Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

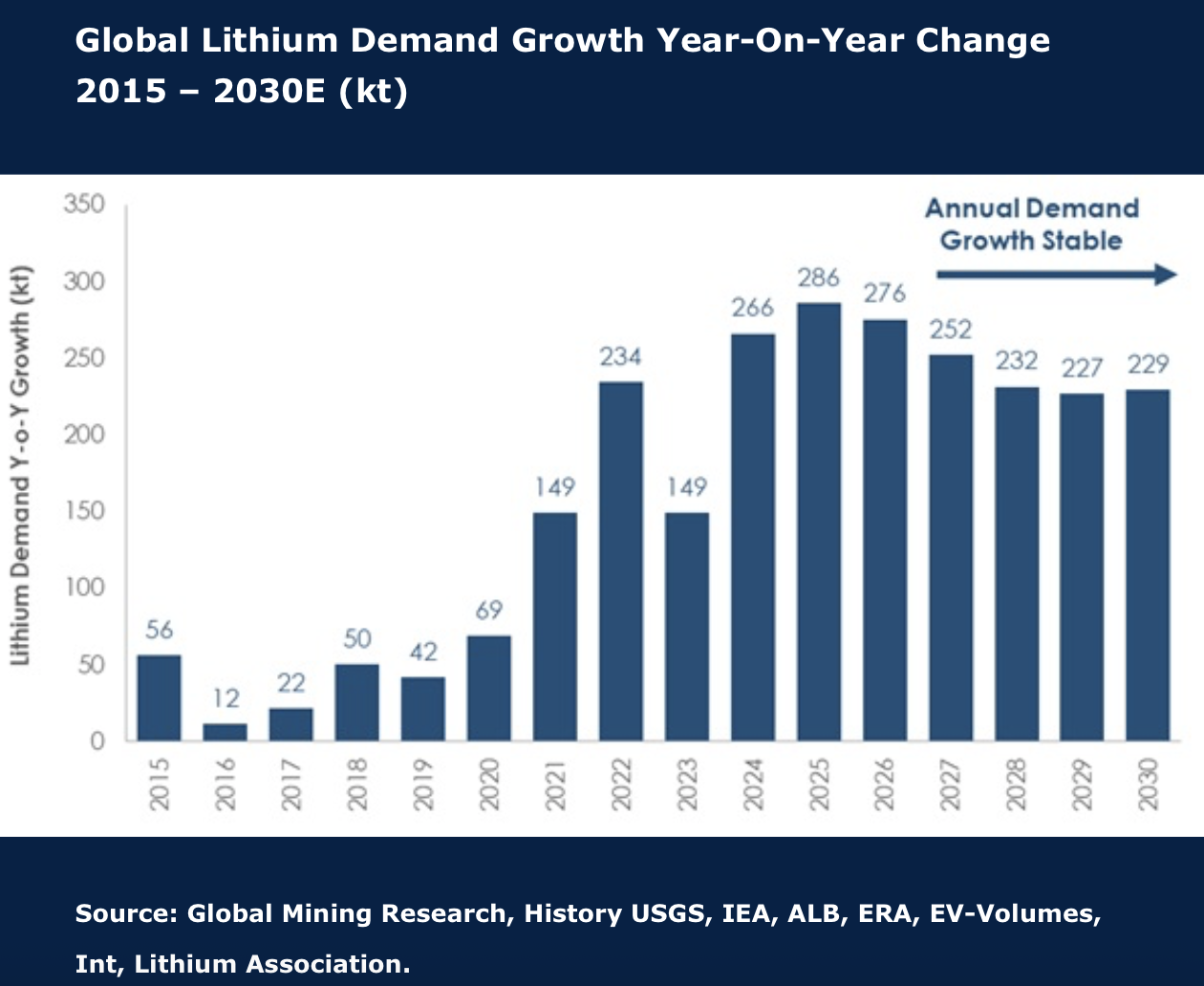

Lithium production to exceed demand to 2030

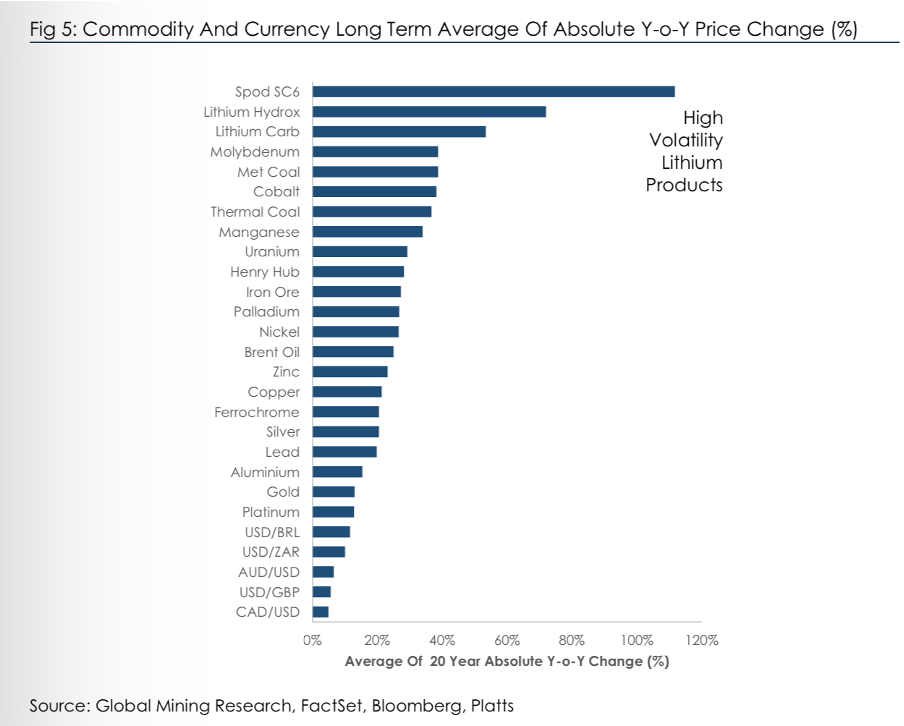

Lithium, like other minor commodities, is marked by volatile short- to medium-term cycles, with an extraordinary bull market of 2021–2022 followed by a relatively prolonged bear market. This is despite very strong demand growth, due to an equally strong (or greater) advance in production, plus inventory de-stocking. David Radclyffe finds evidence for a continued market surplus out to 2030. Although prices have recently started to turn up, an excess of idled capacity along with significant new projects coming online suggests prices will hover around the top of the cost curve for some time. Of late share prices have moved up ahead of the commodity prices, with equity markets getting more optimistic. Investors should be cautious and favour those already in production or juniors with fully financed projects. David has no Buy-rated stocks dealing in lithium. Pilbara Minerals Ltd has outperformed and, now looking expensive, is downgraded to HOLD. Rio Tinto Plc and Sociedad Química y Minera de Chile SA are rated HOLD, while Albemarle Corp, Energy Resources of Australia Ltd, IGO Ltd and Mineral Resources Ltd are rated SELL.

Edition: 226

- 12 December, 2025

Lithium: Signs of cycle troughing

The last 12 months have marked a complete collapse in lithium pricing from all-time highs. The commodity is marked by short and sharp cycles (see graph) and David Radclyffe sees evidence that investors should increase exposure: product prices are stabilising, production curtailment is underway, EV demand growth is continuing, and seniors are raising equity (like in 2021). Low prices should make Boards more cautious when it comes to adding new capacity. Having been underweight for some time, David now sees opportunity in lithium equities with preferred stocks including Pilbara Minerals and IGO.

Edition: 183

- 05 April, 2024

Falling nickel prices hitting higher cost producers

After a good 2022, nickel prices are now feeling the pressure of rising Indonesian production and generally soft economic conditions. Although nickel equities don’t appear expensive for the long-term, shares are now fighting a headwind of lower prices and margins are compressed enough that several would be in difficultly should prices weaken another 10-20%. David Radclyffe’s views are mostly negative to neutral, his preferred nickel equities are IGO and Sherritt, while he has SELL ratings on Vale Indonesia, Norilsk Nickel and Nickel Industries.

Edition: 166

- 04 August, 2023

Lithium: A trade off

Lithium prices surged to record levels but have now rolled over; investors face a trade off between strong cash generation near-term versus risks of holding (or acquiring) shares that are falling. Higher lithium prices near-term does mean the sector looks “cheap” with a PE of 7.7x and EV/EBITDA 5.6x in 2024 in David Radclyffe’s forecasts, but he is not bullish near-term. Greater upside may be available with juniors that successfully develop projects, but David expects many investors to minimise risks and stay with large cap players. Preferred stocks are SQM and IGO, offering value and production growth.

Edition: 158

- 14 April, 2023

Nickel in turmoil after hitting $100,000 per ton

David Radclyffe’s team reviews the listed nickel equities in a world of increasing geopolitical and LME market tension, and volatile price swings that will continue throughout 2022. After a very large market deficit last year of ~130kt he estimates a balanced market in 2022 with price forecasts raised from US$7.45/lb to US$11.75/lb. There are very few investable nickel equities left, but GMR prefers IGO and Nickel Mines, and Vale among the diversified miners.

Edition: 131

- 18 March, 2022

Nickel: Recycled projects adding to production growth

High prices with a favourable outlook have driven interest in nickel. Old projects are being recycled and presented with fresh economics. David Radclyffe reviews the sector, introducing the ranking system for nickel producers. Key takeaways include idled projects in Australia and Zambia predicted to restart in the near term with good economics (50-75kt/yr by 2023). David’s preferred Nickel exposure is through Nickel Mines Ltd (leverage), IGO (quality) and MMC Norilsk (Value) now upgraded to BUY.

Edition: 121

- 15 October, 2021