Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

Consumer Discretionary

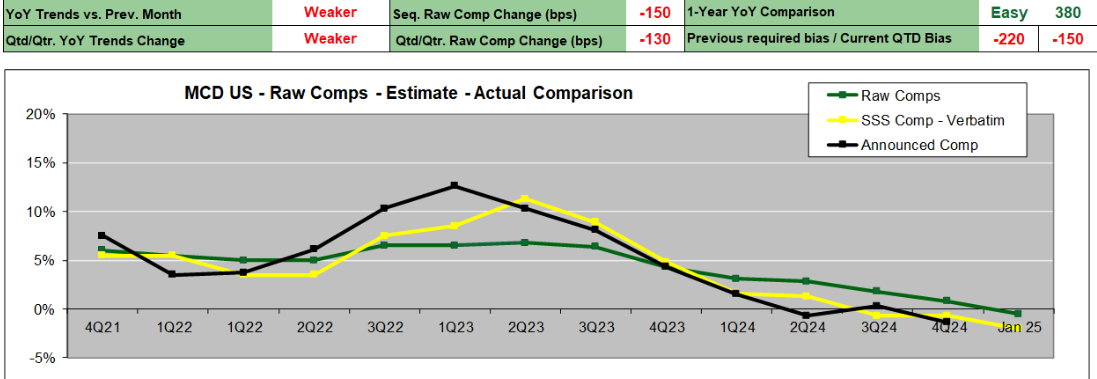

MCD US Jan sales trends are weaker than both Dec and 4Q24 trends, according to Verbatim’s latest channel survey. Traffic and sales remain sluggish mainly because of adverse weather, higher competition and a weaker macro environment. Prices have risen by 2% on average for Big Macs, Quarter Pounders and French fries. Staffing is easier Y/Y due to a higher number of applicants, with wages remaining steady. Online ordering continues to grow. Verbatim’s Jan Comp Estimate is -2.0% vs. 4Q24 (Oct-Dec) Actual Comp of -1.4%.

Edition: 205

- 21 February, 2025

Consumer Discretionary

According to Verbatim’s latest channel checks, Oct sales trends are weaker than Sep and overall Q3 trends. They first noticed weakness within their MCD (US) sample a couple of months ago and now that slowdown has accelerated. Customer count has been negatively impacted by the inflationary environment and higher competition. The average basket size has reduced. Promotions are increasing. The current y/y comparison is tougher both on a one-year basis and on a multi-year basis. In Q3, Verbatim required a bias of positive 170 bps. Based on the tougher multi-year comparison and weaker trends, they are applying a bias of positive 50 bps in Oct. With an Oct Raw Comp of +3.5%, their Oct Comp Estimate is +4.0%.

Edition: 174

- 24 November, 2023

Consumer Discretionary

Compass Restaurant Consulting & Research

One of the standout performers in Steve Crichlow’s latest Restaurant Industry Pulse Report - the burger giant enjoyed a strong performance in the US during Nov which has continued into Dec driven by an exceptionally successful marketing campaign of running multiple promotions simultaneously and all being profitable (something it has been unable to achieve since 2012). 82% of contacts interviewed stated they were pleased with the recent shifts in promotional focus. Steve now expects Dec SSS to be at the top end of his current estimates of 5-7%.

Edition: 150

- 09 December, 2022

Chipotle (CMG), McDonald's (MCD), Domino's (DPZ)

Consumer Discretionary

Compass Restaurant Consulting & Research

CMG - Can sustain current SSS trends (June est. +8-10%); growing positive traffic trends (one of the only concepts doing so) coupled with little to no resistance to price increases. The new Pollo Asado is one of the most successful promotions in a long time.

MCD - Dominating the price / value messaging and taking market share from peers. June SSS expectations are +2-4%. Top sales drivers: 2 for $6, Nugget Bundles, Off Premise sales. On the negative side, most franchisees unhappy with the new PACE Store Visitation Program.

DPZ - Declining momentum. June SSS expectations are in the negative 3-1% range. Driver shortages not only impacting sales and market share, but also brand credibility; not easily fixed.

Edition: 137

- 10 June, 2022