Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

Communications

NBIS announced its first hyperscaler contract - a 5-year deal with Microsoft worth up to $19.4bn, which will consume nearly the entire capacity of its New Jersey facility. The agreement marks a major validation of NBIS’s model, significantly de-risking its capacity buildout plans as it targets 1GW across the US in the coming years. Hamed Khorsand thinks the deal provides unprecedented clarity on the company's long-term revenue potential and opens the door to further hyperscaler partnerships. Following the news, the shares surged ~50% and are now up 170% since he turned bullish in Jan 25, however, Hamed continues to see significant upside raising his TP from $90 to $130.

Edition: 220

- 19 September, 2025

IT Survey: Robust spend, GenAI boom, staffing cuts

Technology

Rosenblatt’s July survey of 100+ senior IT managers reveals a surprisingly robust IT spending outlook, with two-thirds of budgets being revised higher since the start of 2025, despite macro concerns. GenAI is the top investment priority, with 60% increasing spend and nearly 70% expecting a material organisational impact. Over 75% expect developer staffing cuts of 10%+. Cybersecurity remains a defensive spending priority with investment flowing towards securing modern, distributed environments (Cloud, SASE/SSE) and data itself - benefitting CrowdStrike, CyberArk, Palo Alto, Zscaler and Fortinet. AWS fared much better, ranking first in "cloud service provider best positioned in AI", with 28% (vs. 16% in Dec 24), surpassing Google and Microsoft. Infrastructure names like Snowflake, Rubrik and MongoDB are also well-positioned amid data estate modernisation.

Edition: 216

- 25 July, 2025

Do tariffs and pricing matter?

Trivariate used NLP to analyse 2,488 earnings calls since Mar 25, finding that 37% of companies mentioned both tariffs and pricing - most notably in Materials, Consumer Discretionary and Consumer Staples sectors. Lower-quality and value stocks were more likely to raise the issue. The most cited terms were “uncertainty” and “indirect impacts”, flagged by 584 companies including Microsoft, JPMorgan and Coca-Cola. From a performance lens, firms discussing tariff benefits or direct price pass-throughs outperformed by over 3% vs. those referencing absorption or uncertainty. "Price increases" and "surcharges" were associated with weaker performance, while "wait and see" commentary outperformed.

Edition: 213

- 13 June, 2025

Communications

META is doubling down on AI infrastructure, raising its 2025 capex forecast to $64–72bn as it accelerates data centre construction amid rising costs. CEO Mark Zuckerberg is committed to making META a leading AI platform and insists on building in-house capacity to avoid reliance on others. While the AI strategy (centred on open source) is progressing well, it comes with a steep price tag, notably the ongoing $4bn+ quarterly burn at Reality Labs. Richard Windsor sees a growing risk of AI infrastructure overbuild, with META, Google, Microsoft and Amazon all ramping up spend - setting the stage for a painful correction. Despite this, META’s core business remains solid, with strong Q1 performance and improved operational efficiency via AI. At 23.5x FY25 PER, META is reasonably valued, but Richard prefers Google, where AI disruption risks from players like OpenAI are, in his view, overstated.

Edition: 210

- 02 May, 2025

Big Tech: Asia vs. US - Samsung spoils the chase

Technology

2024 was a banner year for mega-cap US Tech companies, with Apple, Nvidia, Microsoft, Amazon and Meta rising a collective +64%. Were it not for Samsung Electronics crashing -41%, Asia’s mega-cap Tech companies (TSMC, Tencent, Samsung, Alibaba and Meituan) would have almost matched their US peers: +61% collective return (USD) without Samsung but +40% with Samsung. The good news: rolling into 2025, Crystal Shore has a positive risk rating on all 5 Asian Tech companies. Even Samsung.

Edition: 202

- 10 January, 2025

IT Spending: Sentiment weaker than last quarter

Technology

SPR’s latest channel checks reveal disappointment that the second half pick up that many expected has not materialised. Stock specific feedback includes: ServiceNow - all very positive - probably the strongest indications for any vendor. Crowdstrike channels and end users see the vendor moving quickly past its recent crash. SPR has picked up mixed feedback re. Fortinet’s recent security breach and whether it negatively impacted Sept Qtr end deal flow. Outside of security, the vendors seeing an increase in positive comments include IBM, Oracle, Microsoft, Arista and Juniper/Mist. It has been easy to pick up comments on share loss by Cisco.

Edition: 197

- 18 October, 2024

Consumer Discretionary

BABA’s transformation from China’s eBay to China’s Microsoft continues - the group’s AI strategy involves both the development of its open-source LLM model (Qwen), which has performed well on benchmarks in China, and investment in Chinese AI startups. This strategy has already proven successful with Moonshot and MiniMax developing popular AI applications. BABA provides these start-ups with credits that can be used for training or inference, which has driven growing demand for AI services on AliCloud. Although GPU supply is a constraint, Blue Lotus sees domestic breakthroughs in semiconductor equipment providing BABA with an avenue to expand its supply of AI compute and expects the group (and Tencent) to reinvent China’s software industry.

Edition: 193

- 23 August, 2024

Technology

Survey data suggests more friction converting customers to SaaS - ETR’s Technology Spending Intention Survey (TSIS) results have shown a 28-point Net Score decline over the past two years and preliminary July Net Score data puts VRNS as the second lowest among publicly traded security vendors. The company has executed its first SaaS transition phase well, but ETR’s data reflects declining spending intentions among existing customers it aims to convert. AI adoption is expected to grow the volume and complexity of enterprise data use, but ETR sees increasing competition from Microsoft, large security platform companies and AI-focused security start-ups.

Edition: 189

- 28 June, 2024

AI: Artificially Inflated

The market is currently valuing revenues from AI at 150x for 2024, which is clearly unsustainable. A significant reset will come soon, with only the big digital ecosystems surviving. Nvidia remains the exception, with a far more reasonable valuation that will result in a much calmer correction when the time comes. Richard Windsor prefers to look more laterally where there is more value to be had. One of these lateral arcs is nuclear power which is going to be needed to power all the data centres and another is inference at the edge (which Microsoft has just championed) where Qualcomm and MediaTek are likely to be the big players.

Edition: 187

- 31 May, 2024

Technology

A lot of IT Services companies that are employee-heavy and not prepared for the AI revolution, will get displaced by hardware- and software-based solutions. ACN has ~750k employees. Revenue per employee is lower than a restaurant group like Darden. The entire share price move during 2023-24 was ACN pitching themselves as an AI solution company; they have been trying to buy the expertise by doing small acquisitions but why would anyone hire them vs. using Microsoft or Amazon? ACN has negative organic growth in a massive AI tech spending boom and trades at a bigger multiple than MSFT! TP $200 (30% downside).

Edition: 185

- 03 May, 2024

US: Big tech’s spending

The headline GDP figure for Q1 came in below expectations but the underlying numbers were strong again, especially in the core PCE index after it rebounded by an annualised 3.73% q/q in Q1, well above expectations. The 2-year treasury yield now sits at 5% as the market prices out all rate cuts this year, pulling up the long end of the curve. Multiple FAANG members saw significant capex jumps, with Microsoft’s up 79% y/y and Meta’s forecast raised by an additional $5bn+. It is difficult to envisage a slowdown in the US economy, claims Graham Turner, given the strength of tech capex and consumer spending on services. The strength of the US economy will force Europe and other economies to take a bolder approach.

Edition: 185

- 03 May, 2024

Is AI spend impacting the RPA sector?

Technology

ETR’s latest Gen AI survey indicates that budget to fuel AI ambitions is being reallocated from elsewhere (vs. newly added budget). In addition, preliminary data from their Apr 24 Technology Spending Intentions Survey shows a stark divergence in Net Score momentum between ML/AI and RPA. The y/y Net Score declines are squarely focused on three vendors: UiPath and Automation Anywhere, with whopping 18 ppts and 24 ppts Net Score declines y/y, respectively (along with Blue Prism’s 24 ppts decline, with a lower citation count). Microsoft Power Automate and Pegasystems are notably stable both y/y and sequentially from Jan, with Appian the only vendor seeing significant Net Score momentum to the upside.

Edition: 183

- 05 April, 2024

Technology

TSMC is enjoying renewed investor interest after its surprisingly strong Oct monthly sales. In KC Rajkumar’s view, the consensus bull thesis for 2024 - ASP increase as the 3nm node ramps, cyclical upturn in PC / smartphone - is inadequate. KC expects upside theme to TSMC’s consensus expectations next year includes significant 5nm demand from major cloud service providers - Microsoft’s newly unveiled AI accelerator chip and Amazon’s newly unveiled Graviton-4 CPU. Relative to Nvidia, KC believes TSMC is an inexpensive vehicle to invest in the AI theme as MSFT's internal AI program makes a major effort to find an alternative to NVDA’s GPU. TP NT$750 (30% upside).

Edition: 175

- 08 December, 2023

The Magnificent Seven

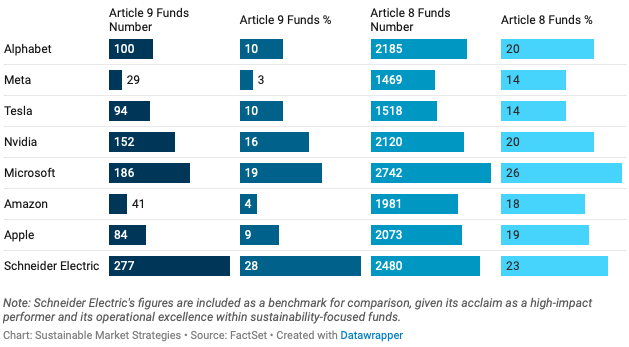

The impressive growth trajectory of the Mag 7 has been fuelled by AI and cloud computing, as money continues to chase their share prices higher despite pressure from rising bond yields on tech stocks’ long duration and their steep valuations compared to equity benchmarks. As pioneers in innovation, they are increasingly encountering legal challenges, but this has been intensifying as of late. The giants have a noteworthy presence in sustainable investment funds (see chart). However, the Sustainable Market Strategies team see the broad inclusion of these stocks as somewhat dubious. They tout Nvidia and Microsoft as the leaders, although the former is trading on a lot of AI hype and will fall short of growth expectations. Meanwhile, Amazon and Meta should be avoided as long positions in a sustainable strategy.

Edition: 173

- 10 November, 2023

AI regulation should target people, not machines

Governments are moving to impose regulations on AI but a lack of understanding on their part may destroy most of the value that large language models bring. Some of the proposals are focused on topics such as veracity and accuracy, hallucination, and objectivity of AI models – each of which will be very difficult or even possible to effectively fix. Regulation will also impact competition, making it harder for smaller companies and benefitting the likes of Meta, Microsoft and Google. Richard Windsor still believes the machines are still quite dumb, yet they are managing to create a convincing illusion of sentience which leads people to anthropomorphise these systems. This in turn makes them much more capable of being used by bad actors; humans remain far more in danger from other humans than from machines and should be the focus of regulation.

Edition: 172

- 27 October, 2023

Generative AI & Microsoft Copilot

Technology

The ETR Insights team recently hosted a Generative AI panel discussing use cases within the enterprise, the extent to which certain companies have already adopted these technologies and the pain points associated with this process. A few key takeaways include: 1) All panellists seemed comfortable with the price points mentioned (e.g., $30 user/month for MS 365 Copilot) and felt confident in their ability to show ROI on these investments. 2) Panellists felt mostly ready to put GenAI to work at scale from an infrastructure standpoint. 3) A few panellists noted substantial overlap between their RPA use cases and their plans for GenAI tools - could GenAI now be leapfrogging RPA?

Edition: 169

- 15 September, 2023

Technology

Buy the dip even as AI momentum shows cracks - as the semis complex comes under pressure for all the right reasons (disappointments at Apple, loss of momentum in AI, analog inventory, China trade worries), KC Rajkumar believes (near-term) long ideas in semis have become harder to come by. However, he argues the Street has become too negative re. traditional servers and expects investors to gravitate towards AMD despite ongoing worries regarding share gain of its MI300. Over time, KC would not be surprised if up to a third of Microsoft’s AI servers come to be based on an AMD solution vs. the dominant share Nvidia currently enjoys.

Edition: 167

- 18 August, 2023

The Exponential Age has begun

Raoul Pal has long believed that The Exponential Age, a revolutionary transformation of the world into a new digital era, would come. It has now arrived. We’re at that really sweet spot in the cycle where no one believes what is happening in tech and everyone is underweight equities. A sharp correction in the short-term is likely, but any purchase of stock stocks will soon pay off very well. Any sell-off is an opportunity to buy more. BUY NDX, tech stocks such as Google and Microsoft, and crypto including Ethereum and Solana. Don’t miss out.

Edition: 162

- 09 June, 2023

Connectivity, speed & scale combine to blow up IT as we know it

Technology

In John Harrington’s latest Tech Trends report, he looks at several factors that have combined to change IT development and sales dynamics. These include how the accelerating deployment of speedier wired and wireless connectivity to the cloud, very fast computing platforms being built at scale within the clouds, the accelerating development of quantum computing as a viable commercial business, and the development of serious AI capabilities are affecting the global digital landscape. As IT increasingly transitions from in-house networking to the cloud, some new areas of IT will benefit, while others face an uncertain future.

Positive: Advanced Micro Devices, Alphabet, Apple, Amazon, Broadcom, Ciena, Dycom, Intel, IonQ, Microsoft, Nvidia, Rigetti.

Negative: C3.ai, Cisco, Dell, Qualcomm, Salesforce.

Edition: 162

- 09 June, 2023

Technology

67% of Woozle’s sources* reported positive outlooks for the next 6 months. New business has started to pick up again and SGE appears poised to win market share, especially among SMEs, as well as a growing presence in the enterprise market with the expansion of Intacct. Competitive pricing, product simplicity and flexibility with SaaS has put the software company on pace to beat 1H23 consensus estimates.

*Woozle conducted interviews with ERP software resellers, channel partners and consultants. Their sample evenly reflects both SAP and SGE, with some sources selling both brands, as well as Oracle and Microsoft. Regional split: 60% Europe / 40% N.America.

Edition: 160

- 12 May, 2023

Advanced AI: Sink or swim time for cybersecurity vendors

Technology

How are AI advancements and hype affecting the cybersecurity industry? What are data security vendors doing with AI/ML and cybersecurity automation, and can they protect their market from the major cloud operators with their investments in AI-driven security for their own platforms? During the interviews conducted by Blueshift, industry sources were also asked how they would play the sector near to mid-term and out over time. Companies discussed include Amazon, CrowdStrike, Cisco, CyberArk, Fortinet, Google, IBM, Microsoft, Okta, Palo Alto and Zscaler.

Edition: 158

- 14 April, 2023

Technology

Inflection Point Research, LLC

Following its share price collapse, Michael Fox remarks that it is difficult to watch a big customer like Microsoft treat a small vendor with leading edge technology in such a terrible way. However, he believes MSFT’s development of new tech has been broken for some time (internal ineptitude / no cohesive strategy) and it may well turn out that they realise that they need CRDO as a strategic vendor and will give them additional business going forward. Meanwhile, the other business activities remain intact, and the overall trends in the industry benefiting AECs, and CRDO as the first supplier, have not changed.

Edition: 154

- 17 February, 2023

Technology

Stay short - while the Street recognises that ZM’s Online segment has likely peaked, it is still too bullish about growth prospects for the Enterprise segment - OWS argues that competition from Microsoft Teams and Google Meet is likely to impede ZM from attaining its mid-20s targeted revenue growth rate. Operating margin may also be lower than bulls anticipate due to mix shift to lower margin Zoom Phones and the need to up spending in R&D / S&M. The magnitude of the company’s SBC expense is starkly exposed by the fact that it has spent ~$1bn YTD on stock buybacks while lowering the share count by a paltry 1% Y/Y. TP $55.

Edition: 150

- 09 December, 2022

Rapidly detecting meaningful language changes in 10Qs / 10Ks. Recent alerts include...

Acuity Brands (AYI) - Working on a large acquisition(s) that could endanger dividends / share repurchases?

Amazon (AMZN) - No more reduced prices for AWS customers?

Kilroy Realty (KRC) - Under pressure to lower rents and increase expenditures for re-leasing?

Microsoft (MSFT) - Growing concerns that government contracts are at risk of being cancelled?

Edition: 148

- 11 November, 2022

Activision (ATVI), Black Knight (BKI), VMware (VMW)

CTFN provides in-depth news on mergers, event-driven situations and major corporate developments. The news service, in conjunction with their PressRisk platform, delivers content and resources that increase the value and efficiency of their readers’ research efforts. Recent coverage includes:

Activision - The state of play meeting with the EC for Microsoft’s acquisition of ATVI was 21st Oct. MSFT can offer Phase I remedies by 28th Oct.

Black Knight - The FTC sought a declaration from a vendor in the loan origination space as part of its review of Intercontinental Exchange’s purchase of BKI.

VMware - Market power in virtualisation software likely to take centre stage in EC’s examination of Broadcom merger.

Click here to access the three news stories.

Edition: 147

- 28 October, 2022

Technology

The strangest profit warning - Richard Windsor questions the validity of MSFT’s claim that USD strength is to blame and sees a difficult quarter ahead. Looking at the wider Technology sector, he notes that while many stocks have already fallen by 70%+ they could easily halve again. Stick with the value end of the sector and semis in particular. He favours Qualcomm, TSMC and MediaTek as companies with reasonable growth ahead, strong positions in their markets as well as valuations that are less than 15x 2022 PER.

Edition: 137

- 10 June, 2022

Technology

Inflection Point Research, LLC

A Cloudy future is a good one - ANET is in a great competitive position, with tailwinds across all its end markets and product lines. Michael Fox points to the ongoing and accelerating networking upgrade cycles at Microsoft and Meta Platforms, in addition to greenfield business ramping at Alphabet as reasons to be bullish. Add to that share gains in an increasing TAM for enterprise / campus and you get the best networking growth story for the next two years.

Edition: 131

- 18 March, 2022

Best short ideas in Software

Technology

Former software engineer, Srini Nandury, who was the original bear on Nutanix and JFrog, highlights three names that continue to offer material downside…

Gitlab (GTLB) - Reminds Srini of JFrog; market fragmentation and intense competition will limit growth.

HashiCorp (HCP) - Growth to slow more quickly than investors realise; VMware catching on faster as it did with Nutanix. Stock could easily fall to $22.

UiPath (PATH) - Turned bearish with the stock at $70 last June. Expensive solution in a commoditising market; Microsoft is quickly vaulting to the leadership position in RPA.

Edition: 131

- 18 March, 2022

Technology Trends: Change, disruption and opportunity in 2022

1) The acceleration from legacy security solutions to the newer generation of solutions - SASE / shake-up of enterprise networking and network security (Zscaler, Cloudflare, Palo Alto Networks).

2) Leverage of AI in cloud-based communications and collaboration (CCaaS) to the advantage of vendors who are separating themselves from commodity services and pricing (Five9, NICE). Changing competitive landscape as Zoom, Microsoft, and others collide in the large and growing UCaaS market.

3) Further strength in BI / Analytics / Observability to the benefit of vendors with the strongest cloud-based solutions (Datadog, Dynatrace), but more mixed results from vendors transitioning to SaaS (Teradata, Elastic).

Edition: 128

- 04 February, 2022

Sector rotation just hit a major inflection point

Energy, Financials and Value are IN, Tech and Growth are OUT - that's according to market timing and sector rotation specialist Michael Belkin. Having previously had an underperform forecast for both energy (S&P Energy -26% alpha from early Mar to end Aug) and financials (S&P Financials -10% alpha from its Jun peak to its recent relative low), his model forecast has just turned bullish for both these sectors on a 3-6 month view. This rotation also feeds into a reversal for value vs. growth - Michael has a fresh sell signal and underperform forecast for the likes of Alphabet, Amazon, Apple, Facebook and Microsoft.

Edition: 120

- 01 October, 2021

UiPath (PATH)

Technology

Too much hype, too little differentiation, commoditising market, unsustainable valuation and slowing growth - Srini Nandury initiates coverage with a Sell-rating. Estimates 50% of RPA (Robotic Process Automation) projects are not delivering on their intended goals. Competition is intensifying and Srini considers Microsoft to be the most significant threat. TP $40 translates to 23x EV/C2022 sales - PATH should trade at a discount to high growth peer groups since most of its revenue is derived from on-prem sales. Lock-up expiration (Oct 18th) is likely to result in the shares coming under further pressure.

Edition: 116

- 06 August, 2021

Lack of customer expertise hurts Enterprise IT sales

Technology

Blueshift primary research finds the effectiveness of cloud-based applications is swiftly diminishing the need to retain in-house IT staff, leaving a dwindling pool of experienced workers clinging to familiar last-generation technologies, instead of staying current on newer IT capabilities. Hence, enterprise technology sales are likely to miss a hoped for rebound in H2 to the direct benefit of the public cloud operators. Positive: Amazon, Datadog, Microsoft. Negative: Cisco, IBM, Snowflake.

Edition: 111

- 28 May, 2021