Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

Forest Products: Tough year ahead

Materials

The outlook for lumber / panel producers (Canfor, West Fraser, Boise Cascade, Louisiana-Pacific) is difficult, with no obvious upside catalyst before a recovery in US housing (unlikely before late 2023). ERA expects pulp prices to move lower through 1H23. Anticipated price declines are now almost fully priced into pulp names (Mercer, International Paper). In packaging, more pain lies in store for containerboard (Westrock) and a raft downtime will be needed to combat weaker demand and offset new capacity. Boxboard will outperform (Graphic Packaging, Clearwater Paper), with both demand and prices expected to remain robust.

Edition: 151

- 06 January, 2023

Materials

LPX’s OSB earnings for 1H22 will be spectacular and 2H22 results should remain well above trend levels - OSB prices remain at historically high levels (but will move lower through quarter-end) and should housing demand pull back in late 2022 or 2023, downside for commodity OSB prices will be more limited than for lumber given the dearth of new supply coming to market in the next 12 months. In LPX’s siding business the biggest opportunity comes from displacing alternatives such as stucco and vinyl. TP $90 (30% upside) is based on a 5x multiple applied to a 50/50 blend of 2022E/2023E EBITDA of $1.5bn.

Edition: 136

- 27 May, 2022

High conviction shorts offering 30%+ downside

Choice Hotels (CHH) - Brand commoditisation + long-term supply overhang = broken unit growth story. Once the 2021 pent-up leisure boom passes, CHH’s multiple will contract to reflect its reduced long-term growth prospects. TP $69.

Focus Financial (FOCS) - Roll-up strategy is destroying value; questionable accounting. Cash ROIC continues to look very poor. TP $25.

Louisiana-Pacific (LPX) - OSB supply response will happen much faster than bulls expect. Accelerating capex / capacity expansion near cyclical peak is a mistake. TP $30.

Edition: 134

- 29 April, 2022

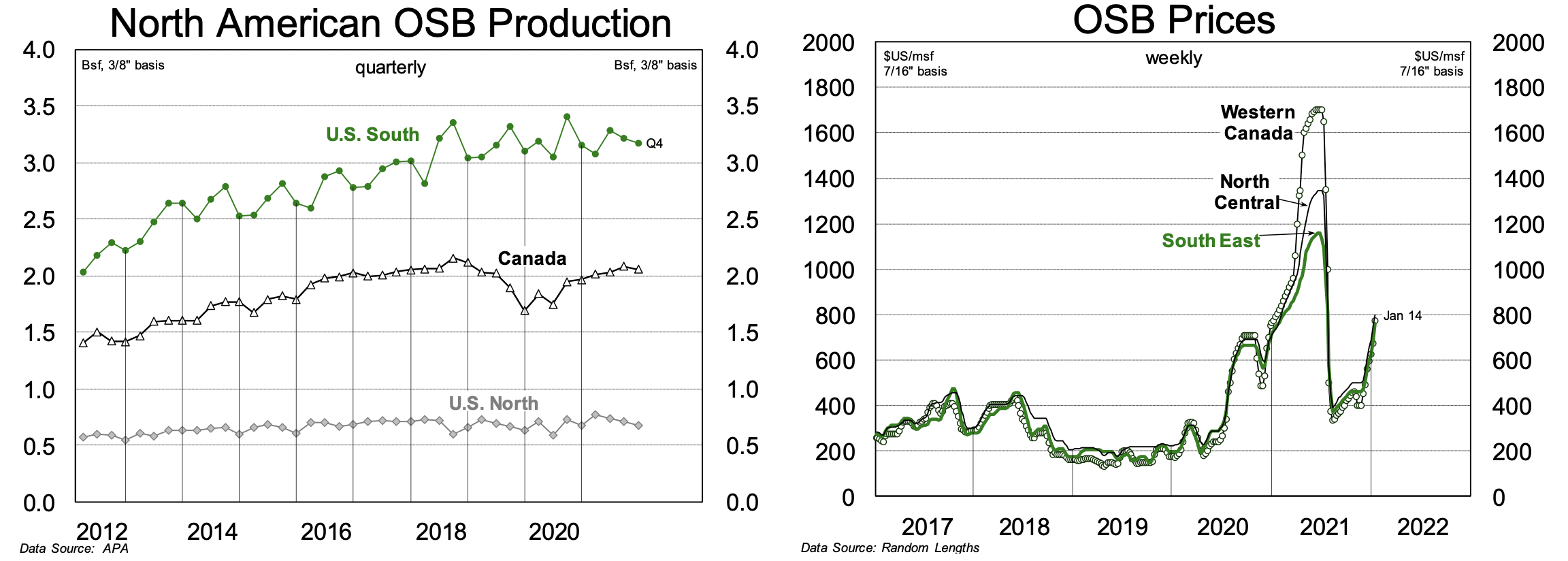

North American OSB production

North American OSB markets have shifted into high gear, with benchmark North Central 7/13” prices up by $145, to $800 over the last three weeks (see chart). While demand has been robust, supply shortages have had greater impact on the market. Despite two OSB mill restarts in 2021, prices have not begun cycling back closer to historical averages and higher prices are here to stay for another couple of years. To play it, go for West Fraser Timber and Louisiana-Pacific Corp.

Edition: 128

- 04 February, 2022