Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

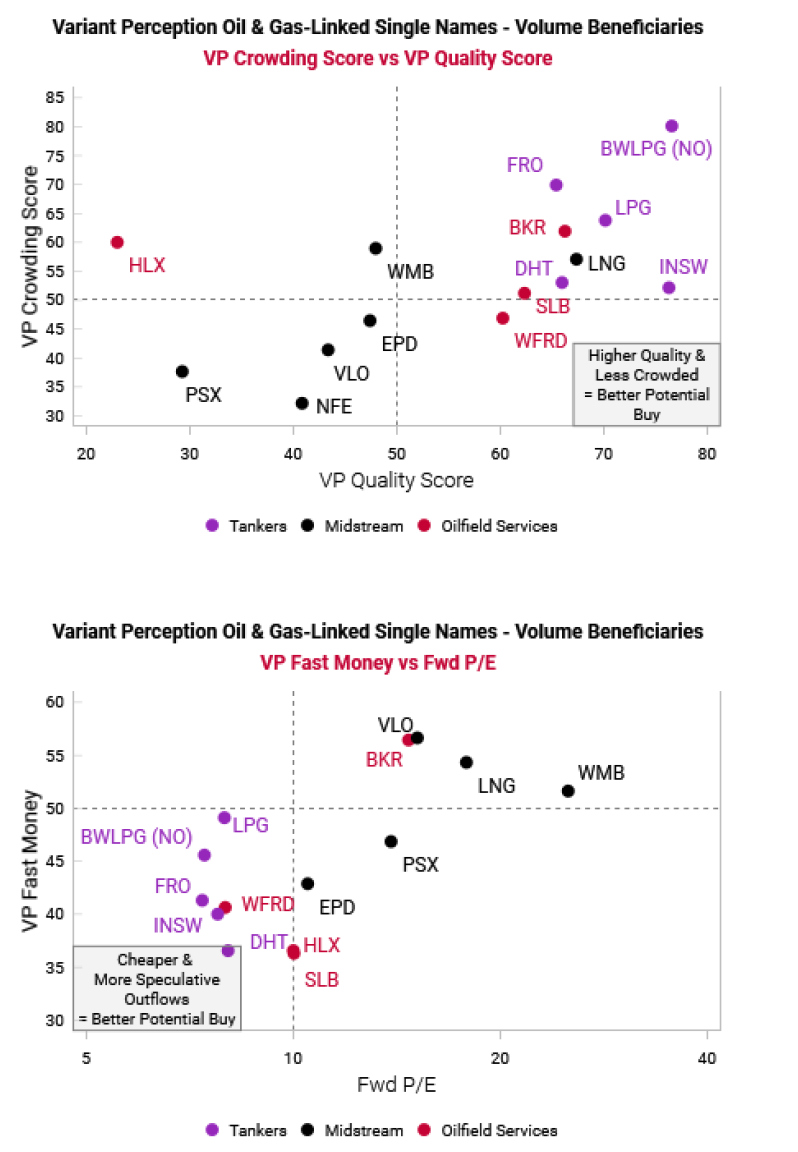

Pockets of value emerging in energy-linked single stocks

Variant Perception’s team suggest that underperformance in the energy market may continue, but they still see an opportunity for select single names if/when their tactical models turn bullish. They examine the market for single stocks that have favourable business models that benefit from higher volumes for oil and gas, and that screen well on VP metrics like capital cycle, crowding, and quality. Oilfield services, midstream and tankers are well suited, US-listed oilfield services are not. Despite appealing valuations, some midstream names still offer reasonable upside and volatility. However, among tankers, the team are highly cautious on LNG and product tankers as these have a glut of new builds coming online in the next few years relative to the existing fleets. Potential plays include Schlumberger, Baker Hughes, Enterprise Products Partners, Frontline and DHT.

Edition: 216

- 25 July, 2025

Energy

Examining recent financial trends in the company suggests a heightened risk of uncollectable receivables - J Capital believes SLB risks impairments of at least $1.5bn from its Russian and Mexican operations (nearly half its 2022 net income). If operations from these countries are subsequently impaired or ceased, there may also be a downgrade of future revenue growth. From a wider perspective, they are concerned that SLB, in the pursuit of business, is tolerating more risk instead of downscaling it.

Edition: 171

- 13 October, 2023

Energy

SLB was one of the stocks highlighted in a roundup of recent real time alerts that were extracted and published by FirstAlert (280First's 10Q/10K analysis module) after it flagged that the oil services firm had removed the following wording from its 2Q23 10Q "...as SLB continues to support the strong revenue growth that is expected to continue in 2023..." - this wording was first added to the 3Q22 10Q and continued in both the 2022 10K and 1Q23 10Q. The company noted on its earnings call that it continued to expect YoY growth of >15%. However, as there are always reasons why companies elect to remove wording, is management becoming less confident on SLB's growth rates this year?

Edition: 166

- 04 August, 2023

4Q22 Earnings: A quantitative and predictive outlook

Energy

Cmind is rolling out 4Q22 earnings beats / misses predictions at both the sector level and company level. In the Energy sector, they have made predictions for 182 US public companies. Breaking down to cap level, there are 34 large-cap (28 predicted to beat vs. 6 predicted to miss), 37 mid-cap (20 beats vs. 17 misses) and 111 small-cap ( 52 beats vs. 59 misses) companies. Overall, the energy sector is predicted to outperform most other sectors. Stocks expected to beat: Schlumberger, Diamondback Energy, Halliburton and Plains All American Pipeline. Stocks likely to miss: Cheniere Energy, Williams Companies, Enbridge and Imperial Oil.

Edition: 152

- 20 January, 2023