Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

Gold: Are buybacks a fad?

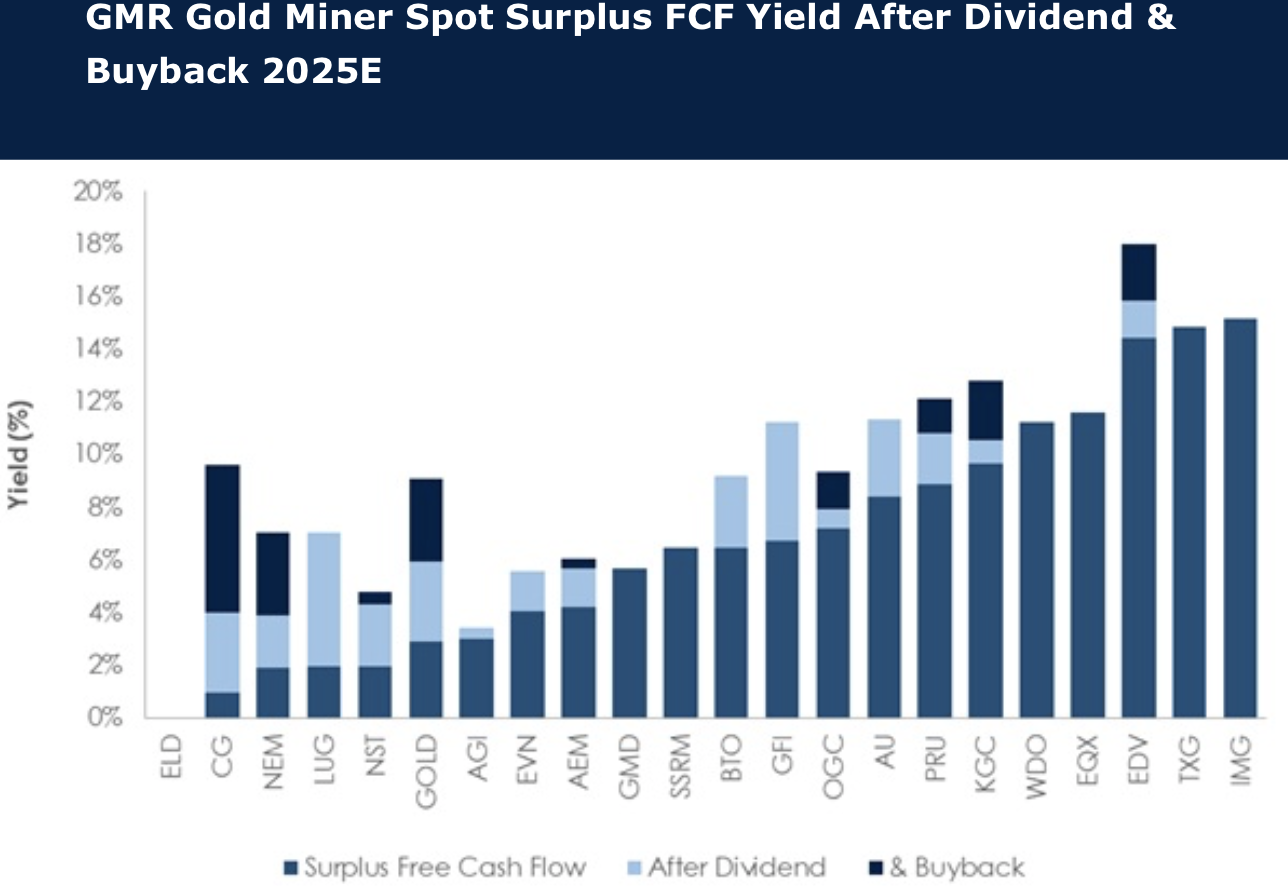

In the face of meaningful cash surpluses, miners are repurchasing shares in record amounts. Some 40% of the Global Mining Research team’s gold coverage have active buybacks in 2025E, equating to ~US$3.7B of cash returns, a record level for the sector and equivalent to ~US$110/GEO. The impact on share prices is subject to debate. The team find that at spot gold the 2025E FCF yield of the sector after expected dividends and buybacks is ~4.6% (and ~8.5% in 2026E). So, shareholder return potential is still to the upside whilst gold prices remain elevated. Stocks least progressed (~20% or less) with buybacks include Carlyle Group, OceanaGold, Barrick Gold, Kinross Gold and Agnico Eagle Mines. Stocks trading at larger discounts to 2025E spot FCF include IAMGOLD, Torex Gold, Endeavour Mining, Equinox Gold and Wesdome Gold Mines. Preferred stocks of these are Kinross Gold, Agnico Eagle Mines, IAMGOLD and Equinox Gold.

Edition: 211

- 16 May, 2025

Gold: Higher prices, higher costs

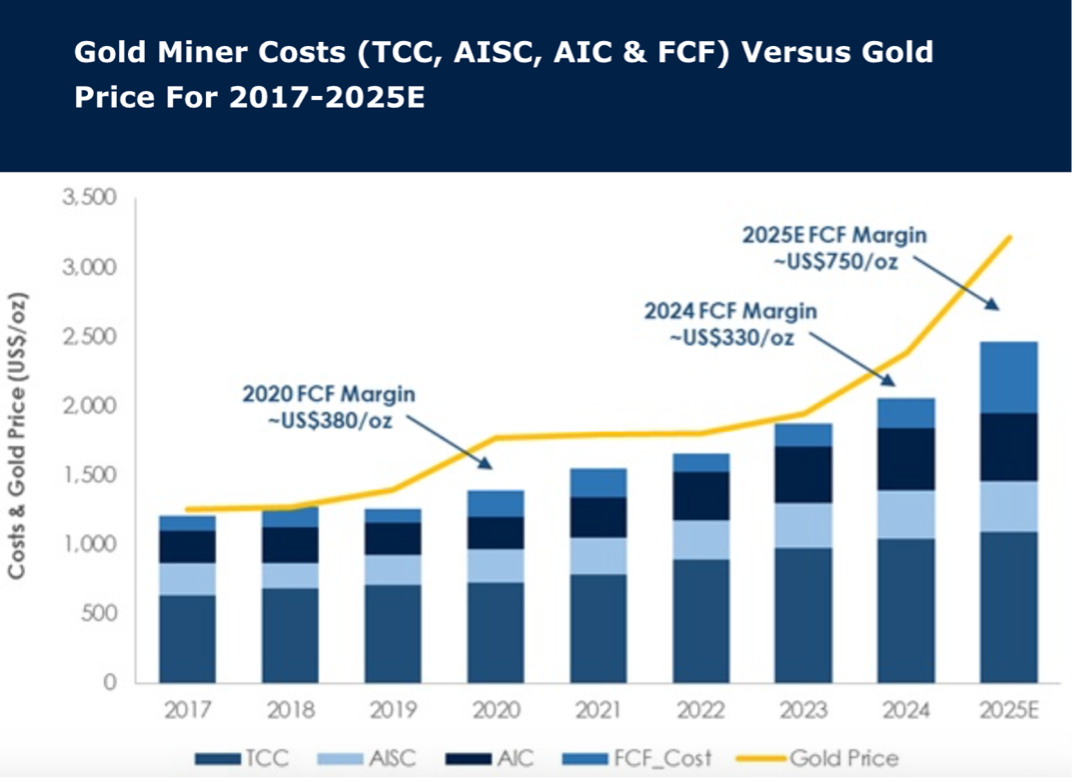

As markets focus on record spot prices in 2025, price-linked costs and general mining inflation are also driving operating costs to record highs. In 2025 gold miner FCF costs are expected to reach a record ~US$2,465/oz, in line with inflation expectations. Positively, gold prices are rising faster and the 2025E FCF spot margin at ~US$750/oz is near double the last high in 2020. Gold miners (covered by Global Mining Research) with the lowest FCF costs in 2025 are Lundin Gold, Wesdome, Kinross and Agnico. Stocks with improvement in FCF costs from 2024 to 2025 are IAMGOLD, Torex and Equinox. Preferred gold stocks are BUY-rated Agnico (delivery and lower-risk portfolio), Kinross (risk reduction and execution), Equinox (transitions from project development to cash generation), IAMGOLD (Côté ramp up and derisking) and Lundin Gold (FDN continues to outperform).

Edition: 210

- 02 May, 2025

High beta gold stocks outperforming peers

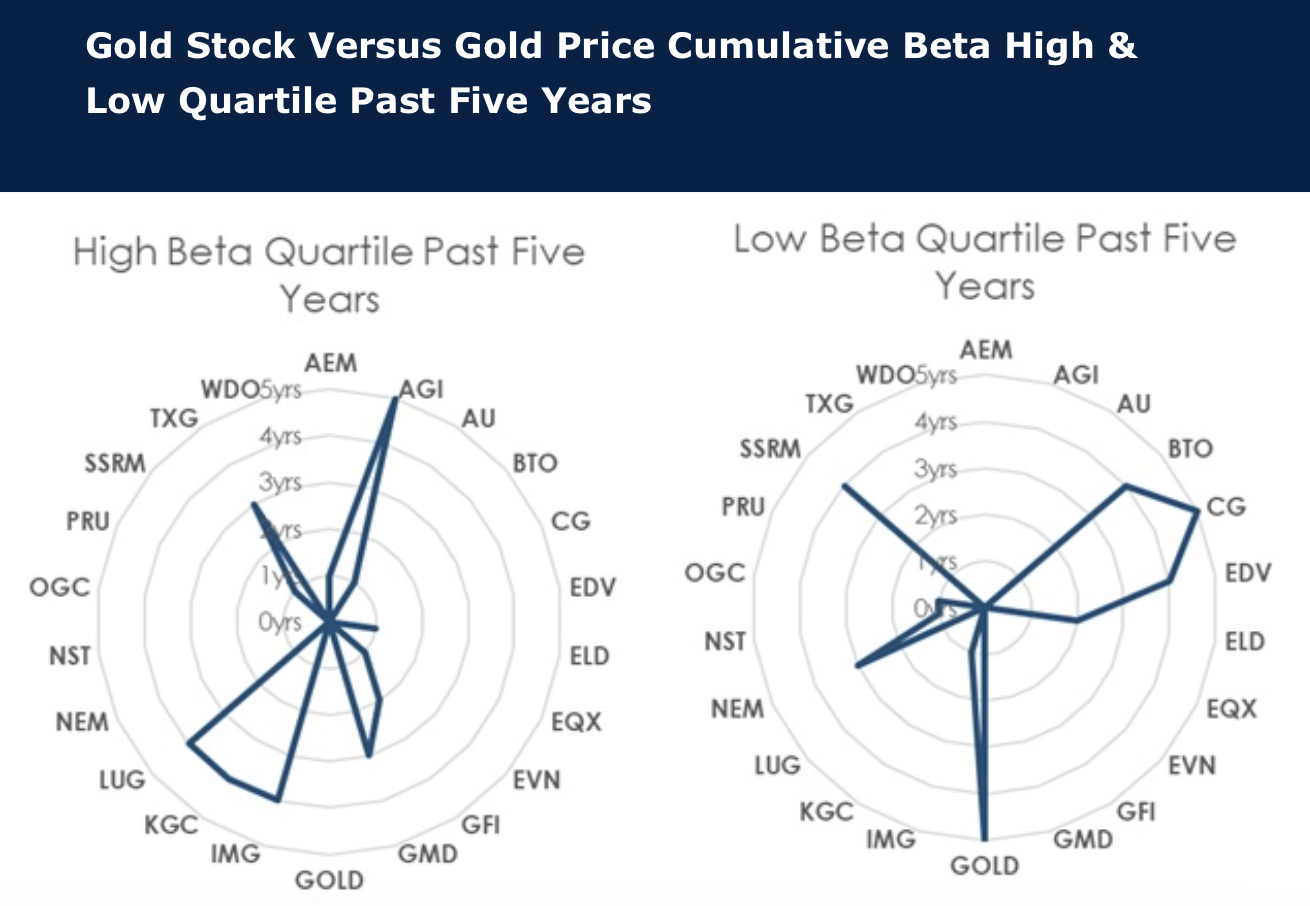

The Global Mining Research team research the correlation of stocks to the gold price and the beta of those stocks. The stocks with consistently high beta to the gold price over the past five years are Alamos Gold, Genesis Minerals, IAMGOLD, Kinross Gold, Lundin Gold and Torex Gold Resources. Stocks with a weak beta to gold price over the past five years are B2Gold, Centerra Gold, Endeavour Mining, Barrick Gold, Newmont and SSR Mining (except 2025), each with mine or management issues, heightened risk or M&A troubles. Market preference for gold stocks appears to be more driven by investor perception rather than quantifiable valuation or sensitivity measures, and investors are preferring stocks with “issues” and aren’t seeking deeply discounted cheap stocks. Preferred gold stocks are BUY-rated Agnico (delivery and lower-risk portfolio), Kinross (risk reduction and execution), Equinox (transitions from project development to cash generation), IAMGOLD (Côté ramp up and derisking) and Lundin Gold (FDN continues to outperform).

Edition: 209

- 18 April, 2025

LatAM gold producers

One-fifth of global gold production is sourced from Latin America, but investors should be wary of the higher risk regions. David Radclyffe’s latest report examines these small but important nations. Key takeaways include Newmont remaining the preferred senior gold stock, and Torex (in Mexico) and Lundin Gold (in Ecuador) named as preferred mid-sized gold stocks with growth and value appeal in the region.

Edition: 123

- 12 November, 2021