Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

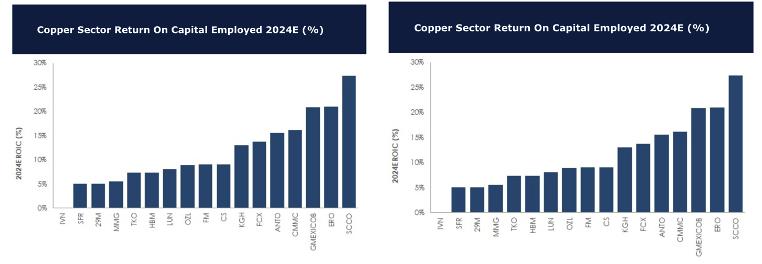

Returns on capital: Copper vs Gold

For 2024, David Radclyffe forecasts copper to enjoy an average ROCE of 11.1%. The standout is Southern Copper Corp, helped by some very low cost and long-lived assets. Relatively new to the market Ero Copper Corp does well, while at the lower end sit Ivanhoe Mines and Sandfire Resources. When it comes to gold, the forecasted average ROCE for 2024 is at 8.3%, with Gold Fields coming out on top and Lundin Gold close behind. The copper sector as a whole continues to generate better real returns on capital than the gold sector, with gold miners continuing to suffer from shorter mine lives and a commitment to M&A to create growth.

Edition: 155

- 03 March, 2023

Increasing overweight position in copper

David Radclyffe recently published on the positive supply outlook for copper, setting out the scene for near- and medium-term market deficits and noted the lack of new projects to fill demand. In addition to the near-term price forecast, the long-term copper price forecast has been lifted to $4.00/lb in 2023 dollar terms. As a result, the sector trades on a prospective 2024 EV/EBITDA of 8.2x, and P/NPV10 of 1.3x. For equities, copper exposure remains in demand and is likely to drive more M&A. Investors may move along the equity risk curve to small caps. Capstone and Sandfire Resources are preferred in the small cap copper stocks, and Antofagasta and Grupo México in the mid/large ones.

Edition: 151

- 06 January, 2023

Sandfire Resources (SFR AU), Capstone Copper (CS CN) Canada

Materials

GMR’s two preferred junior copper names - in addition to offering growth at attractive valuations, their scale, longer mine lives and exploration upside also highlight potential corporate upside as industry peers seek to increase their exposure to copper and the EV materials thematic. The two miners are rapidly evolving businesses; a year ago they each had half the number of producing assets as they do in 2022. SFR is GMR’s cheapest copper stock. It trades at a P/NPV multiple of 0.5x and prospective FY24 FCF yield of 11%. At +200kt/yr from 2023 CS offers scale / leveraged exposure to copper.

Edition: 149

- 25 November, 2022

Preferred copper mine exposure

With copper trading above US$4.00/lb the ability for copper miners to fund initiatives is strong, providing a boon especially for small capitalisation base metals companies. In such a group, David Radclyffe’s preferred exposure is through BUY-rated Capstone Mining and Sandfire Resources, both offering a blend of value and growth, and which have benefited from M&A accelerated growth. Tony Robson considers Ero Copper after its massive underperformance; it is now more attractively priced and the company is pushing exploration hard, but growth is some time out, so he maintains his HOLD rating.

Edition: 132

- 01 April, 2022

Materials

In a bold and transformative step, SFR has announced it has beaten off peers to acquire the Minas De Aguas Tenidas (MATSA) operation in Spain - this is one of the largest copper transactions for some time and it is not cheap (GMR estimates SFR has paid the equivalent of US$3.90/lb LT). Investor interest in the stock is likely to increase significantly given the big jump in Mkt/Cap (it would notionally now have a larger capitalisation than both Hudbay Minerals and Ero Copper). Post deal the miner is trading at a prospective 1.0x P/NPV and 5.9x FY23 EV/EBITDA.

Edition: 120

- 01 October, 2021