Fortnightly Publication Highlighting Latest Insights From IRF Providers

Company Research

Outside of AI, why invest in the US?

US equities remain the world’s most important market, but passive benchmarks are distorted by AI concentration risk. Durable alpha lies in structural themes beyond AI. Power infrastructure (Constellation, Duke, NextEra) will benefit from grid bottlenecks as data centres drive demand. Re-industrialisation (Caterpillar, Honeywell, Rockwell) reflects reshoring and automation. The energy transition (Dominion, Enphase, ExxonMobil) requires trillions in capex. Housing scarcity (D.R. Horton, Home Depot, Lennar) is a structural imbalance. Healthcare innovation (Abbott, Eli Lilly, UnitedHealth) rides longevity and med-tech advances. Cybersecurity (Cisco, CrowdStrike, Palo Alto) is non-discretionary. Generational wealth transfer (BlackRock, Morgan Stanley, Schwab) reshapes capital flows. The AI productivity super-cycle is real, but thematic allocations across these shifts offer broader, smarter US exposure.

Edition: 220

- 19 September, 2025

Short Shots

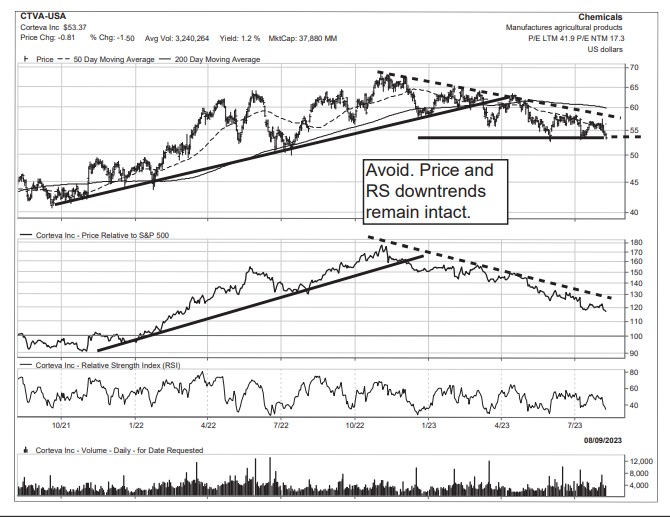

Is a collection of technically vulnerable charts culled from the “Negatively Inflecting” and “Toppy” columns within Vermilion’s Weekly Compass report or from various technical screening processes. The charts contained in this report have developed concerning technical patterns that suggest further price deterioration is likely. For these reasons Short Shots can also be a great source of ideas for investors interested in short-selling candidates.

Charts highlighted include Corteva (see above), Enphase Energy, General Mills, Kraft Heinz, Hershey, MarketAxess, Moderna, Newmont, Penumbra, Roblox, SolarEdge and Valmont Industries.

Edition: 167

- 18 August, 2023

Energy

Solar demand will continue to grow at a fast pace for at least a decade driven by the "game changing" US clean energy bill and Europe’s need to replace Russian gas / decarbonise. Abacus believes the US duopoly of Enphase and SEDG is well protected. In Europe, they expect both firms will take share from string inverters but will continue to face competition from cheaper Chinese products. SEDG should be able to expand operating margins from 15% to ~18-19% over the next few years despite the higher growth in lower margin areas such as commercial and batteries. Abacus’ EPS estimate for 2025 is ~25% ahead of the street. TP $430 (45% upside).

Edition: 160

- 12 May, 2023

LifeStance Health Group Inc (LSFT)

Health Care

LSFT's executive employment agreements contained severance and change in control policies. It seems that the new policy contains more benefits under Change in Control. Executive employment agreements were last amended in May and June of 2020. The new policy does not seem to be a routine update. As there are always reasons why companies elect to take any action, is this new policy prompted by external takeover interests? Other key findings from 280first's Q2 22 10Q and 10K filings analysis included Altice USA (ATUS), Microstrategy Incorporated (MSTR) and Enphase Energy (ENPH).

Edition: 145

- 30 September, 2022

Enphase Energy (ENPH)

Energy

Growing momentum in decarbonisation - stock pullback provides an enticing entry point. Improving supply chain dynamics and growing residential storage contributions (potentially +$500m in incremental revenue through 2022) will drive growth for ENPH with potential upside from grid services and portable power. Following similar selloffs, Webber Research also recently upgraded both SolarEdge and TPI Composites to Buy.

Edition: 111

- 28 May, 2021