Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

Top large cap picks for 2H25

Following a strong H1, AIR remains focused on companies that can continue gaining market share through exceptional management, innovation and cost discipline - all driving rising operating margins and FCF, even in challenging environments. The following names pass all 45 of AIR’s proprietary filters (3 layers of 15 valuation and quality criteria) and are expected to significantly outperform over the next 12 months: 1) Adidas - ranked No.1 in AIR’s quantitative system, with accelerating EBIT, margin gains and surging FCF. 2) Aena - best-in-class margins, strong traffic growth and a robust balance sheet. 3) Prysmian - a key player in energy transition and digital infrastructure with a record €40.3bn order book. AIR rates all three stocks as Strong Buys, with 50-100% upside potential.

Edition: 216

- 25 July, 2025

Prysmian (PRY IM) Italy

Industrials

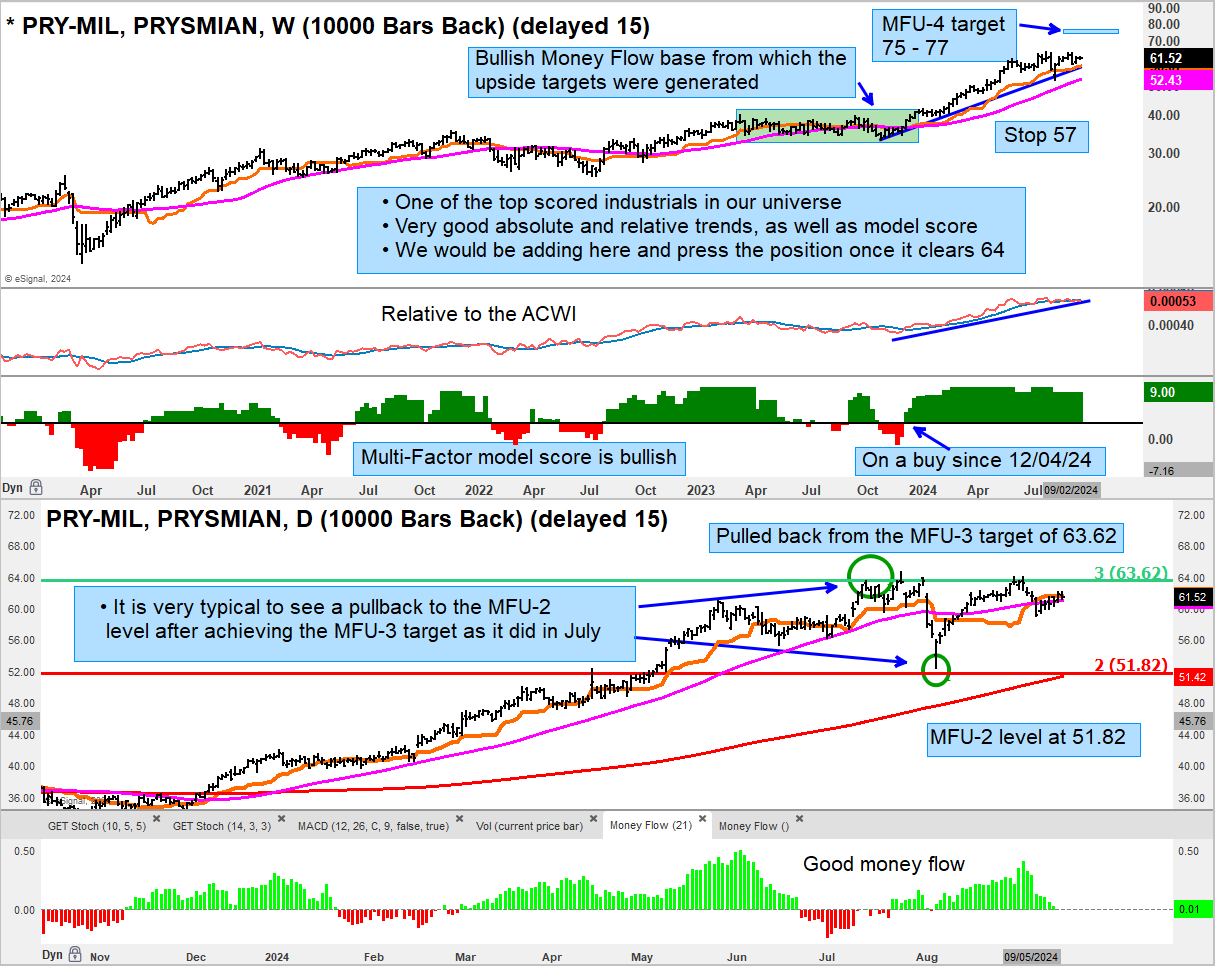

Guy Cerundolo highlights 10 European long ideas scored and ranked using his multi-factor technical model. These stocks have good absolute and relative structure and either emerged or are starting to emerge from consolidation patterns from which he sees further upside. In addition to PRY (see chart), other companies highlighted include Inditex, MTU Aero Engines, Pandora, Rolls-Royce and Schneider Electric.

Edition: 195

- 20 September, 2024

Nexans (NEX FP) France

Industrials

Sean Maher adds NEX his green grid infrastructure basket (includes Rolls-Royce, Cummins, Ming Yang) after unjustified YTD weakness on a 14x PER, a 3-point discount to Italian rival Prysmian. Sean highlights NEX’s recent agreement with TenneT (largest in its history) and successful testing of the first 525 kV DC cable which enables a substantial increase in transmission capacity. Furthermore, as digital decoupling from China extends to subsea data infrastructure, what was already a very strong growth market driven by international data volumes in providing highly sophisticated multi-layer cables now has a further tailwind from national security led duplication and redundancy.

Edition: 163

- 23 June, 2023

Nexans (NEX FP) France

Industrials

US potential and pivot to electrification pure play offers 45%+ upside - Sustainable Investing are more bullish on US transmission & distribution (T&D) growth than consensus (sees the market doubling to $600bn in a decade - 2x size of EU). NEX's leverage to US is underappreciated - it is currently only 22% of revenue, but will be closer to 40% by 2025, driving a 33% increase in group EBIT. The group's pivot to electrification pure play via the disposal of telco and industrial cable and the HVDC acquisition also drives margin improvement. 30% valuation discount to peers; NEX should be worth 9x EV/EBITDA, in line with Prysmian.

Edition: 127

- 21 January, 2022

EU Net Zero Ideas: Cable offers long term FCF & returns, Electrolysers do not

HVDC players (Nexans, Prysmian and NKT) offer improved growth, margins and ROIC as interconnection becomes a key enabling technology for net zero. The US market could triple. Barriers to entry are high and incumbents are well placed to be the main beneficiaries.

Electrolyser producers (Nel and ITM Power) face increasingly competitive industry dynamics (similar to German solar in 2008) and overcapacity / pricing pressure through 2030. Current leaders are unlikely to generate cash in the coming decade or remain independent. Both could raise capital again.

Edition: 122

- 29 October, 2021