Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

Is it finally time to buy Cyclicals?

At a time when economists are slashing year-end targets for major equity indices, star asset managers are forecasting the dollar’s demise, the collapse of the US economy and gold prices surging further, the real story has already begun and it’s the exact opposite. Recent sector rotation suggests markets are anticipating a brief global GDP contraction, followed by a rapid and robust rebound. Q1 results in Europe are strong. Companies are quickly adjusting supply chains to outmanoeuvre Trump’s tariffs. By early Jun, the tariff story will be old news and business will be almost back to normal. Stop overthinking and trust corporate agility. The real opportunity is in quality cyclicals - cash-rich, order-heavy, sector-dominating companies with rock-solid fundamentals. AIR’s top picks include Airbus, ASM International, Renault, Rexel, Schneider and Vestas Wind.

Edition: 210

- 02 May, 2025

Prysmian (PRY IM) Italy

Industrials

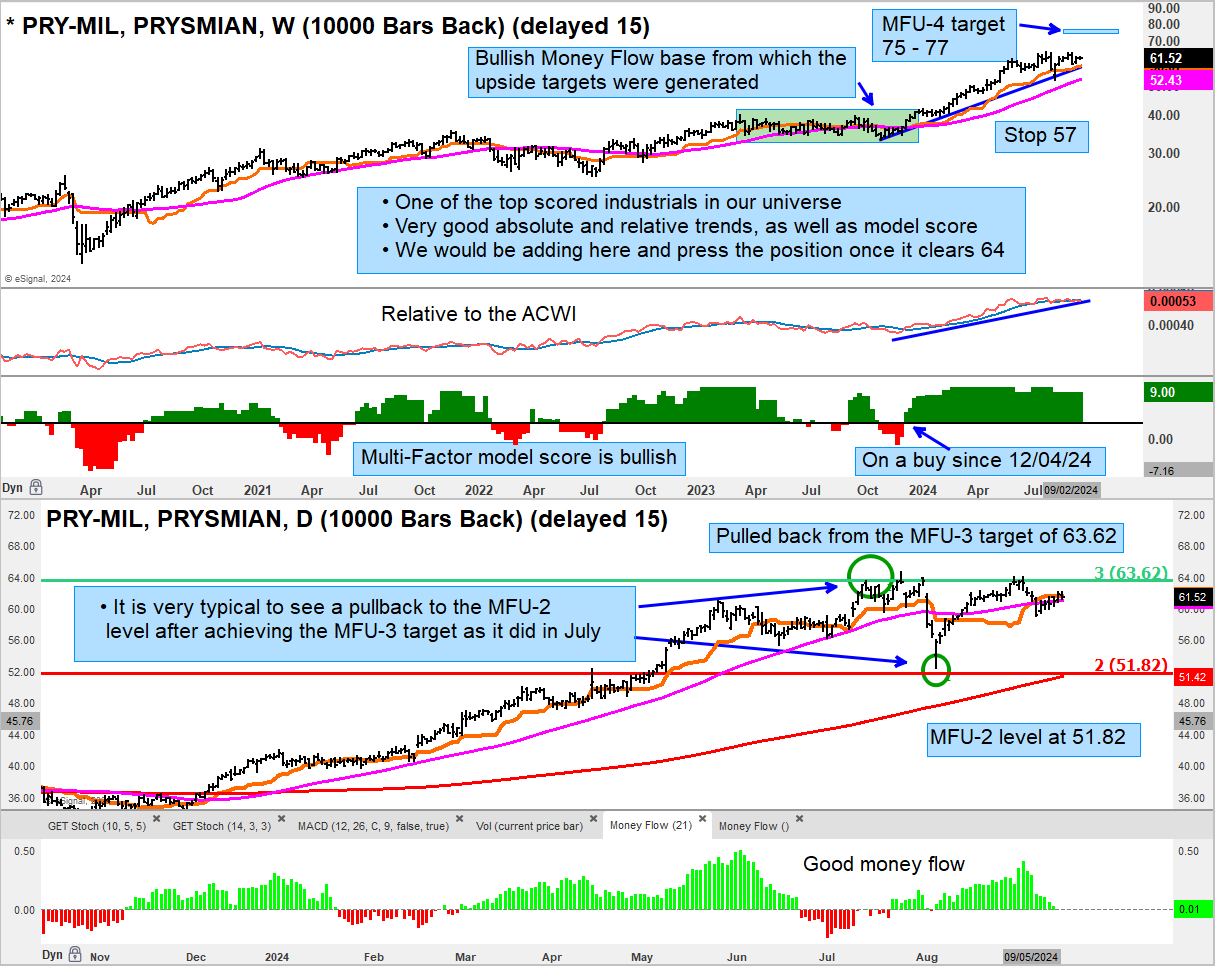

Guy Cerundolo highlights 10 European long ideas scored and ranked using his multi-factor technical model. These stocks have good absolute and relative structure and either emerged or are starting to emerge from consolidation patterns from which he sees further upside. In addition to PRY (see chart), other companies highlighted include Inditex, MTU Aero Engines, Pandora, Rolls-Royce and Schneider Electric.

Edition: 195

- 20 September, 2024

FTSEurofirst 80 Index: Bullish & bearish themes

Bullish charts featured in Messels' weekly 'European Technical Highlights' report include: Ferrari - finds 7-year price and relative uptrend support; NEL - finds 4-year price and relative uptrend support; ABN AMRO - finds 2-year uptrend support and is bottom of the relative range, although they still prefer Banco de Sabadell and CaixaBank. Bearish charts include: Akzo Nobel - breaks support and loses relative momentum; Legrand - breaks support from prior highs and loses relative momentum; Schneider Electric - breaks the uptrend and develops price and relative top formations.

Edition: 138

- 24 June, 2022

Asia’s Covid Woes & Global Supply Chain Implications

Autos / Industrials

More Asian countries are currently under some form of lockdown than at any point in the past year. This includes Taiwan, Thailand and Vietnam - all key source countries for global supply chains. SRR’s contacts in the Automotive and Automation industries now expect supply chain bottlenecks to persist for the remainder of the year with Logistics contacts expecting air and ocean freight to remain tight through to June 2022! SRR’s top picks for China exposure in H2 include Otis, ABB, Schneider Electric, Siemens, Yaskawa, Fanuc, Aptiv, Nio and Volkswagen.

Edition: 116

- 06 August, 2021