 2023

Copper: Risk vs Reward

The post-Covid economic hangover has arrived. For copper this means equities have corrected, yet the metal is close to $4/lb. Markets have repriced risk, especially in small caps, but this is a short-term view. There is a case for investing while there is blood on the street, explains David Radclyffe, as he advises investors to position for a traditionally strong Q4. His preferred exposure is through more attractive and better value larger caps such as First Quantum Minerals and Lundin Mining Corp. He also upgrades 29Metals to a BUY given its better overall metrics to peers.

Edition: 138

- 24 June, 2022