Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

AI & Big Tech: Hunger Games, coming soon

Technology

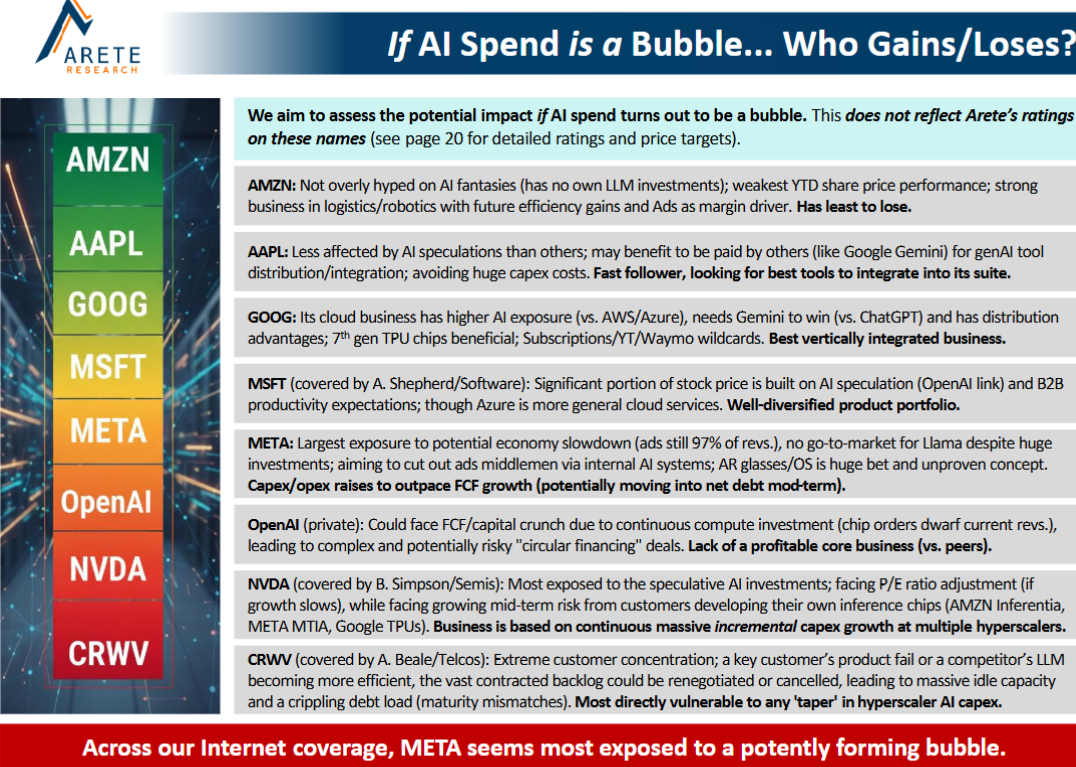

Arete reviews the surge in Big Tech capex, with their forecasts 20-40% above consensus. They note the mismatch of long-term deals and shortening tech life cycles and accelerated depreciation, believing it will require Big Tech to address new TAMs or target each other’s businesses. Their report weighs whether this spending boom will prove to be a “bubble” and identifies who is most exposed. Arete sees Alphabet, Meta, Apple and Amazon all seeking to “own” a customer interface layer as GenAI products move into mainstream adoption.

Edition: 223

- 31 October, 2025

Communications

META is doubling down on AI infrastructure, raising its 2025 capex forecast to $64–72bn as it accelerates data centre construction amid rising costs. CEO Mark Zuckerberg is committed to making META a leading AI platform and insists on building in-house capacity to avoid reliance on others. While the AI strategy (centred on open source) is progressing well, it comes with a steep price tag, notably the ongoing $4bn+ quarterly burn at Reality Labs. Richard Windsor sees a growing risk of AI infrastructure overbuild, with META, Google, Microsoft and Amazon all ramping up spend - setting the stage for a painful correction. Despite this, META’s core business remains solid, with strong Q1 performance and improved operational efficiency via AI. At 23.5x FY25 PER, META is reasonably valued, but Richard prefers Google, where AI disruption risks from players like OpenAI are, in his view, overstated.

Edition: 210

- 02 May, 2025

Technology

Revelare recently hosted a call for their clients on APP’s e-commerce advertising expansion. Their guest speaker was Jonathan Snow, co-founder at Avenue Z, an advertising, performance marketing and PR agency managing $75m+ in digital media spend annually across APP, Facebook, Instagram, TikTok Shop, Snap, among other platforms. Mr. Snow provided an update on his agency’s use of APP’s advertising platform for ecommerce clients, growth of brands on the platform, APP’s performance relative to Meta, growth of advertising budgets for APP, how they test for incrementality, audience demographics, CPMs, improvements to the tech stack, and competition from Unity and Liftoff, among other topics.

Edition: 208

- 04 April, 2025

Big Tech: Asia vs. US - Samsung spoils the chase

Technology

2024 was a banner year for mega-cap US Tech companies, with Apple, Nvidia, Microsoft, Amazon and Meta rising a collective +64%. Were it not for Samsung Electronics crashing -41%, Asia’s mega-cap Tech companies (TSMC, Tencent, Samsung, Alibaba and Meituan) would have almost matched their US peers: +61% collective return (USD) without Samsung but +40% with Samsung. The good news: rolling into 2025, Crystal Shore has a positive risk rating on all 5 Asian Tech companies. Even Samsung.

Edition: 202

- 10 January, 2025

AI: The race to the bottom

One would have expected Anthropic’s latest innovation to be part of its premium tier, but the fact it is free is a sign that the race to the bottom, kicked off by Meta, is already underway. Richard Windsor sees it as a sign that the company is struggling to attract users to its platform in an already competitive environment. There are still no signs of the promised superintelligence on the horizon. Current expectations and valuations are unrealistic, and we will likely see the reset begin in the venture capital space as start-ups fail to meet their targets and go back to their backers for more money. Against this backdrop, everyone is going to take a hit, but the least pain is likely to be felt by Nvidia and TSMC. Richard prefers adjacencies of inference at the edge and nuclear power as the best way to get exposure to AI.

Edition: 194

- 06 September, 2024

Stock market rotation is gradually turning defensive

While Utilities outperformance is being attributed to greater energy demands of AI and EVs, many “boring” electric utilities without obvious AI potential are up DD % over the last few months (AES, Dominion Energy, PSEG). Furthermore, Consumer Staples has an early outperform forecast in Michael Belkin's proprietary times series analysis model - another risk-off signal. The AI and Tech obsession obscures a bigger trend: many Tech stocks are declining. The CLOU cloud software ETF is down -15% since early Feb. Former leading new-era disruptors are top Sell recommendations (Uber, Meta, Netflix). Even Nvidia remains a Sell and its biggest risk is something nobody is talking about: its chips are made in Taiwan.

Edition: 187

- 31 May, 2024

US: Big tech’s spending

The headline GDP figure for Q1 came in below expectations but the underlying numbers were strong again, especially in the core PCE index after it rebounded by an annualised 3.73% q/q in Q1, well above expectations. The 2-year treasury yield now sits at 5% as the market prices out all rate cuts this year, pulling up the long end of the curve. Multiple FAANG members saw significant capex jumps, with Microsoft’s up 79% y/y and Meta’s forecast raised by an additional $5bn+. It is difficult to envisage a slowdown in the US economy, claims Graham Turner, given the strength of tech capex and consumer spending on services. The strength of the US economy will force Europe and other economies to take a bolder approach.

Edition: 185

- 03 May, 2024

E&P ranking model appears to be working

Energy

Mike Churchill only developed this model in early Jan but is pleased with the results so far. The E&Ps that scored better than average back in Jan have performed 11 points better than those rated below average (+28% vs. +17%) over the last 12 weeks. Interestingly, all the stocks with a 40%+ gain were in the better-than-average group (Riley, Vaalco, Valeura, SM Energy and Ring Energy). During this process, Mike also noted that certain meta-themes became apparent including how Permian plays seem to really generate wealth (they don’t just recycle capital endlessly without benefitting investors) and Canadian domestic E&Ps often have a problem with creating wealth over time.

Edition: 183

- 05 April, 2024

Communications

SNAP shares sink 35% amid fears over growth. Craig Huber provides his take on the company’s 4Q23 results and updates his earnings estimates. He remains bearish with a 12-month TP of $8 per share based on 2.3x 2025(E) revenue or 26.6x FCF. Craig continues to view SNAP’s smaller scale as a disadvantage to larger peers in this environment and much prefers Meta’s fundamentals and stock. Despite the law of larger numbers, META saw advertising in 4Q grow 24% vs. SNAP’s total revenue growth of 5%, and for 1Q24 Craig expects 26% ad revenue growth at META vs. only 14% growth for SNAP.

Edition: 179

- 09 February, 2024

Technology

RELY is the leader in cross border digital remittances for migrants and has a long revenue runway with attractive scale economics. Q4 earnings are scheduled for 28th Feb and will be an intense point of market focus. Recent sentiment is exceedingly negative as the company's increased marketing spend is viewed by the street as defensive. Pernas believes increased marketing spend is a positive given attractive LTV/CAC economics and this coming earnings should mark a meaningful shift in sentiment. 100% upside.

Since inception in 2017, the Pernas Portfolio has significantly outperformed the S&P 500 by an annualised 13.06%. Recent successful calls include: Donnelley Financial (+580%), Centrus Energy (+350%), Franklin Covey (+118%) and Meta (+70%).

Edition: 179

- 09 February, 2024

Communications

META shares have had an incredible run this year driven by a stabilisation in margins, a depressed multiple and negative sentiment. However, Rickin Thakrar recommends taking profits given his 1) DCF valuation has the company priced for perfection. 2) Two-year growth rates remain sluggish (a sequential improvement in MAU and DAU has been driven by easy comps). 3) Mark Zuckerberg has been selling shares for the first time in a couple of years. Rickin believe the shares could once again retest the $270 level (20%+ downside).

Edition: 176

- 22 December, 2023

The Magnificent Seven

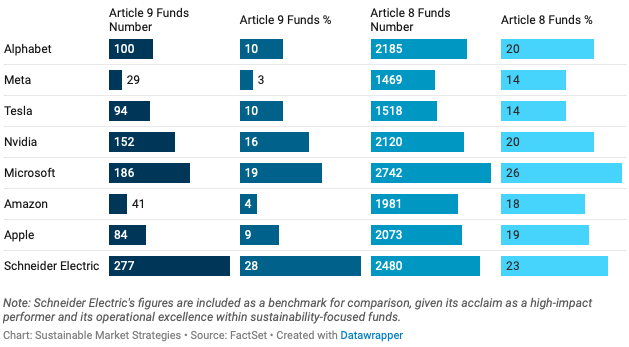

The impressive growth trajectory of the Mag 7 has been fuelled by AI and cloud computing, as money continues to chase their share prices higher despite pressure from rising bond yields on tech stocks’ long duration and their steep valuations compared to equity benchmarks. As pioneers in innovation, they are increasingly encountering legal challenges, but this has been intensifying as of late. The giants have a noteworthy presence in sustainable investment funds (see chart). However, the Sustainable Market Strategies team see the broad inclusion of these stocks as somewhat dubious. They tout Nvidia and Microsoft as the leaders, although the former is trading on a lot of AI hype and will fall short of growth expectations. Meanwhile, Amazon and Meta should be avoided as long positions in a sustainable strategy.

Edition: 173

- 10 November, 2023

AI regulation should target people, not machines

Governments are moving to impose regulations on AI but a lack of understanding on their part may destroy most of the value that large language models bring. Some of the proposals are focused on topics such as veracity and accuracy, hallucination, and objectivity of AI models – each of which will be very difficult or even possible to effectively fix. Regulation will also impact competition, making it harder for smaller companies and benefitting the likes of Meta, Microsoft and Google. Richard Windsor still believes the machines are still quite dumb, yet they are managing to create a convincing illusion of sentience which leads people to anthropomorphise these systems. This in turn makes them much more capable of being used by bad actors; humans remain far more in danger from other humans than from machines and should be the focus of regulation.

Edition: 172

- 27 October, 2023

Communications

Zuckerberg giveth and he taketh away - the benefits from another round of job cuts look set to be offset by the decision to cut prices on VR headsets due to flagging sales. Richard Windsor suspects that META has been losing >$200 for every device shipped and if volume returns to ~1m per month this will increase the losses at Reality Labs by anything up to $800m per year. Richard still thinks there is far more that Zuckerberg could do to increase profitability and if this were to occur then the stock would look very cheap indeed. However, he is not convinced this will happen meaning the value proposition remains uninteresting with >20x PER ratio being demanded for negative growth.

Edition: 156

- 17 March, 2023

Communications

Using Cash Flow Returns On Investments based valuation tools, Meta Platforms is looking significantly undervalued. ROCGA’s portal has been built using the Cash Flow Returns On Investments methodology. It allows you to identify, research and value listed companies. They have 15 years of clean fundamental data and you can model and assess companies in seconds. Current coverage: 1,010 North American, 515 UK and 440 European companies. Other companies identified include eBay, United Parcel Service and Adobe. More details on ROCGA’s systematic and interactive valuation tools can be found here. A free trial is available on request.

Edition: 152

- 20 January, 2023

Communications

Too cheap to ignore - this 35-page report focuses on why social media companies, especially Meta, look very attractive. Yes, there is a lot of noise around FB, but it is worth sifting through it as all the problems are short term in nature with plenty of free upside options. Abacus sees tailwinds for (sustainable) 10%+ revenue growth and margin expansion. Net income (GAAP) approximately doubles by 2025 from 2022 levels. The stock currently trades at close to intrinsic value; offers minimal downside with potential for 100% upside over 3-yrs.

Edition: 133

- 14 April, 2022

Technology

Inflection Point Research, LLC

A Cloudy future is a good one - ANET is in a great competitive position, with tailwinds across all its end markets and product lines. Michael Fox points to the ongoing and accelerating networking upgrade cycles at Microsoft and Meta Platforms, in addition to greenfield business ramping at Alphabet as reasons to be bullish. Add to that share gains in an increasing TAM for enterprise / campus and you get the best networking growth story for the next two years.

Edition: 131

- 18 March, 2022

Technology

An Epic partner - Mio Kato has been arguing that significant collaboration between Sony and Epic Games is likely in forming the key infrastructure for the metaverse. The recent Matrix Awakens demo starts to reveal some of the possibilities. In addition, it demonstrates why Mio believes popular metaverse theme names like Meta and Roblox have no realistic chance of competing. Mio also discusses the (increasingly high) likelihood that Tencent decides to sell its stake in Epic with Sony expected to be one of several interested parties.

Edition: 126

- 07 January, 2022

Meta Platforms / Facebook (FB)

Communications

Trip around the Digital Life Pie begins - FB's acquisition of VR fitness company Within will be the first of many as it looks to acquire the technologies and services that it lacks in order to have a complete ecosystem for the Metaverse (where the green shoots of early beginnings are springing up in VR and in Oculus particularly). While Richard Windsor believes the stock will remain under pressure in the near-term (PR problems), FB will be one of the cheapest ways to play the Metaverse theme.

Edition: 123

- 12 November, 2021