Company & Sector Research

Europe

Forensic Alpha

Recent equity raise not enough to mend fragile balance sheet - €1.1bn rights issue brings the total raised this year to €1.6bn. However, this substantial cash injection is neither sufficient to guarantee covenant compliance nor to allow the firm to delever organically. In the short/medium term Forensic Alpha anticipates a further capital raise as well as materially weaker results vs. competitors. TP €1.20 (58% downside).

Clear strategic focus on growth - successful implementation of the “Strategy 2021-2026” will result in a material rerating in VPBN shares and significantly narrow the discount to book value. Shares trade at a P/E 2021E of 7.9x (vs. sector: 12.3x), P/B of 0.59x (1.31x) and dividend yield of 5.5% (4.2%). A core capital ratio (CET1) of 20.8% opens up scope for acquisitions. TP CHF 147.00 (40% upside).

Intron Health

EU Pharma: The forgotten sector

Sector fundamentals have been materially enhanced since Covid struck with sales set to grow 5% CAGR 2021-26 and net income 7% CAGR. Moreover, drug output has been consistently high for most companies. This enhanced output has come due to a decade of investment which is now normalising and should allow margins to grow by 300bps over the next 5 years. Despite this, current share prices imply terminal growth rates are negative even as the background level of innovation is accelerating. Sanofi, AstraZeneca and Novo Nordisk are Intron’s top picks for the next 12 months.

the IDEA!

14% dividend yield! Shareholders to be rewarded with a special dividend of €6.75 per share as cash surplus hits €1.25bn. RAND remains comfortably on track to record higher revenue in 2021 vs. 2019, an achievement not many staffing companies will accomplish. It also continues to invest heavily in its workforce, products and services, and above all digitalisation to drive market share gains long-term.

EU Net Zero Ideas: Cable offers long term FCF & returns, Electrolysers do not

HVDC players (Nexans, Prysmian and NKT) offer improved growth, margins and ROIC as interconnection becomes a key enabling technology for net zero. The US market could triple. Barriers to entry are high and incumbents are well placed to be the main beneficiaries.

Electrolyser producers (Nel and ITM Power) face increasingly competitive industry dynamics (similar to German solar in 2008) and overcapacity / pricing pressure through 2030. Current leaders are unlikely to generate cash in the coming decade or remain independent. Both could raise capital again.

North America

Huber Research Partners

Stock hit hard on disappointing quarter and 4Q outlook, but at <$60 the shares are a Buy - Craig Huber argues the headwinds facing SNAP (and the digital advertising sector overall) will only temporarily dampen its revenue growth trajectory. The social media company continues to head in the right direction focusing on building out its sales and marketing functions globally, creating innovative ad experiences around video and AR with a focus on ecommerce, and there are still areas of the platform that have strong engagement that it has not begun to monetise.

BWS Financial

Space for Re-entry - Hamed Khorsand turns bullish once again having previously made a 400%+ return on the stock (May 2018-Jan 2021). IRDM continues to grow its IOT subscribers at an accelerated pace and with broader adoption of using satellite communications (only a matter of time before satellite communication capabilities are embedded into a smartphone) it puts the company in the middle of a brand-new growth cycle. This growth will allow IRDM to delever its balance sheet aggressively, contributing to a higher stock price. TP $60 (50% upside).

Quo Vadis Capital

Inflation to déclenche next round of pricing action - provides an opportunity for DOL to resume its extremely successful strategy of introducing higher prices and taking price on existing items. This action will generate faster same-store sales growth, margin gains, and accelerated EPS growth. The fact that DOL also represents a refuge from the supply-chain concerns that are severely impacting US retailers only increases John Zolidis’ bullish view. A 25x P/E (5-yr average is 24x) would see the shares appreciate 30%+ from here.

New Constructs

Don’t get run over by this IPO - the proposed $80bn valuation is equivalent to the Mkt/Cap of General Motors and implies it will sell 3m vehicles in 2030, nearly four times the number of Tesla vehicles produced over the past 12 months. RIVN has yet to manufacture a meaningful number of vehicles and competes with well-capitalised EV upstarts as well as incumbents which have decades of experience and multi-billion dollar plans to expand EV production. The stock is worth $13bn at best (84% downside).

Bios Research

Alpha generating fundamental research in the biotech space

Bios Research continues to identify strong short ideas (>$1bn Mkt/Cap) while also pursuing coverage of under-covered long opportunities. In the past year they have provided several potentially fraudulent theses in their short research. For example, having done a significant amount of research in the Alzheimer's disease space Aaron Fletcher has found the early data of Cassava Sciences particularly troublesome. Re. long ideas, Aaron highlights some very attractive <$750m Mkt/Cap names with significant cash on hand and upcoming catalysts. Further information is available on request.

Gradient Analytics

New short thesis on this $10.8bn Mkt/Cap firm in the Diagnostics & Research industry - key points include: (1) Increased frequency of complaints about its billing practices. (2) Insurance providers have been reluctant to reimburse for microdeletion screening. (3) Disparate trends between receivables and deferred revenue signal deteriorating revenue quality. (4) NTRA may have pushed current-period expenses into the future. (5) Executives and directors have engaged in some unusual divestiture activity in recent periods. (6) Valuation metrics leave room for further downside.

Thompson Research Group

REIT-like beneficiary of the Non-Res Construction & Industrial recovery - TRG remain very bullish on the outlook for residential and non-residential construction, as well as an ongoing rebound in economic activity. This should drive higher units on rent (UOR) and increased pricing. WSC is ideally placed to benefit with its dominant market position (45% share in modular office and 25% in portable storage) and very attractive valuation. TP $46 (40% upside) based on ~11x FY23 EBITDA and maintaining net leverage of 3.0-3.5x.

Paragon Intel

New CEO Sudhakar Ramakrishna uniquely suited for the task of rebuilding the firm’s reputation - Paragon highlight his experience taking on operationally challenging roles and crisis management. Sudhakar will improve customer retention levels, increase subscription sales, and acquire companies to infuse more AI/ML and security throughout the portfolio. Earnings to grow 23-29% from 2021-23, well ahead of consensus estimates.

Abacus Research

A unique asset that provides a ‘must have’, high ROI data collection and automation tool for salespeople - ZI has been the first to reach scale and competition will struggle to catch up. The fact that the product sells itself is shown by ZI‘s >45% operating margin since 2018 along with 50%+ growth despite being in the early adoption stage. LTV/CAC of >10x. Abacus estimate revenue growth of 41% CAGR 2021-25 (vs. company guidance and consensus of 29% p.a.). TP $102 (55% upside).

Japan

LightStream Research

Sony’s execution on its IP cross selling continues to gather steam and the Jan-Mar quarter could see a slew of major titles releasing on PS5, some old favourites being released for PC to broaden the PlayStation fanbase and a couple of blockbuster movies to boot. If Uncharted succeeds and Spider-Man: No Way Home is successful in accelerating the launch of the Spiderverse, Sony’s IP catalogue could start to almost rival Disney’s.

Emerging Markets

Galliano's Financials Research

Chinese Banks: Focusing on the credit quality challenge

Victor Galliano conducts a credit quality review of eleven Chinese banks in the light of the Evergrande and real estate sector headwinds - he also assesses the banks’ profitability ratios and their capacity to absorb increasing credit losses. Victor considers the best placed banks to be China Merchants Bank and PSBC; the most exposed to further credit quality deterioration are China Minsheng Bank and China CITIC Bank.

Hemindra Hazari

Yes Men at Yes Bank, and Elsewhere - not just government banks indulging in ‘phone banking’ (being instructed by ruling party politicians and civil bureaucrats to lend to specific unworthy companies) - the Enforcement Directorate’s affidavit in the Delhi Court reveals how senior executives from the private sector Yes Bank were no different from their government counterparts. Hemindra Hazari believes the situation may be systemic as regulatory agencies are also investigating transactions at several other banks. As the unscrupulous behaviour of these executives continues to be well rewarded, investors should reassess whether this reality is reflected in stock valuations.

Alembic Global Advisors

A misunderstood story; raises TP from BRL65 to BRL75 (30%+ upside) - share price underperformance relative to peers is unwarranted; geographic and feedstock diversity, along with improving fundamentals, isn't appreciated by investors. Braskem has meaningfully improved its operating rates, which, combined with cost management, has resulted in a significant (and sustainable) boost in EBITDA margins. The shares trade at 0.57x replacement value and Alembic continue to believe Braskem is an attractive acquisition target.

Propitious Research

Can the stellar share price performance continue? This is a high-quality fabless semiconductor company, with significant revenue growth, generating returns well above its cost of capital, a net cash balance sheet, and an attractive sustainable dividend. Although current valuation levels are above historical average levels, Wium Malan expects a continuation of the earnings upgrade cycle to provide a positive share price catalyst. The stock is also likely to see large passive inflows following the MSCI November Semi-Annual Index Review.

RedTech Advisors

eCommerce Consumer Survey: Meituan & Pinduoduo surge in China Community Group Buy

Not only are online groceries one of the largest categories in eCommerce, reaching RMB3.7tn in GMV for 2021, but they are also the most tumultuous. Community Group Buy (CGB) and local service models are upending the industry and incumbent eCommerce platforms, with Meituan and PDD coming out ahead. However, more than 50% are likely to switch in the next year, mostly to local service or CGB, and an early lead does not guarantee long-term success.

Riedel Research Group

Power struggles set China up for a fall: Sell US-listed Chinese stocks

Constant flow of negative news on US-listed Chinese names - regulatory pressure from Beijing, delisting pressure from Washington and energy / power shortages pressure Chinese stocks. Higher tensions over Taiwan raise the risk of an accidental escalation. ETF favourites like Alibaba and Baidu would get hurt the most.

Datayes

Say “No!” to default risk with Datayes corporate bond rating

Driven by empirical knowledge and machine learning, Datayes corporate bond rating offers strong predictive capability in identifying defaulting issuers and predicting occurrence of negative events. Instead of relying on a black-box prediction mechanism, Datayes also leverages an interpretable model to increase transparency. Coupled with additional attribution analysis, the model provides rating results that are timely and of high accuracy to help better manage investment risk. Click here for more details.

Macro Research

Developed Markets

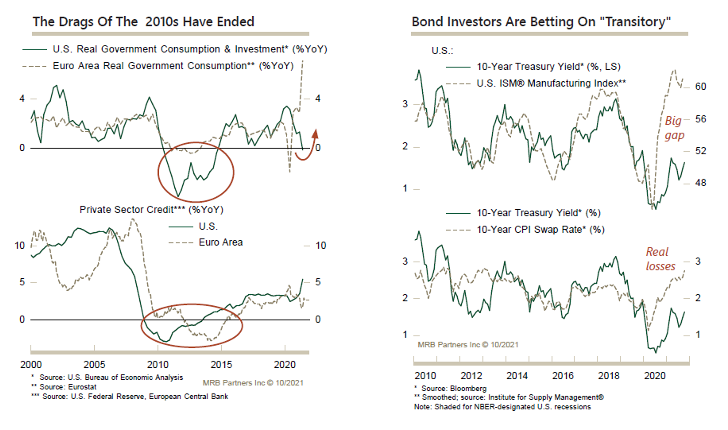

MRB Partners

Chart of the fortnight: The end of transitory

The consensus is that this year’s spike in growth/inflation will peter out as secular stagnation takes hold. Phillip Colmar disagrees; underlying economic growth will settle into a much faster run rate as solid demand and diminishing slack become the cyclical drivers of inflation. The bond market is betting on too pessimistic an outlook. Meanwhile, risk-taking has been subsidised by negative real interest rates, causing equity, credit and commodity markets to front-run improving fundamentals, setting the stage for a volatile next 6-12 months.

Deep Macro

AI shows UK will be among first to raise interest rates

Jeffrey Young’s AI Short-Term Rates-1 model predicts that 2yr UK swap rates will rise, and by more than market forwards have discounted (to about 1.44% in three months vs. 1.14% discounted in three-month forwards). This takes into account the economic outlook, but also Jeffrey’s own AI central bank bias index which evaluates inflation/growth bias of MPC members.

Greenmantle

Global monetary whiplash

A global monetary tightening wave is well underway. Niall Ferguson expects developed economies such as Canada, Australia, and the UK to start their own hiking cycle over the next six months; the Fed is likely to follow in H2/2022 and the ECB in 2023. The main risk from this synchronised tightening of monetary conditions is a macroeconomic whiplash that pushes 2022’s global GDP growth below both private forecaster consensus and policymakers’ optimistic expectations.

Eurointelligence

Is Polexit possible?

Speaking about troubles with Poland, Angela Merkel made a plea to the EU to find ways of coming back together, but Wolfgang Münchau sees it falling on deaf ears. Although polls show the country’s EU support as strong, so was the case in the UK until the referendum. The growing Eurosceptic fringe in Poland cannot be underestimated by Tusk, as he did with Brexit. It’s time to heed Merkel’s warnings.

Longview Economics

US: Investors should start building short positions

Despite strong S&P500 earnings reports, Chris Watling believes that buyer exhaustion is setting in as prices have reached the top of an uptrend. Market participants have become greedy and markets are now complacently priced, while traders have limited levels of downside put protection in their portfolios. Move ¼ SHORT S&P500 Dec futures at current prices and increase to ½ SHORT if forthcoming (i.e, at 4,610) with stop loss at 2% above combined entry.

Beacon Policy Advisors

US: Biden’s trade policy takes shape

Despite campaigning to represent a stark contrast from Trump, Biden’s trade policy has been so far more of the same. However, look below the surface and you will see the nuances of Biden’s approach, in particular his lack of zero-sum mindset, which has allowed him to create opportunities for American businesses that did not emerge under Trump. It will create a softer environment for US trade negotiations, especially with the EU over steel tariffs in coming months.

CrossBorder Capital

US: Could LONG bonds be a contrarian bet for 2022?

Government bond markets may once again be a step-ahead of other assets classes. Mike Howell is concerned by the prospect of monetary tightening because of the dominant role of Central Banks in providing liquidity. Soaring term structure convexity and a flattening at the back-end of the US Treasury curve point towards ‘stagflation’ and rising credit risks for 2022. In this light, the out-of-favour 10-year UST note may be an interesting investment…

Minack Advisors

Australia: Border reopening will dictate when the RBA tightens

Markets have increased their RBA cash rate target expectations, a response to new forecasts for the US Fed funds rate target. Gerard Minack believes this to be nonsensical. Ultimately it will boil down to when the labour market is tight enough to generate significant wage growth, which is down the border reopening impact on labour supply. However, should migration flows revert to pre-pandemic levels, the RBA may be able to go 11 more years without tightening!

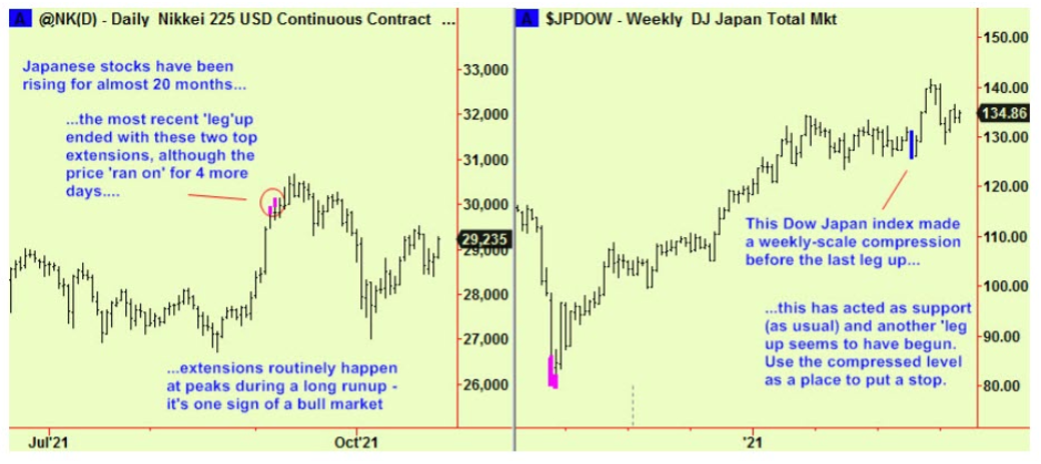

HED Capital Management

Japan provides further support for bullish positions

Richard Edwards recently pointed out various bullish signals in Asian equity markets, and now Japan has provided a separate reason to be bullish – the price has just bounced off support from an old weekly compression. BUY now and use the compressed level as a place to put a stop.

Alquant

Risk-on

The Alquant Vega Indicator, which was able to anticipate the main pullbacks and corrections of recent years, is again risk-on since October 5 and thus doesn’t expect a major increase in stock market volatility; this situation should prevail in the short-term. Since 2018, following Alquant’s Indicator has more than doubled the performance of major stock indices while dividing their maximum drawdown by three.

Emerging Markets

Andrew Hunt Economics

China: The Japanification of the banks

Andrew Hunt comments that China is already facing a familiar Debt Trap Dynamic. With significant debt numbers and issues in the banking system, a credit crunch is possible. Investors are wrong to assume the PBoC can restart the credit boom and the economy will be weaker for longer than many expect. In the near-term Andrew expects stable yields, but in 2022 yields will collapse and the RMB will start a trend appreciation.

Commodity Intelligence

China’s economy is teetering on the brink of disaster

If China’s economy keeps on stumbling it will cause the whole world to collapse with it, according to Mark Latham. Beijing has been on a warpath of cancelling IPOs, fining companies billions, and sent CEOs running for the exits, all amongst the currently volatile landscape. If Xi Jinping’s plan to move the economy back to greater state control fails, the resulting shockwaves will crater the global financial system, slow trade and devastate businesses.

High Frequency Economics

Nearshoring trend is changing China’s growth model

Many firms are “nearshoring”: bringing production and supply chains closer to home for safety and security. Thus far, China has suffered little since its export sector has turned towards its Silk Road allies. If all goes to Beijing’s plan, this will allow China to undertake a more combative political and military engagement with the G7, opening the door for a reunion with Taiwan and a seize of commerce control in the South China Sea.

Alberdi Partners

Peru: A positive but not definitive step

Activity in Peru has now reached pre-pandemic levels, and Marcos Buscaglia has revised GDP growth forecasts to 12.5% in 2021 and 1.5% in 2022. Although fiscal consolidation is slow, Marcos explains that it is manageable given that the government avoids new fiscal expansive programs. The recent hike in rates did not compensate the rise in inflation expectations, so investors should expect policy rates at >2.5% by 2021’s end.

Krutham (formerly known as Intellidex)

South Africa: Slightly positive

The Medium-Term Budget Policy Statement on Nov 11th will present a meaningfully better position for the current fiscal year and a tighter, faster path to a primary surplus. Although Peter Montalto actually expects in reality a flatter path towards a narrow primary deficit, he sees further upside surprises on revenue offset on the expenditure side so the forecast path is less sensitive. The NT will remain risk averse and avoid cuts this year, hence we will see a step up in SAGB issuance.

Oxford Analytica

Tanzania’s president offers a fresh new direction

President Suluhu unveiled a new $1.57bn Economic Recovery Plan with a focus on the health, tourism and water sectors. Alongside promises to fast-track negotiations over a $30bn LNG project, a new cabinet reshuffle brings in more ministers aligned with Suluhu’s own approach to politics and business and a fresh outlook. Confidence among foreign investors in these developments will begin to grow.

ESG

Llewellyn Consulting

COP26 has been set up for failure

John Llewellyn examines how the clash between ambition and reality on climate change, along with the impossible task of creating a unified global programme, will lead only to disappointment. Nevertheless, some interesting developments may come to fruition; watch out for signs of a proposal to coordinate the fuel transition, a push from EMs for help to move away from fossil fuels, and a collective attempt to set achievable targets over the next 5-10 years rather than decades.

Global Mining Research

Miners forced to become green power companies?

David Radclyffe reviews how mines with little access to green electricity will need to build capacity themselves or via a third party in order to meet emissions targets. Some will come under increasing scrutiny; Rio Tinto, South32, Southern Copper Corp, Freeport-McMoRan and Anglo American could all face increased capital/opex exposure. The potential capital costs associated with self-generation are massive, so investors should keep a close eye for opportunities present in the partial or full outsourcing of infrastructure.

Commodities

Krainer Analytics

Inflation expectations and commodity prices

Ten years ago, Alex Krainer launched an inflation-hedging fund, based on the intuition that as the purchasing power of a currency declines, commodity prices would rise and offset the decline of the currency value with real assets. At the time, few investors agreed with Alex that his strategy was a valid inflation hedge. Now, the point is no longer controversial: inflation expectations are again at high levels as ten years ago, and commodity prices have been and are showing almost perfect correlation with inflation!

Precious Metals: Could they still have their day in the sun?

Eric Fill points out that despite a big jump in front-end yields and a generally higher USD, precious metals have actually held up well. Certainly, very negative real yields have undoubtedly been supportive. Now, however, there are signs that precious metals are starting to twitch like a reanimated Frankenstein, as Halloween approaches. This is especially noticeable vs. DM currencies like the EUR and the JPY; are these the first signs of a potential broad based precious metals run?

Queen Anne's Gate Capital

WTI spiking above $80

Kathleen Kelley expects gasoline demand in the US to hit new records next year, offsetting weaker jet fuel demand. We are now seeing price spikes above $80 WTI and Kathleen does not see this curbing demand yet. As demand levels return to 100mmbpd in 2022, the level of inventories will remain below the 5-year average and set the stage for additional price rallies.