Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

Fears of lower oil prices may be too pessimistic

While market participants await to see what, if any, peace accord emerges from the current Russia-Ukraine talks, William Brown notes that Wall Street analysts appear to be leapfrogging over one another in terms of how bad the global oil “surplus’ will be next year and beyond, and in turn how low oil prices could go. Once again, as William has discussed over the years, analysts always qualify their either extreme bullish or bearish price forecasts with “could” and not “will”. Be that as it may, he notes that one bank he has now heard from is JP Morgan, who suggests that Brent, again “could”, plummet into the $30s due to an “overwhelming” market oversupply. Meanwhile Goldman Sachs are reiterating their bearish view, estimating an average 2.0 MMB/D surplus in 2026, leading to a Brent average of $53.00 per barrel. In contrast, William’s view is the opposite, given what he estimates to be the substantial net short position investors and funds have already amassed.

Edition: 225

- 28 November, 2025

Capital Markets at Risk: Jefferies echoing Bear Stearns

Financials

Charles Peabody believes we are in the mature phase of the capital markets cycle, with revenues likely topping out in 2026, while stocks are expected to turn lower well before then. He recommends selling Morgan Stanley and Goldman Sachs on near-term strength. Credit and liquidity stresses are emerging following the automotive credit, Tricolor and First Brands developments, while syndicated loan offerings are being pulled. He sees echoes of Bear Stearns at JEF, noting that MS and BlackRock have ended relations with Bonita Point, the JEF subsidiary housing First Brands receivables, just as this rapidly growing broker reached top-tier status. Sell Capital Markets, Buy NII - he favours Citi, M&T, Citizens Financial and UBS.

Edition: 222

- 17 October, 2025

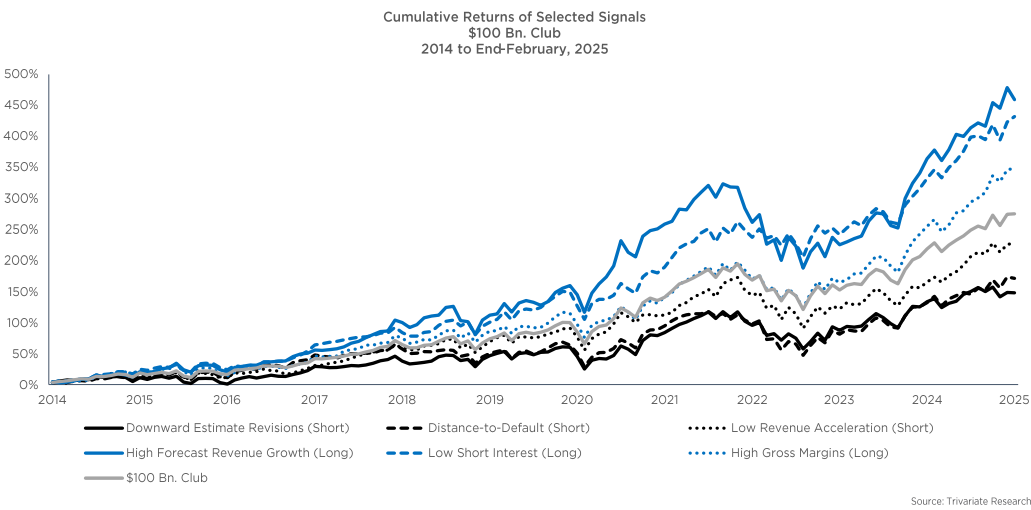

Which stocks >$100bn m/cap are buys now?

With investors searching for value in the current market sell-off and likely looking to buy names among the safer, larger cap universe, Trivariate has assessed the performance of several metrics within the stocks >$100bn m/cap to see if they could systematically pick winners from losers. The best performing signal over the last 10 years, was buying the companies in the top third of forecasted revenue growth, while the second best was buying the one-third of companies with the lowest short interest. The worst performing signals were those in the highest third of leverage and stock volatility (distance-to-default) and those with the worst third of downward earnings revisions. Current long ideas from Trivariate’s $100bn Club Framework include all the Mag 7 (except Tesla), as well as Eli Lilly, Visa and UnitedHealth. Shorts include Goldman Sachs, PepsiCo, Caterpillar and Starbucks.

Edition: 207

- 21 March, 2025

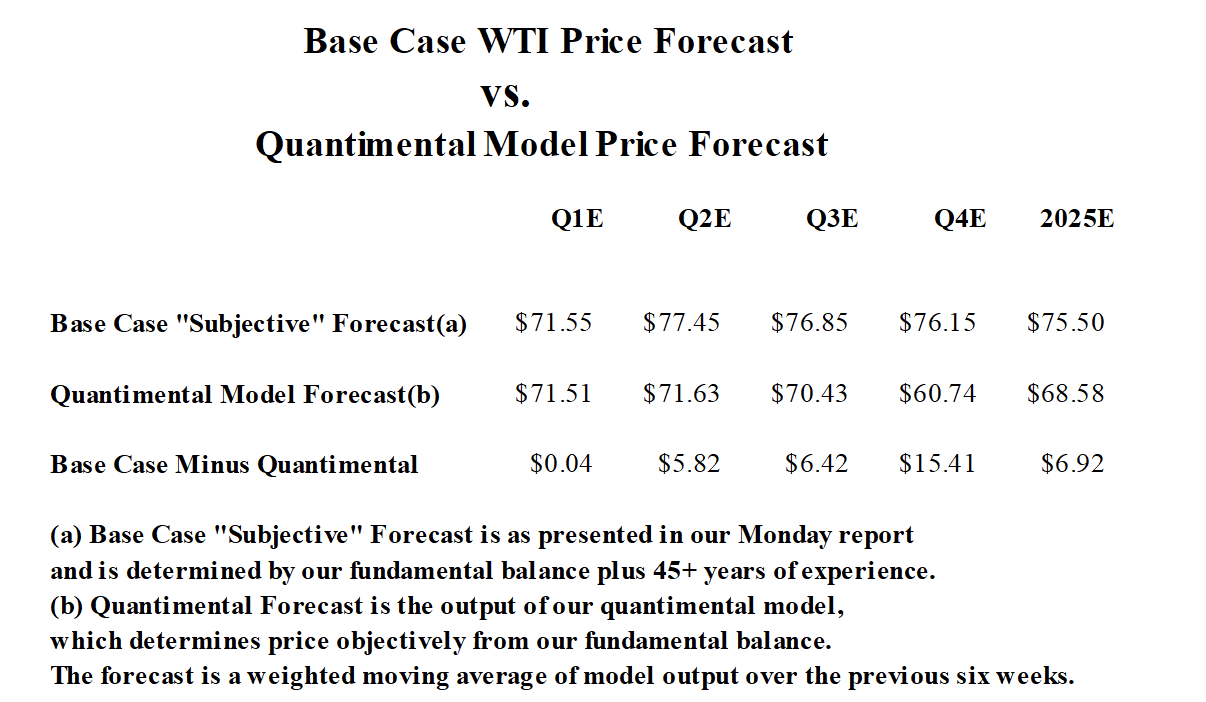

Middle-East uncertainty prompts oil price rethinks

With all the uncertainty on the geopolitical front in the Middle East, there is no shortage of “rethinks” on Wall Street in terms of where crude oil prices are headed this year. In this regard, Goldman Sachs have cut their crude oil price forecasts, reflecting a somewhat less robust demand outlook due to their assumed impact of tariffs on global economic activity. For this year and for WTI, GS is now looking for an average of $69.00 per barrel, well below William Brown’s base case. For Brent, GS is looking for an average of $73.00 per barrel for 2025 compared to William’s average of $79.23 per barrel. His short-term trading range for NYMEX remains at $65-$72 per barrel, and he would rather remain long than short and still recommends opportunistic trading in the calendar spreads.

Edition: 207

- 21 March, 2025

Valuation in a resilient US economy

Goldman Sachs’ bold projection that the next 10 years may be a “lost decade” for stocks, with mere 3% annual returns, is unlikely in the extreme according to Ed Yardeni. It rests on the assumption that valuations in the future will be lower than today’s. Even without expanding valuation multiples, earnings growth would likely boost the S&P 500 price index at a pace that’s at least twice Goldman’s projection, and returns would be more like 11% a year including reinvested dividends. Furthermore, in Ed’s “Roaring 2020s” economic scenario, earnings growth and valuation—and the index’s appreciation potential—would be even greater than that, driven by a technology-led productivity boom.

Edition: 198

- 01 November, 2024

Financials

After earnings beats from JPMorgan, Wells Fargo, Goldman Sachs, Bank of America, PNC as well as Citi why were all the other banks up significantly and Citi was down 5%? Charles Peabody discusses asset caps (Citi is already shrinking itself by shedding its global consumer bank, so an asset cap makes no sense whatsoever) and a probable delay in the Banamex IPO. He argues Citi is one of the best stories in large cap financials and is the only company able to repurchase large amounts of its common stock at a substantial discount to TBV. Expectations are low, the regulatory pressure is high and management is doing all the right things.

Edition: 197

- 18 October, 2024

Financials

Charles Peabody discusses the 33% Q/Q jump in NII to $2.2bn, drawing attention to the $815m figure in the Global Banking & Markets unit (which could have added as much as $500m to revenues, or $1.15 a share to EPS) and questions the sustainability of the bank's financing revenues. The bottom line is that Charles believes that the stock is nothing more than a momentum play and will unwind quickly once the capital markets prove hostile. Contrary to management's commentary, its earnings stream is still very cyclical and not deserving of a premium valuation.

Edition: 191

- 26 July, 2024

Financials

While many are trumpeting the fact that GS is returning to its roots, investors should remember what those roots were and why investors and (GS itself) wanted to transform this organisation into something different. Charles Peabody loves a turnaround story and has been alongside Bank of America in the past, Wells Fargo, and more recently Citigroup, emphasising that it generally takes 5 years to transform a company. GS is no different. He would exit the shares and favours Citi as a turnaround, WFC as a work in progress about to exit a regulatory yoke, BAC as a play on rates, and JPMorgan as a defensive fortress.

Edition: 175

- 08 December, 2023

Banks announce capital plans after passing Fed stress test

Financials

Charles Peabody believes the banks conducted themselves well in fairly harsh stress tests that indicate an excess of capital in the sector. If regulators don’t panic, the path from crisis to normalisation can proceed even if we confront a mild recession. Charles favours the fundamental strength of JPMorgan but notes the underappreciated capital power of PNC and Wells Fargo. He is attracted to the adjusted yields of Citizens Financial and M&T while commenting that Morgan Stanley and Goldman Sachs also fare well in this category.

Edition: 164

- 07 July, 2023

Financials

“DJ Sol” remix uninspiring - Charles Peabody at a loss as to what the new strategic plan / organisation will do to improve the operation of the firm. This effort comes at a time when earnings are pressured, especially in the Investment Banking division, which is CEO Solomon’s heritage. The traditional conflict between ‘Trading’ and IB typically flares during bonus season, and, this year, GS faces the additional burden of the money losing Consumer Bank initiative. Recent media reports of certain cultural aspects at GS are no coincidence and reflect both dissatisfaction and possible tumult.

Edition: 149

- 25 November, 2022

Financials

Likely to take several years before EPS starts to grow y/y as revenue potholes emerge in private equity and 10% growth in asset and wealth management proves challenging. While valuations are not dear, as liquidity is withdrawn and casualties litter the headlines such as Tiger Global, GS will suffer as well. Simply put, Charles Peabody sees $6-7bn of PE type revenues declining over the next few years and does not see more than $2.4bn in growth from asset management to replace it.

Edition: 137

- 10 June, 2022